Advance Auto Parts 2003 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2003 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

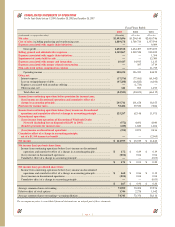

The discontinued wholesale segment, excluding certain

allocated and team member benefit expenses, represented the

entire results of operations previously reported in that segment.

These excluded expenses represented $2,361, $3,272 and

$5,490 of allocated and team member benefit expenses for fis-

cal 2003, 2002 and 2001, respectively, that remain a compo-

nent of income from continuing operations and have therefore

been excluded from discontinued operations. The Company

has allocated corporate interest expenses incurred under the

Company’s senior credit facility and subordinated notes. The

allocated interest complies with the provisions of EITF 87-

24, “Allocation of Interest to Discontinued Operations,” and

are reported in discontinued operations on the accompanying

statements of operations. These amounts were $484, $1,126

and $1,665 for fiscal 2003, 2002 and 2001, respectively. The

loss on the discontinued operations of Wholesale for fiscal

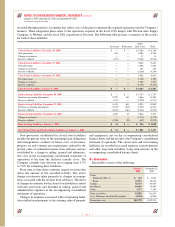

2003 included $2,693 of exit costs as follows:

Severance costs............................................................................ $1,183

Warranty allowances ................................................................... 1,656

Other............................................................................................ (146)

Total exit costs............................................................................. $2,693

4—Acquisitions

Discount Acquisition

On November 28, 2001, the Company acquired 100% of

the outstanding common stock of Discount Auto Parts, Inc.

(“Discount”). Discount’s shareholders received $7.50 per

share in cash plus 0.2577 shares of Advance common stock

for each share of Discount common stock. The Company

issued 4,310 shares of Advance common stock to the former

Discount shareholders, which represented 13.2% of the

Company’s total shares outstanding immediately following

the acquisition.

Discount was the fifth largest specialty retailer of auto-

motive parts, accessories and maintenance items in the

United States with 671 stores in six states, including the

leading market position in Florida, with 437 stores. The

Discount acquisition further solidified the Company’s

leading market position throughout the Southeast.

In accordance with SFAS No. 141, the acquisition was

accounted for under the purchase method of accounting and

was effective for accounting purposes on December 2,

2001. Accordingly, the results of operations of Discount for

the period from December 2, 2001 are included in the

accompanying consolidated financial statements. The

purchase price of $481,688 was allocated to the assets

acquired and liabilities assumed based upon estimates of

fair values. Negative goodwill of $58,763, resulting from

excess fair value over the purchase price, was allocated

proportionately as a reduction to certain non-current assets,

primarily property and equipment.

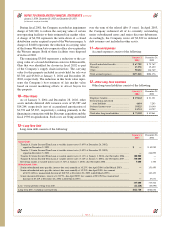

For the fiscal years ended January 3, 2004, December 28,

2002 and December 29, 2001, the Company incurred

$10,417, $35,532 and $4,854, respectively, of merger and

integration and merger related restructuring expenses.

These expenses represent merger and integration costs

associated with integrating the Discount operations.

Trak Acquisition

On July 23, 2002, the Company announced that it had

received bankruptcy court approval to acquire certain assets

of Trak Auto Corporation, or Trak, including the leases on

55 stores in Virginia, Washington, D.C. and Maryland. On

September 20, 2002, the Company agreed to acquire two

additional Trak stores. The acquisition has been accounted

for under the purchase method of accounting and, accord-

ingly, each store’s results of operations has been included in

the Company’s financial records from the date each store

was transferred to the Company. Negative goodwill of

$1,687, resulting from excess fair value over the purchase

price, was allocated proportionately as a reduction to

certain non-current assets. As of December 28, 2002, the

Company had taken ownership and converted all 57 stores,

assumed the respective lease obligations and had paid

$12,465 for inventory and fixtures.

Carport Acquisition

On April 23, 2001, the Company completed its acquisition

of Carport Auto Parts, Inc., or Carport. The acquisition

included a net 30 retail stores located in Alabama and

Mississippi, and substantially all of the assets used in Carport’s

operations. The acquisition has been accounted for under

the purchase method of accounting and, accordingly, Carport’s

results of operations have been included in the Company’s

consolidated statement of operations since the acquisition date.

The purchase price of $21,533 has been allocated to the

assets acquired and the liabilities assumed based on their

fair values at the date of acquisition. This allocation resulted

in the recognition of $3,695 in goodwill, of which $444 was

amortized during fiscal 2001.

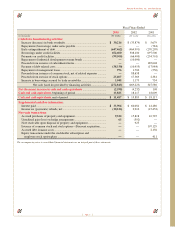

5—Closed Store and Restructuring Liabilities

The Company continually reviews the operating perform-

ance of its existing store locations and closes certain locations

identified as under performing. Closing an under performing

location does not result in the elimination of the operations

and associated cash flows from the Company’s ongoing

operations as the Company transfers those operations to

another location in the local market. Accordingly, the

Company maintains closed store liabilities that include

liabilities for these exit activities and liabilities assumed

through past acquisitions that are similar in nature but

recorded by the acquired companies prior to acquisition.

The Company also maintains restructuring liabilities

Page 33

Advance Auto Parts, Inc. and Subsidiaries