Advance Auto Parts 2003 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2003 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Company also maintains a profit sharing plan covering

Western team members that was frozen prior to the Western

Merger on November 2, 1998. This plan covered all full-

time team members who had completed one year of service

and had attained the age of 21 on the first day of each

month. All team members covered under this plan were

included in the Company’s plan on January 3, 2004.

Deferred Compensation

During third quarter of fiscal 2003, the Company estab-

lished an unqualified deferred compensation plan for

certain team members. The Company has accounted for

the unqualified deferred compensation plan in accordance

with EITF 97-14, “Accounting for Deferred Compensation

Arrangements Where Amounts Earned Are Held in a Rabbi

Trust and Invested.” The liability related to the former

Discount deferred compensation plan, which was terminated

in May 2002, was merged into the new plan. This plan

provides for a minimum and maximum deferral percentage

of the team member base salary and bonus, as determined

by the Retirement Plan Committee. The Company estab-

lishes and maintains a deferred compensation liability for

this plan. The Company funds this liability by remitting the

team members deferral to a Rabbi Trust. All gains and losses

are held in the Rabbi Trust to fund the deferred compensation

liability. At January 3, 2004 and December 28, 2002 these

liabilities were $1,011 and $863, respectively.

The Company maintains an unfunded deferred compen-

sation plan established for certain key team members of

Western prior to the fiscal 1998 Western merger. The

Company assumed the plan liability of $15,253 through the

Western merger. The plan was frozen at the date of the

Western merger. As of January 3, 2004 and December 28,

2002, $2,409 and $2,998, respectively, was accrued for

these plans with the current portion included in accrued

expenses and the long-term portion in other long-term

liabilities in the accompanying consolidated balance sheets.

Postretirement Plan

The Company provides certain health care and life

insurance benefits for eligible retired team members. Team

members retiring from the Company with 20 consecutive

years of service after age 40 are eligible for these benefits,

subject to deductibles, co-payment provisions and other

limitations. Effective December 2002, the Company amended

its postretirement plan to only include benefits for team

members who are eligible at January 1, 2005. This negative

plan amendment also resulted in a curtailment gain of

$2,939, which is being amortized over 12 years consistent

with the provisions of SFAS 106, “Employers Accounting

for Postretirement Benefits Other Than Pensions.”

The estimated cost of retiree health and life insurance

benefits is recognized over the years that the team members

render service as required by SFAS No. 106, “Employers

Accounting for Postretirement Benefits Other Than Pensions.”

The initial accumulated liability, measured as of January 1,

1995, the date the Company adopted SFAS No. 106, is

being recognized over a 20-year amortization period.

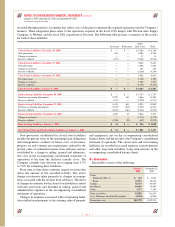

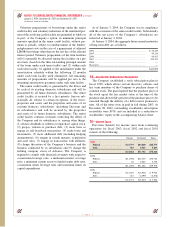

Other financial information related to the plans was

determined by the Company’s independent actuaries as of

January 3, 2004, December 28, 2002 and December 29,

2001, respectively. The following provides a reconciliation

of the accrued benefit obligation included in other long-

term liabilities in the accompanying consolidated balance

sheets, recorded and the funded status of the plan:

2003 2002

Change in benefit obligation:

Benefit obligation at beginning

of the year................................................. $ 23,002 $ 17,360

Service cost................................................... 5473

Interest cost................................................... 1,485 1,239

Benefits paid................................................. (3,336) (2,471)

Curtailment gain........................................... —(2,939)

Actuarial loss (gain) ..................................... 1,594 9,340

Benefit obligation at end of the year............ 22,750 23,002

Change in plan assets:

Fair value of plan assets at

beginning of the year................................ ——

Employer contributions ................................ 3,336 2,471

Participant contributions............................... 1,779 1,700

Benefits paid................................................. (5,115) (4,171)

Fair value of plan assets at end of year........ ——

Reconciliation of funded status:

Funded status................................................ (22,750) (23,002)

Unrecognized transition obligation .............. 910

Unrecognized actuarial (gain) loss............... 5,362 3,915

Accrued postretirement benefit cost............. $(17,379) $(19,077)

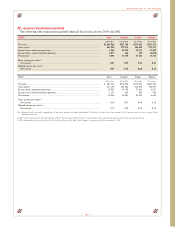

Net periodic postretirement benefit cost is as follows:

2003 2002 2001

Service cost................................................ $5$ 473 $ 326

Interest cost................................................ 1,485 1,239 1,584

Amortization of the transition obligation ... 158 58

Amortization of recognized net gains ........ 146 (89) —

$1,637 $1,681 $1,968

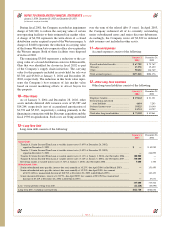

The postretirement benefit obligation was computed

using the following discount rates as determined by the

Company’s actuaries as January 1 for each applicable year.

2003 2002

Discount rate ............................................................... 6.25% 6.75%

The health care cost trend rate was assumed to be 15.0%

for 2003, 14.0% for 2004, 12.5% for 2005, 11.5% for 2006,

10.0% for 2007, 9.5% for 2008 and 5.0% to 8.5% for 2009

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

January 3, 2004, December 28, 2002 and December 29, 2001

(in thousands, except per share data)

Page 42