Advance Auto Parts 2003 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2003 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

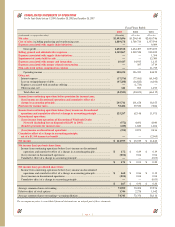

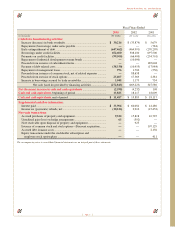

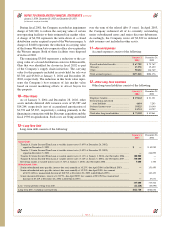

Fiscal Years Ended

2003 2002 2001

(in thousands) (53 weeks) (52 weeks) (52 weeks)

Cash flows from operating activities:

Net income.................................................................................................... $ 124,935 $ 65,019 $ 11,442

Adjustments to reconcile net income to net cash

provided by operating activities:

Depreciation and amortization ............................................................. 100,737 94,090 71,231

Stock option compensation expense..................................................... —— 11,735

Amortization of deferred debt issuance costs ...................................... 1,470 3,536 3,121

Amortization of bond discount............................................................. 3,640 13,076 11,468

Compensation for stock issued under the employee

stock purchase plan .......................................................................... 3,543 667 —

Loss (gain) on disposal of property and equipment, net...................... 793 (1,838) 2,027

Impairment of assets held for sale........................................................ —— 12,300

Provision (benefit) for deferred income taxes...................................... 53,742 51,426 (5,447)

Tax benefit related to exercise of stock options................................... 7,964 6,968 —

Loss on extinguishment of debt ........................................................... 47,288 16,822 6,106

Cumulative effect of a change in accounting principle, net of tax ...... —— 2,065

Net decrease (increase) in:

Receivables, net................................................................................ 17,775 (6,610) 3,073

Inventories, net ................................................................................. (64,893) (69,481) 13,101

Other assets....................................................................................... (7,216) (9,824) 172

Net increase (decrease) in:

Accounts payable.............................................................................. 97,535 41,699 (17,663)

Accrued expenses............................................................................. (27,985) 34,110 (5,106)

Other liabilities................................................................................. (3,407) 3,336 (16,089)

Net cash provided by operating activities .................................... 355,921 242,996 103,536

Cash flows from investing activities:

Purchases of property and equipment .......................................................... (101,177) (98,186) (63,695)

Acquisitions, net of cash acquired ............................................................... —(13,176) (389,953)

Proceeds from sales of property and equipment.......................................... 15,703 33,357 2,640

Net cash used in investing activities............................................. (85,474) (78,005) (451,008)

(continued)

CONSOLIDATED STATEMENTS OF CASH FLOWS

For the Years Ended January 3, 2004, December 28, 2002 and December 29, 2001

Page 26