Advance Auto Parts 2003 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2003 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

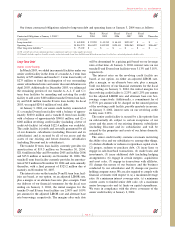

1—Organization and Description of Business

Advance Auto Parts, Inc. (“Advance”) conducts all of its

operations through its wholly owned subsidiary, Advance

Stores Company, Incorporated and its subsidiaries (“Stores”).

Advance and Stores (collectively, the “Company”) operate

2,539 stores within the United States, Puerto Rico and the

Virgin Islands. The Company operates 2,503 stores

throughout 39 states in the Northeastern, Southeastern and

Midwestern regions of the United States. These stores oper-

ate primarily under the “Advance Auto Parts” trade name

except for the State of Florida which operate under

“Advance Discount Auto Parts” or “Discount Auto Parts”

trade names. These stores offer automotive replacement

parts, accessories and maintenance items, with no signifi-

cant concentration in any specific area. In addition, the

Company operates 36 stores under the “Western Auto”

trade name, located primarily in Puerto Rico and the Virgin

Islands, which offer certain home and garden merchandise

in addition to automotive parts, accessories and service.

2—Summary of Significant Accounting Policies

Accounting Period

The Company’s fiscal year ends on the Saturday nearest

the end of December, which results in an extra week every

six years. Accordingly, fiscal 2003 includes 53 weeks of

operations. All other fiscal years presented include 52

weeks of operations.

Principles of Consolidation

The consolidated financial statements include the accounts

of the Company and its wholly owned subsidiaries. All

significant intercompany balances and transactions have

been eliminated in consolidation.

Use of Estimates

The preparation of financial statements in conformity

with accounting principles generally accepted in the United

States of America requires management to make estimates

and assumptions that affect the reported amounts of assets

and liabilities and the disclosure of contingent assets and lia-

bilities at the date of the financial statements and the reported

amounts of revenues and expenses during the reporting

period. Actual results could differ from those estimates.

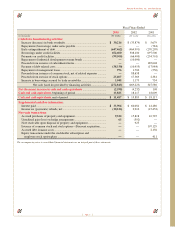

Cash, Cash Equivalents and Bank Overdrafts

Cash and cash equivalents consist of cash in banks and

money market funds. Bank overdrafts include net outstand-

ing checks not yet presented to a bank for settlement.

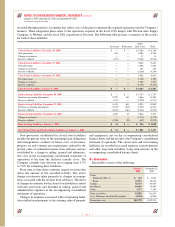

Vendor Incentives and Change in Accounting Method

The Company receives incentives from vendors related to

cooperative advertising allowances, volume rebates and other

functional discounts. Many of the incentives are under long-

term agreements (terms in excess of one year), while others

are negotiated on an annual basis. Certain vendors require

the Company to use cooperative advertising allowances

exclusively for advertising. The Company defines these

allowances as restricted cooperative advertising allowances

and recognizes them as a reduction to selling, general and

administrative expenses as incremental advertising expendi-

tures are incurred. The remaining cooperative advertising

allowances not restricted by the Company’s vendors, or unre-

stricted, rebates and other functional incentives are earned

based on purchases and/or the sale of product. The Company

accounts for vendor incentives in accordance with Emerging

Issues Task Force, or EITF, No. 02-16, “Accounting by a

Customer (Including a Reseller) for Certain Consideration

Received from a Vendor.” Accordingly, the Company records

unrestricted cooperative advertising and volume rebates

earned as a reduction of inventory and recognizes the incen-

tives as a reduction to cost of sales as the inventory is sold.

The Company recognizes the functional incentives earned

related to long-term agreements as a reduction of cost of

sales over the life of the agreement based on the timing of

purchases. These incentives are not recorded as reductions to

inventory. The functional amounts earned under long-term

arrangements are based on estimates of total purchases that

will be made over the life of the contracts and the amount of

incentives that will be earned. These incentives are generally

recognized based on the cumulative purchases as a percent-

age of total estimated purchases over the life of the contract.

The Company’s margins could be impacted positively or

negatively if actual purchases or results from any one year

differ from its estimates, however the impact over the life of

the contract would be the same. Short-term incentives (terms

less than one year) are recognized as a reduction to cost of

sales over the course of the annual agreement and are not

recorded as reductions to inventory.

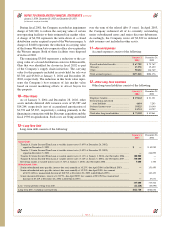

Amounts received or receivable from vendors that are not

yet earned are reflected as deferred revenue in the accompa-

nying consolidated balance sheets. Management’s estimate

of the portion of deferred revenue that will be realized

within one year of the balance sheet date has been included

in other current liabilities in the accompanying consolidated

balance sheets. Total deferred revenue is $19,524 and

$20,592 at January 3, 2004 and December 28, 2002. Earned

amounts that are receivable from vendors are included in

receivables, net on the accompanying consolidated balance

sheets except for that portion expected to be received after

one-year, which is included in other assets, net on the

accompanying consolidated balance sheets.

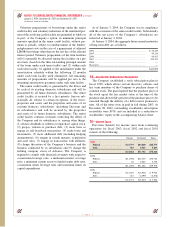

Effective December 31, 2000, the Company changed its

method of accounting for unrestricted cooperative advertis-

ing funds received from certain vendors to recognize these

payments as a reduction to the cost of inventory acquired

from these vendors. Previously, these funds were accounted

for as a reduction to selling, general and administrative

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

January 3, 2004, December 28, 2002 and December 29, 2001

(in thousands, except per share data)

Page 28