Advance Auto Parts 2003 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2003 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

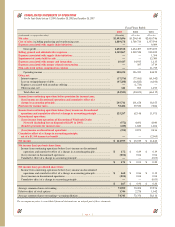

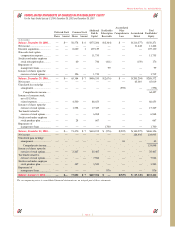

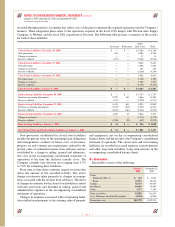

Fiscal Years Ended

2003 2002 2001

(in thousands, except per share data) (53 weeks) (52 weeks) (52 weeks)

Net sales............................................................................................................................... $3,493,696 $3,204,140 $2,419,746

Cost of sales, including purchasing and warehousing costs................................................ 1,889,178 1,769,733 1,357,594

Expenses associated with supply chain initiatives........................................................... —— 9,099

Gross profit................................................................................................................... 1,604,518 1,434,407 1,053,053

Selling, general and administrative expenses................................................................... 1,305,867 1,202,524 938,300

Expenses associated with supply chain initiatives........................................................... —— 1,394

Impairment of assets held for sale .................................................................................... —— 12,300

Expenses associated with merger and integration........................................................... 10,417 34,935 1,135

Expenses associated with merger related restructuring .................................................. —597 3,719

Non-cash stock option compensation expense................................................................. —— 11,735

Operating income ......................................................................................................... 288,234 196,351 84,470

Other, net:

Interest expense ................................................................................................................ (37,576) (77,081) (61,042)

Loss on extinguishment of debt ....................................................................................... (47,288) (16,822) (6,106)

Expenses associated with secondary offering.................................................................. —(1,733) —

Other income, net ............................................................................................................. 341 963 1,033

Total other, net.............................................................................................................. (84,523) (94,673) (66,115)

Income from continuing operations before provision for income taxes,

(loss) income on discontinued operations and cumulative effect of a

change in accounting principle...................................................................................... 203,711 101,678 18,355

Provision for income taxes ................................................................................................. 78,424 39,530 7,284

Income from continuing operations before (loss) income on discontinued

operations and cumulative effect of a change in accounting principle ..................... 125,287 62,148 11,071

Discontinued operations:

(Loss) income from operations of discontinued Wholesale Dealer

Network (including loss on disposal of $2,693 in 2003).......................................... (572) 4,691 4,040

(Benefit) provision for income taxes ............................................................................. (220) 1,820 1,604

(Loss) income on discontinued operations.................................................................... (352) 2,871 2,436

Cumulative effect of a change in accounting principle,

net of a $1,360 income tax benefit................................................................................. —— (2,065)

Net income........................................................................................................................... $ 124,935 $ 65,019 $ 11,442

Net income (loss) per basic share from:

Income from continuing operations before (loss) income on discontinued

operations and cumulative effect of a change in accounting principle........................ $ 1.72 $ 0.89 $ 0.19

(Loss) income on discontinued operations....................................................................... (0.01) 0.04 0.04

Cumulative effect of a change in accounting principle.................................................... —— (0.03)

$ 1.71 $ 0.93 $ 0.20

Net income (loss) per diluted share from:

Income from continuing operations before (loss) income on discontinued

operations and cumulative effect of a change in accounting principle........................ $ 1.68 $ 0.86 $ 0.19

(Loss) income on discontinued operations....................................................................... (0.01) 0.04 0.04

Cumulative effect of a change in accounting principle.................................................... —— (0.03)

$ 1.67 $ 0.90 $ 0.20

Average common shares outstanding................................................................................... 72,999 70,098 57,274

Dilutive effect of stock options ............................................................................................ 1,744 2,278 1,042

Average common shares outstanding—assuming dilution .................................................. 74,743 72,376 58,316

The accompanying notes to consolidated financial statements are an integral part of these statements.

CONSOLIDATED STATEMENTS OF OPERATIONS

For the Years Ended January 3, 2004, December 28, 2002 and December 29, 2001

Page 24