Advance Auto Parts 2003 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2003 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

interest entities created after January 31, 2003, and to variable

interest entities in which an enterprise obtains an interest

after that date. The interpretation applies in the first fiscal

year or interim period beginning after June 15, 2003, to

variable interest entities in which an enterprise holds a vari-

able interest that it acquired before February 1, 2003. The

Company does not have interests in variable interest

entities; therefore, the adoption of Interpretation No. 46 had

no impact on its financial position or results of operations.

In December 2002, the FASB issued SFAS No. 148,

“Accounting for Stock-Based Compensation—Transition and

Disclosure an Amendment of FASB Statement No. 123.”

This statement amends SFAS 123, “Accounting for Stock-

Based Compensation” to allow for alternative methods of

transition for a voluntary change to the fair value based

method of accounting for stock issued to employees, who

the Company refers to as team members. This statement

also amends FASB No. 123 to require disclosure of the

accounting method used for valuation in both annual and

interim financial statements. This statement permits an

entity to recognize compensation expense under the

prospective method, modified prospective method or the

retroactive restatement method. If an entity elects to adopt

this statement, fiscal years beginning after December 15,

2003 must include this change in accounting for employee

stock-based compensation. The Company has adopted the

enhanced disclosure requirements of SFAS No. 148 and

accordingly included the related disclosures in these footnotes.

The Company has concluded that it will continue to account

for employee stock-based compensation in accordance with

Accounting Principles Board No. 25, “Accounting for Stock

Issued to Employees.”

In July 2003 (as subsequently updated in November 2003),

the FASB released EITF Issue No. 03-10, “Application of

Issue No. 02-16 by Resellers to Sales Incentives Offered to

Customers by Manufacturers.” This EITF addresses

whether a reseller should account for consideration received

from a vendor that is a reimbursement by the vendor for

honoring the vendor’s sales incentives offered directly to

consumers in accordance with the guidance in EITF Issue

No. 02-16. For purposes of this Issue, the “vendor’s sales

incentive offered directly to consumers” is limited to a ven-

dor’s incentive (i) that can be tendered by a consumer at

resellers that accept manufacturer’s incentives in partial (or

full) of the price charged by the reseller for the vendor’s

product, (ii) for which the reseller receives a direct reim-

bursement from the vendor (or a clearinghouse authorized

by the vendor) based on the face amount of the incentive,

(iii) for which the terms of reimbursement to the reseller for

the vendor’s sales incentive offered to the consumer must

not be influenced by or negotiated in conjunction with any

other incentive arrangements between the vendor and the

reseller but, rather may only be determined by the terms

of the incentive offered to consumers and (iv) whereby

the reseller is subject to an agency relationship with the

vendor, whether expressed or implied, in the sales incentive

transaction between the vendor and the consumer. The

consensus is that sales incentives that meet all of such

criteria are not subject to the guidance in Issue No. 02-16.

The release is effective for fiscal periods beginning after

November 25, 2003. The Company is currently evaluating the

effect of this release and does not expect that the adoption

will have a material impact on its financial position or

results of operations.

In December 2003, the FASB issued SFAS No. 132R,

“Employers’ Disclosures about Pensions and Other Post-

retirement Benefits.” SFAS No. 132R amends the disclosure

requirements of SFAS No. 132 to require additional disclo-

sures about assets, obligations, cash flow and net periodic

benefit cost of defined benefit pension plans and other

defined postretirement plans. This statement is effective for

fiscal periods ending after December 15, 2003 and for

interim periods beginning after December 15, 2003. The

Company adopted this statement during the fourth quarter of

fiscal 2003 and accordingly included the related disclosures

in the other benefits footnote.

Reclassifications

Certain items in the fiscal 2002 financial statements have

been reclassified to conform with the fiscal 2003 presentation.

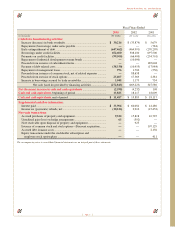

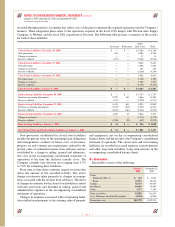

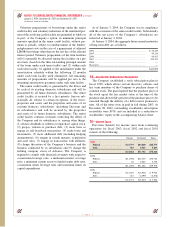

3—Discontinued Operations

On December 19, 2003, the Company discontinued the

supply of merchandise to its Wholesale Distribution

Network, or Wholesale. Wholesale consisted of independ-

ently owned and operated dealer locations, for which the

Company supplied merchandise inventory. This component

of the Company’s business operated in the Company’s

previously reported wholesale segment. The Company has

accounted for the discontinuance of the wholesale segment

in accordance with SFAS No. 144, “Accounting for

the Impairment or Disposal of Long-Lived Assets.” The

Company has classified these operating results as discontin-

ued operations in the accompanying consolidated statements

of operations for the fiscal years ended January 3, 2004,

December 28, 2002 and December 29, 2001. For the fiscal

years ended January 3, 2004, December 28, 2002 and

December 29, 2001, the Wholesale Distribution Network

had revenues of $52,486, $83,743 and $97,893, respectively.

At January 3, 2004, the Wholesale Distribution Network

assets were not significant to the accompanying consoli-

dated balance sheet.

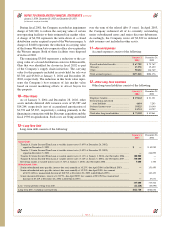

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

January 3, 2004, December 28, 2002 and December 29, 2001

(in thousands, except per share data)

Page 32