Advance Auto Parts 2003 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2003 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

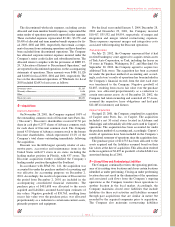

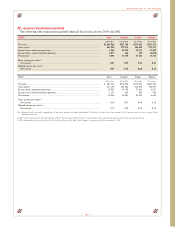

Total option activity was as follows:

2003 2002 2001

Number Weighted-Average Number Weighted-Average Number Weighted-Average

Plan of Shares Exercise Price of Shares Exercise Price of Shares Exercise Price

Fixed Price Service Options

Outstanding at beginning of year................. 5,536 $13.13 6,056 $11.24 4,408 $ 8.61

Granted ......................................................... 1,252 21.78 1,104 21.13 686 10.50

Converted options in connection

with Discount acquisition......................... —— — — 1,150 19.45

Exercised ...................................................... (1,274) 12.89 (1,556) 11.17 (124) 17.54

Forfeited........................................................ (103) 21.16 (68) 21.16 (64) 8.35

Outstanding at end of year ........................... 5,411 $15.05 5,536 $13.13 6,056 $11.24

Other Options

Outstanding at beginning of year................. 1,000 $ 9.00 1,000 $ 8.00 1,000 $ 7.00

Exercised ...................................................... (1,000) 9.00 ————

Outstanding at end of year ........................... —$— 1,000 $ 9.00 1,000 $ 8.00

Page 43

Advance Auto Parts, Inc. and Subsidiaries

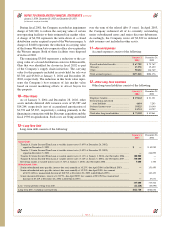

and thereafter. If the health care cost were increased 1% for

all future years the accumulated postretirement benefit

obligation would have increased by $2,588 as of January 3,

2004. The effect of this change on the combined service and

interest cost would have been an increase of $153 for 2003.

If the health care cost were decreased 1% for all future

years the accumulated postretirement benefit obligation

would have decreased by $2,538 as of January 3, 2004. The

effect of this change on the combined service and interest

cost would have been a decrease of $127 for 2003.

The Company reserves the right to change or terminate

the benefits or contributions at any time. The Company also

continues to evaluate ways in which it can better manage

these benefits and control costs. Any changes in the plan or

revisions to assumptions that affect the amount of expected

future benefits may have a significant impact on the amount

of the reported obligation and annual expense.

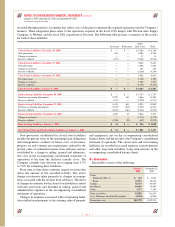

20—Stock Options

The Company maintains a senior executive stock option

plan and an executive stock option plan, or the Option Plans,

for key team members of the Company. The Option Plans

provide for the granting of non-qualified stock options. All

options terminate on the seventh anniversary of the grant

date. Shares authorized for grant under the senior executive

and the executive stock option plans are 3,420 and 7,200,

respectively, at January 3, 2004. Subsequent to January 3,

2004, the Company granted 1,188 fixed price options at an

exercise price of $39.31.

The Company has historically maintained three types of

option plans; Fixed Price Service Options, or Fixed Options,

Performance Options, or Performance Options, and Variable

Option plans, or Variable Options. The Fixed Options vest

over a three-year period in three equal installments begin-

ning on the first anniversary of the grant date. During the

fourth quarter of fiscal 2001, the board of directors

approved an amendment to the Performance Options and

the Variable Options. The amendment accelerated the vest-

ing of the Performance Options by removing the variable

provisions under the plan and established a fixed exercise

price of $9.00 per share for the Variable Options. As a result

of the increase in the Company’s stock price and the above

amendment, the Company recorded a charge of $8,611 in fis-

cal 2001 to recognize the associated compensation expense.

Accordingly, all options under the above-mentioned plans

are considered fixed for accounting treatment under APB

No. 25 as described below.

Additionally, as a result of the Discount acquisition, the

Company converted all outstanding stock options of Discount

with an exercise price greater than $7.50 per share to options

to purchase the Company’s common stock. The Company

converted 1,150 options from the executive stock option

plan at a weighted-average exercise price of $19.45 per

share. These options will terminate on the tenth anniversary

of the original option agreement between Discount and the

team member. The fair value of the 1,150 converted options

to purchase the Company’s common stock was included in

the purchase price of Discount.

As a result of the recapitalization in fiscal 1998, an existing

stockholder received stock options, referred to as other

options, to purchase up to 1,000 shares of common stock. The

stock options are fully vested, nonforfeitable and provided

for a $5.00 per share exercise price, increasing $1.00 per

share annually, through the expiration date of April 2005.

The fair value of these options, as determined at the grant

date were included in the recapitalization in fiscal 1998 as

consideration paid to the existing stockholder. The other

options were completely exercised during fiscal 2003.