Advance Auto Parts 2003 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2003 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

These amounts are recorded in other current assets,

other current liabilities, other assets and other long-term

liabilities in the accompanying consolidated balance sheets,

as appropriate.

The Company currently has four years that are open to

audit by the Internal Revenue Service. In addition, various

state and foreign income tax returns for several years are

open to audit. In management’s opinion, any amounts

assessed will not have a material effect on the Company’s

financial position or results of operations.

Additionally, the Company has certain periods open to

examination by taxing authorities in various states and

foreign jurisdictions for sales, use and excise taxes. In man-

agement’s opinion, any amounts assessed will not have a

material effect on the Company’s financial position or

results of operations.

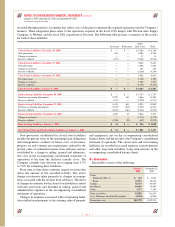

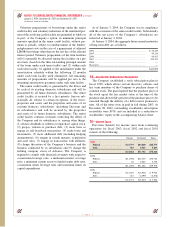

16—Lease Commitments

The Company leases store locations, distribution centers,

office space, equipment and vehicles under lease arrange-

ments that extend through 2024, some of which are with

related parties.

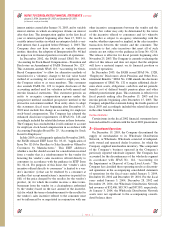

At January 3, 2004, future minimum lease payments due

under non-cancelable operating leases are as follows:

Related

Other(a) Parties(a) Total

2004............................................ $ 160,703 $3,119 $ 163,822

2005............................................ 139,748 2,772 142,520

2006............................................ 123,167 2,244 125,411

2007............................................ 108,343 620 108,963

2008............................................ 90,206 461 90,667

Thereafter................................... 386,718 169 386,887

$1,008,885 $9,385 $1,018,270

(a) The Other and Related Parties columns include stores closed as a result of the

Company’s restructuring plans.

At January 3, 2004 and December 28, 2002, future mini-

mum sublease income to be received under non-cancelable

operating leases is $9,487 and $9,937, respectively.

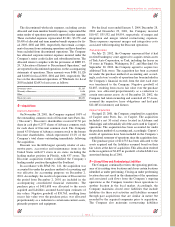

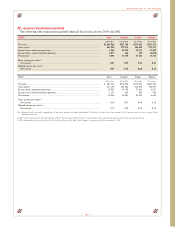

Net rent expense for fiscal 2003, fiscal 2002 and fiscal

2001 was as follows:

2003 2002 2001

Minimum facility rentals.......... $154,461 $140,929 $122,512

Contingent facility rentals........ 1,395 1,059 811

Equipment rentals..................... 5,117 6,112 2,341

Vehicle rentals .......................... 7,104 6,419 6,339

168,077 154,519 132,003

Less: Sublease income ............. (3,223) (3,250) (2,558)

$164,854 $151,269 $129,445

Contingent facility rentals are determined on the basis

of a percentage of sales in excess of stipulated minimums

for certain store facilities as defined in the individual lease

agreements. Most of the leases provide that the Company

pay taxes, maintenance, insurance and certain other

expenses applicable to the leased premises and include

options to renew. Certain leases contain rent escalation

clauses, which are recorded on a straight-line basis. Manage-

ment expects that, in the normal course of business, leases

that expire will be renewed or replaced by other leases.

Rental payments to related parties of approximately

$3,011 in fiscal 2003, $3,168 in fiscal 2002 and $3,824 in

fiscal 2001 are included in net rent expense for open stores.

Rent expense associated with closed locations is included in

other selling, general and administrative expenses.

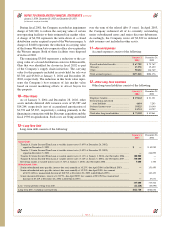

17—Installment Sales Program

A subsidiary of the Company maintains an in-house

finance program, which offers financing to retail cus-

tomers. Finance charges of $3,380, $3,901 and $3,343 on

the installment sales program are included in net sales in the

accompanying consolidated statements of operations for the

fiscal years ended January 3, 2004, December 28, 2002 and

December 29, 2001, respectively. The cost of administering

the installment sales program is included in selling, general

and administrative expenses.

18—Contingencies

In the case of all known contingencies, the Company

accrues for an obligation, including estimated legal costs,

when it is probable and the amount is reasonably estimable.

As facts concerning contingencies become known to the

Company, the Company reassesses its position with respect

to accrued liabilities and other potential exposures.

Estimates that are particularly sensitive to future change

include tax and legal matters, which are subject to change

as events evolve and as additional information becomes

available during the administrative and litigation process.

In February 2000, the Coalition for a Level Playing Field

and over 100 independent automotive parts and accessories

aftermarket warehouse distributors and jobbers filed a lawsuit

styled Coalition for a Level Playing Field, et al. v. AutoZone,

Inc. et al., Case No. 00-0953 in the United States District

Court for the Eastern District of New York against various

automotive parts and accessories retailers. In March 2000, the

Company was notified that it had been named defendants in

the lawsuit. The plaintiffs claimed that the defendants

knowingly induced and received volume discounts, rebates,

slotting and other allowances, fees, free inventory, sham

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

January 3, 2004, December 28, 2002 and December 29, 2001

(in thousands, except per share data)

Page 40