Advance Auto Parts 2003 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2003 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

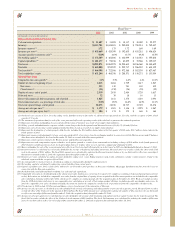

primarily a result of a decrease in merger and integration

expenses related to the integration of Discount. These integra-

tion expenses are related to, among other things, overlapping

administrative functions and store conversion expenses. The

decline in merger and integration costs was anticipated as

we near the completion of the Discount integration.

Excluding the impact of the merger and integration costs,

the decline as a percentage of net sales is a result of lever-

aging our fixed costs with the impact of the 53rd week of

operations in the fourth quarter of 2003.

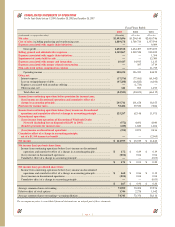

Interest expense for 2003 was $37.6 million, or 1.1% of

net sales, as compared to $77.1 million, or 2.4% of net

sales, in 2002. The decrease in interest expense is a result of

lower overall interest rates resulting primarily from our

redemption of our outstanding senior subordinated notes

and senior discount debentures in first quarter 2003.

Additionally, the decrease is a result of overall lower debt

levels in 2003 as compared to 2002, due to our use of free

cash flow to pay down debt.

Income tax expense for 2003 was $78.4 million, as

compared to $39.5 million for 2002. Our effective income

tax rate decreased to 38.5% for 2003, as compared to 38.8%,

for 2002. The decrease in our effective tax rate was primarily

due to increases in pre-tax income, which reduced the

impact of certain permanent differences on the effective rate.

During 2003, we recorded $47.3 million in a loss on

extinguishment of debt. This loss reflects the write-off of

deferred loan costs and premiums paid to redeem our senior

subordinated notes and senior discount debentures during

the first quarter of fiscal 2003, and also includes the related

financing costs associated with amending our senior credit

facility to finance this redemption. Additionally, this loss

includes the ratable portion of deferred loans costs associ-

ated with the partial repayment of our term loans during

fiscal 2003.

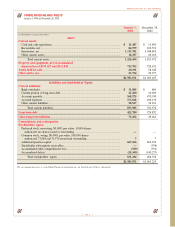

We recorded net income of $124.9 million, $1.67 per

diluted share for 2003, as compared to $65.0 million, or

$0.90 per diluted share for 2002. As a percentage of sales,

net income for 2003 was 3.6%, as compared to 2.0% for

2002. The effect of the expenses associated with merger and

integration and loss on extinguishment of debt on net

income was $35.5 million, or $0.47 per diluted share for

2003 and $32.0 million, or $0.44 per diluted share for 2002.

As previously mentioned, these per share amounts reflect

the two-for-one stock split declared in 2003.

Fiscal 2002 Compared to Fiscal 2001

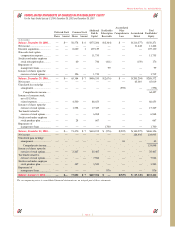

Net sales for 2002 were $3,204.1 million, an increase of

$784.4 million, or 32.4%, over net sales for 2001. The net

sales increase was due to an increase a full year’s contribution

of sales from stores acquired in the Discount acquisition, in

the comparable store sales of 5.5% and contributions from

new stores opened within the last year. The comparable

store sales increase was a result of growth in both the DIY

and DIFM market segments (indicated by an increase in

both comparative customers and average customer sales), as

well as the continued maturation of new stores.

Gross profit for 2002 was $1,434.4 million, or 44.8% of

net sales, as compared to $1,053.1 million, or 43.5% of net

sales, in 2001. The increase in gross profit as a percentage

of sales reflects more favorable merchandise costs realized

in fiscal 2002 as a result of renegotiating merchandise

contracts after the Discount acquisition. Additionally, this

increase represents our ability to leverage logistics costs

primarily driven by a review of our logistics operations,

which occurred in connection with our supply chain initia-

tives. We began these initiatives during the fourth quarter of

fiscal 2001, in which we recorded a $9.1 million charge for

restocking and handling fees associated with the return of

inventory under these initiatives.

Selling, general and administrative expenses increased to

$1,238.1 million, or 38.7% of net sales for 2002, from

$968.6 million, or 40.0% of net sales for 2001. Selling,

general and administrative expenses include merger and

integration expenses related to the integration of Discount of

$35.5 million, or 1.1% of sales, and $4.9 million, or 0.2%

of sales, for 2002 and 2001, respectively. These integration

expenses are related to, among other things, merger related

restructuring, overlapping administrative functions and

store conversion expenses. The merger related restructuring

charges primarily relate to lease costs associated with

closed Advance Auto Parts stores in overlapping markets as

a result of the Discount acquisition. Additionally, selling,

general and administrative expenses include charges of

$25.4 million, or 1.0% of sales, in 2001 as detailed below:

• $1.4 million represents costs of relocating certain

equipment held at facilities closed as a result of our supply

chain initiatives;

• $12.3 million represented the devaluation of property

held for sale; and

• $11.7 million was related to stock option compensation

charges resulting from the elimination of variable provi-

sions in certain of our stock options plans.

Excluding the effects of the above merger and integration and

other expenses above, the decrease in selling, general and

administrative expenses as a percentage of sales reflects

an approximate 43 basis point reduction related to our ability

to leverage our store payroll expenses against a higher sales

base, and an approximate 66 basis point reduction from

lower rent expense as a result of owning a higher percentage

of stores after the Discount acquisition.

Interest expense for 2002 was $77.1 million, or 2.4% of

net sales, as compared to $61.0 million, or 2.5% of net

sales, in 2001. Interest expense reflects the overall increase

in average borrowings offset by more favorable interest

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (continued)

Page 16