Advance Auto Parts 2003 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2003 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

be approximately $130.0 million, up from 2003 reflecting

our intent to own rather than lease a portion of our new

store openings.

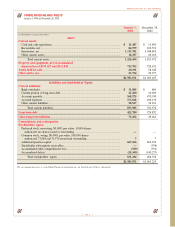

Our recent acquisitions have resulted in restructuring

reserves recorded in purchase accounting for the closure of

certain stores, severance and relocation costs and other facil-

ity exit costs. In addition, we assumed certain restructuring

and deferred compensation liabilities previously recorded by

Western and Discount. At January 3, 2004, the restructuring

reserves had a remaining balance of $7.5 million, of which

$2.8 million is recorded as a current liability. Additionally, at

January 3, 2004, the total liability for the deferred compen-

sation plans was $2.4 million, of which $0.6 million, is

recorded as a current liability. The classification for deferred

compensation is determined by payment terms elected by

plan participants, primarily former Western team members,

which can be changed upon 12 months’ notice. These

reserves are utilized through the settlement of the correspon-

ding liabilities with cash provided by operations and there-

fore do not affect our consolidated statement of operations.

We provide certain health care and life insurance benefits

for eligible retired team members through our post-

retirement plan. At January 3, 2004, our accrued benefit

cost related to this plan was $17.4 million. The plan has no

assets and is funded on a cash basis as benefits are

paid/incurred. The discount rate that we utilize for deter-

mining our postretirement benefit obligation is actuarially

determined. The discount rate utilized at January 3, 2004

and December 28, 2002 was 6.25% and 6.75%, respectively.

We reserve the right to change or terminate the benefits or

contributions at any time. We also continue to evaluate

ways in which we can better manage these benefits and

control costs. Any changes in the plan or revisions to

assumptions that affect the amount of expected future benefits

may have a significant impact on the amount of the reported

obligation and annual expense. Effective December 2002,

we amended the plan to only provide benefits for team

members who are eligible at January 1, 2005. This negative

plan amendment resulted in a curtailment gain of $2.9 mil-

lion in 2002, which is being amortized over 12 years to offset

corresponding increases in health care cost trends.

We expect that funds provided from operations and avail-

able borrowings of approximately $122.4 million under our

revolving credit facility at January 3, 2004, will provide

sufficient funds to operate our business, make expected

capital expenditures of approximately $130.0 million in

2004, finance our restructuring activities and fund future

debt service on our senior credit facility through the next

three years.

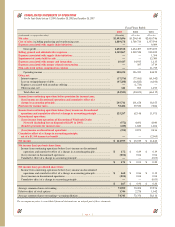

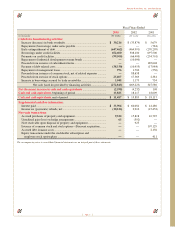

For 2003, net cash provided by operating activities was

$355.9 million. Of this amount, $124.9 million was provided

by net income and $24.2 million was provided as a result of

a net decrease in working capital, other long-term assets

and liabilities and other operating activities. Significant

non-cash items added back for operating cash purposes

include depreciation and amortization of $100.7 million,

amortization of bond discounts and deferred debt issuance

costs of $5.1 million, loss on extinguishment of debt of

$47.3 and provision for deferred income taxes of $53.7 mil-

lion. Net cash used in investing activities was $85.5 million

and was comprised primarily of capital expenditures. Net

cash used in financing activities was $272.8 million and

was comprised primarily of a $294.2 million decrease in

our net borrowings, $38.3 million of expenses to complete

the redemption of our senior subordinated notes and senior

discount debentures in April 2003, offset by proceeds from

the exercise of stock options of $25.4 million and an

increase in bank overdrafts of $30.2 million.

For 2002, net cash provided by operating activities was

$243.0 million. Of this amount, $65.0 million was provided

by net income and $15.9 million was provided as a result of

a net decrease in working capital, other long-term assets

and liabilities and other operating activities. Significant

non-cash items added back for operating cash purposes

include depreciation and amortization of $94.1 million,

amortization of bond discounts and deferred debt issuance

costs of $16.6 million and provision for deferred income

taxes of $51.4 million. Net cash used in investing activities

was $78.0 million and was comprised primarily of capital

expenditures. Net cash used in financing activities was

$169.2 million and was comprised primarily of $223.3 mil-

lion in net payments on the credit facility and payments to

repurchase and retire outstanding bonds and a decrease in

bank overdrafts of $33.9 million, all offset by $88.7 million

in net proceeds from our equity offering in March 2002, and

$17.4 million in proceeds from team member exercises of

stock options. Additionally, in November 2002, we repur-

chased the entire $10 million of indebtedness under the

industrial development revenue bonds.

In 2001, net cash provided by operating activities was

$103.5 million. This amount consisted of an $11.4 million

in net income, depreciation and amortization of $71.2 mil-

lion, amortization of deferred debt issuance costs and bond

discount of $14.6 million, impairment of assets held for sale

of $12.3 million, amortization of stock option compensation

of $11.7 million and an increase of $17.7 million of net

working capital and other operating activities. Net cash

used in investing activities was $451.0 million and was

comprised primarily of capital expenditures of $63.7 mil-

lion and cash consideration of $390.0 million paid in

the Discount and Carport mergers. Net cash provided by

financing activities was $347.6 million and was comprised

primarily of net borrowings.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (continued)

Page 18