Advance Auto Parts 2003 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2003 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

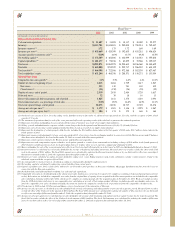

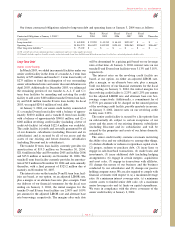

Results of Operations

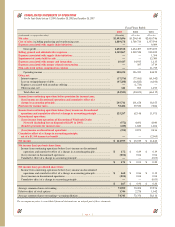

The following table sets forth certain of our operating data expressed as a percentage of net sales for the periods indicated.

Fiscal Year Ended

January 3, December 28, December 29,

2004 2002 2001

Net sales ............................................................................................................................................. 100.0% 100.0% 100.0%

Cost of sales ....................................................................................................................................... 54.1 55.2 56.1

Expenses associated with supply chain initiatives............................................................................. —— 0.4

Gross profit................................................................................................................................. 45.9 44.8 43.5

Selling, general and administrative expenses..................................................................................... 37.3 37.6 38.7

Expense associated with supply chain initiatives .............................................................................. —— 0.1

Impairment of assets held for sale ..................................................................................................... —— 0.5

Expenses associated with merger and integration.............................................................................. 0.3 1.1 0.0

Expenses associated with merger related restructuring ..................................................................... —0.0 0.2

Non-cash stock option compensation expense................................................................................... —— 0.5

Operating income....................................................................................................................... 8.3 6.1 3.5

Interest expense.................................................................................................................................. (1.1) (2.4) (2.5)

Loss on extinguishment of debt......................................................................................................... (1.4) (0.5) (0.2)

Expenses associated with secondary offering.................................................................................... —(0.1) —

Other income, net............................................................................................................................... 0.0 0.0 0.0

Income tax expense............................................................................................................................ 2.2 1.2 0.3

Income from continuing operations before discontinued operations and

cumulative effect of a change in accounting principle .......................................................... 3.6 1.9 0.5

Discontinued operations:

(Loss) income from operations of discontinued wholesale distribution network.......................... (0.0) 0.1 0.2

(Benefit) provision for income taxes.............................................................................................. (0.0) (0.0) 0.1

(Loss) income on discontinued operations................................................................................. (0.0) 0.1 0.1

Cumulative effect of change in accounting principle, net of income taxes....................................... —— (0.1)

Net income ................................................................................................................................. 3.6% 2.0% 0.5%

Cost of Sales

Our cost of sales consists of merchandise costs, net of

incentives under vendor programs, and warehouse and dis-

tribution expenses. Gross profit as a percentage of net sales

may be affected by variations in our product mix, price

changes in response to competitive factors and fluctuations

in merchandise costs and vendor programs. We seek to

avoid fluctuation in merchandise costs and instability of

supply by entering into long-term purchasing agreements

with vendors when we believe it is advantageous.

Selling, General and Administrative Expenses

Selling, general and administrative expenses consist of store

payroll, store occupancy (including rent), net advertising

expenses, other store expenses and general and adminis-

trative expenses, including salaries and related benefits of

corporate team members, administrative office expenses,

data processing, professional expenses and other related

expenses including expenses associated with merger and

integration. We lease a significant portion of our stores.

Page 15

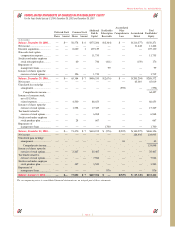

Advance Auto Parts, Inc. and Subsidiaries

Fiscal 2003 Compared to Fiscal 2002

Net sales for 2003 were $3,493.7 million, an increase of

$289.6 million, or 9.0%, over net sales for 2002. Excluding

the effect of the 53rd week our net sales increased $226.6 mil-

lion, or 7.1%, over net sales for 2002. The net sales increase

was due to an increase in the comparable store sales of 3.1%,

driven by increases in both customer traffic and average

ticket sales, and contributions from new stores opened within

the last year. As previously mentioned, increases in both our

DIY and DIFM business contributed to the comparable

store sales increase.

Gross profit for 2003 was $1,604.5 million, or 45.9% of

net sales, as compared to $1,434.4 million, or 44.8% of net

sales, in 2002. The increase in gross profit as a percentage

of sales reflects continued benefits realized from our category

management initiatives and improved efficiencies in our

logistics network. In 2004, we anticipate our gross profit to

continue to improve as a result of the benefits realized from

our category management initiatives and leveraging our

logistics expenses.

Selling, general and administrative expenses, including

merger and integration costs of $10.4 million in 2003 and

$35.5 million in 2002, increased to $1,316.3 million, or

37.6% of net sales for 2003, from $1,238.1 million, or

38.7% of net sales for 2002. The decrease in selling, general

and administrative expenses as a percentage of net sales is