Advance Auto Parts 2003 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2003 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

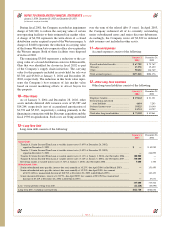

The Company completed the redemption of its outstanding

senior subordinated notes and senior discount debentures on

April 15, 2003. Incremental facilities were added to fund

the redemption in the form of a tranche A-1 term loan facility

of $75,000 and tranche C-1 term loan facility of $275,000.

In conjunction with this redemption and overall partial

repayment of $54,433, the Company wrote off deferred

financing costs in accordance with EITF Issue No. 96-19,

“Debtor’s Accounting for a Modification or Exchange of

Debt Instruments.” The write-off of these costs combined

with the accretion of the discounts and related premiums

paid on the repurchase of the senior subordinated notes and

senior discount debentures resulted in a loss on extinguish-

ment of debt of $46,887 in the accompanying consolidated

statements of operations for the year ended January 3, 2004.

During the remainder of fiscal 2003, the Company repaid

$236,089 of its terms loans under the senior credit facility.

In conjunction with this partial repayment, the Company

wrote off additional deferred financing costs in the amount

of $401, which is classified as a loss on extinguishment of

debt in the accompanying consolidated statements of oper-

ations for the year ended January 3, 2004. Additionally in

December 2003, the Company refinanced the remaining

portion of its tranche A, A-1, C and C-1 term loan facilities

by amending and restating the credit facility to add a new

$100,000 tranche D term loan facility and $340,000 tranche

E term loan facility.

During fiscal 2002, the Company repaid a portion of its

tranche A and tranche B term loan facilities. Subsequently,

it also refinanced the remaining portion of its tranche B

term loan facility by amending and restating the credit facil-

ity to add a new $250,000 tranche C term loan facility. In

conjunction with the extinguishment of this debt, the

Company wrote off deferred financing costs in accordance

with EITF No. 96-19. The write-off of these costs are clas-

sified as a loss on extinguishment of debt of $8,542 in the

accompanying consolidated statement of operations.

During fiscal 2002, the Company also repurchased and

retired a portion of its senior subordinated notes and senior

discount debentures. The premiums paid and the write-off

of the related deferred financing costs are classified as a loss

on extinguishment of debt of $8,280 in the accompanying

statements of operations.

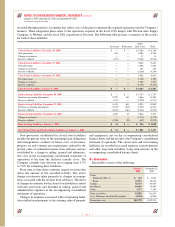

At January 3, 2004, the senior credit facility provided

for (1) $440,000 in term loans (as detailed above) and

(2) $160,000 under a revolving credit facility (which

provides for the issuance of letters of credit with a sub limit

of $70,000). As of January 3, 2004, the Company had

borrowed $5,000 under the revolving credit facility and had

$32,585 in letters of credit outstanding, which reduced

availability under the credit facility to $122,415.

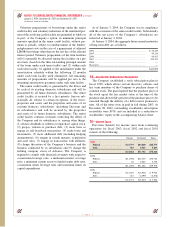

The tranche D term loan facility requires scheduled

repayments of $19,251 on November 30, 2004, $21,636 in

May and November 2005, $21,636 in May 2006 and

$15,839 at maturity on November 30, 2006. Under the

amended credit facility, the tranche E term loan facility

requires scheduled repayments of $2,969 semi-annually

beginning November 30, 2004 through May 31, 2007, and

the Company will be required to pay the remaining balance

at maturity on November 30, 2007.

The interest rates on the tranche D and E term loan facil-

ities are based, at the Company’s option, on either an

adjusted LIBOR rate, plus a margin, or an alternate base

rate, plus a margin. Under the Company’s senior credit

facility as amended in December 2003 and until its delivery

of its financial statements for the fiscal year ending on

January 3, 2004, the initial margins for the tranche D term

loan facilities and the tranche E term loan facilities are

2.00% and 1.00% per annum for the adjusted LIBOR rate and

alternate base rate borrowings, respectively. The margins

subsequent to such date will be determined by a pricing grid

based on the Company’s leverage ratio at that time.

The interest rates on the revolving credit facility are

based, at the Company’s option, on either an adjusted

LIBOR rate, plus a margin, or an alternate base rate, plus a

margin. Under the Company’s senior credit facility as

amended in December 2003 and until its delivery of its

financial statements for the fiscal year ending on January 3,

2004, the initial margins for the revolving credit facility is

2.25% and 1.25% per annum for the adjusted LIBOR rate

and alternate base rate borrowings, respectively. Addi-

tionally, a commitment fee of 0.375% per annum will

be charged on the unused portion of the revolving credit

facility, payable quarterly in arrears.

Borrowings under the senior credit facility are required

to be prepaid, subject to certain exceptions, with (1) 50%

of the Excess Cash Flow (as defined in the senior credit

facility) unless the Company’s Senior Leverage Ratio (as

defined in the senior credit facility) at the end of any fiscal

year is less than or equal to 1.00 to 1.00, in which case

25% of Excess Cash Flow for such fiscal year will be

required to be repaid, (2) 100% of the net cash proceeds of

all asset sales or other dispositions of property by the

Company and its subsidiaries, subject to certain exceptions

(including exceptions for reinvestment of certain asset sale

proceeds within 270 days of such sale and certain sale-

leaseback transactions), and (3) 100% of the net proceeds

of certain issuances of debt or equity by the Company and

its subsidiaries.

Page 37

Advance Auto Parts, Inc. and Subsidiaries