Advance Auto Parts 2003 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2003 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

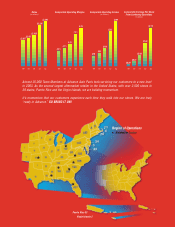

We are pleased to report 2003 was another record year for Advance

Auto Parts.

Our Company built momentum in a number of ways this year. We

raised the sales productivity of our stores, increased our operating

margins, generated strong free cash flow, and increased our return on

invested capital.

Once again, our hard working team took our operating initiatives and

executed at an even higher level than they did in 2002. These initiatives

include category management, an expanded store brands program,

improved supply chain efficiencies, and heightened emphasis on

commercial sales. We also focused on refining our customer-driven

technology systems, including our point-of-sale and electronic catalog

system (APAL) and our Management Planning and Training system

(MPT). Together, these initiatives have increased the number of cus-

tomers who visit our stores and raised the average transaction size.

In 2003:

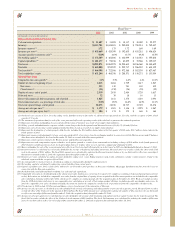

• We served over 200 million customers.

• We opened 125 new stores for a total of 2,539 stores.

• We increased our gross margin by 116 basis points to 45.9%.

• Our GAAP operating margin increased to 8.3% and we raised our

comparable operating margin to 8.5% from 7.2% last year.

• Our GAAP earnings per share rose to $1.67 from $0.90 last year and

we grew comparable earnings per share from continuing operations

65% to $2.15 from $1.30 last year.

(The Company uses non-GAAP measures as an indication of its earnings from its

core operations and believes it is important to the Company’s stockholders due to

the nature and significance of the excluded expenses. Please see our reconciliation

of comparable operating income and comparable earnings per share included on

page 1 of this annual report.)

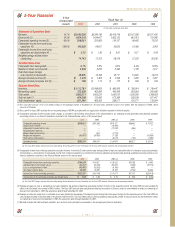

During 2003, we also further strengthened our balance sheet. At the end

of our first quarter, we retired our high yield bonds and debentures, low-

ering the weighted average interest rate of our debt from 8.7% to 3.2%.

We paid down $291 million in debt, ending the year with a total debt to

capitalization rate of 41% compared to 61% in 2002, and 77% in 2001.

Although our team has achieved much, we are hardly satisfied.

We have tremendous opportunities to serve our customers more

efficiently, enhance our profitability and further increase our return

on invested capital.

In 2004, we will continue to build momentum by remaining focused on

the same objectives that generated our past success and by having the

best parts, people, and prices:

Parts—We are committed to having the right parts available for our

customers. In 2004, we will launch the next wave of our custom mix

program, further refine our category management initiatives, and com-

plete the rollout of our new store system.

People—Our team’s dedication to customer service is the primary

reason our customers keep coming back to us. In 2004, we will con-

tinue to emphasize training to equip our Team Members with the

knowledge and skills to enhance our customers’ shopping experience.

We also plan to open 125–135 new locations, which will bring our team

exciting advancement opportunities.

Prices—In 2004, we will continue to bring savings to our customers

by offering great value on quality parts and products.

As stockholders, we hope that you agree that we are serving our

customers better than ever and invite you to visit one of our over

2,500 conveniently located stores. Then you will see that “We’re ready

in Advance.”

Advance Auto Parts was built on integrity and an unwavering commit-

ment to our customers. As guardians of this legacy, we commit to you

that these values will remain at the core of everything we do.

As we begin another year, we would like to thank our stockholders for

their confidence, our Team Members for their dedication to serving our

customers, and our families for their support.

Jim Wade

President

Larry Castellani

Chairman and Chief Executive Officer

Letter to Our Stockholders