Advance Auto Parts 2003 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2003 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

expenses as advertising expense was incurred. The new

method was adopted to better align the reporting of these

payments with the Company’s and the vendors’ use of these

payments as reductions to the price of inventory acquired from

the vendors. The effect of the change in fiscal 2001 was to

increase income from continuing operations by $358, or

$0.01 per diluted share. The cumulative effect of retroactive

application of the change on the year ended December 29,

2001, was to reduce income by approximately $2,065, net

of $1,360 income tax, or $0.03 per share.

Pre-Opening Expenses

Pre-opening expenses, which consist primarily of payroll

and occupancy costs, are expensed as incurred.

Advertising Costs

The Company expenses advertising costs as incurred in

accordance with the American Institute of Certified Public

Accountant’s Statement of Position, or SOP, 93-7, “Reporting

on Advertising Costs.” Advertising expense incurred was

approximately $75,870, $69,637 and $56,698 in fiscal

2003, 2002 and 2001, respectively.

Merger and Integration Costs

As a result of the Discount Auto Parts (“Discount”) acqui-

sition in 2001, the Company incurred costs related to, among

other things, overlapping administrative functions and store

conversions, all of which have been expensed as incurred.

These costs are presented as expenses associated with the

merger and integration in the accompanying statements of

operations.

Warranty Costs

The Company’s vendors are primarily responsible for

warranty claims. Warranty costs relating to merchandise

and services sold under warranty, which are not covered by

vendors’ warranties, are estimated based on the Company’s

historical experience and are recorded in the period the

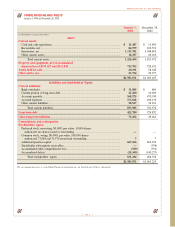

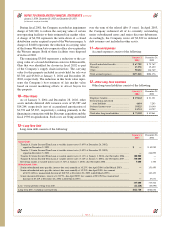

product is sold. The following table presents changes in our

defective and warranty reserves.

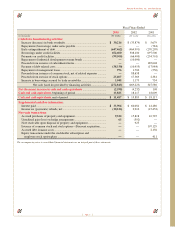

January 3, December 28, December 29,

2004 2002 2001

Defective and warranty

reserve, beginning of period

... $ 15,620 $ 21,587 $ 18,962

Reserves established

(1)

............... 13,755 11,632 15,713

Reserves utilized

....................... (13,797) (16,015) (14,672)

Other adjustments

(2)

.................. —(1,584) 1,584

Defective and warranty

reserve, end of period

............ $ 15,578 $ 15,620 $ 21,587

(1) Includes $1,656 of reserves established for the transition of the discontinued operations

of the wholesale distribution network.

(2) Represents subsequent adjustments to the Company’s original purchase price allocation

from the acquisition of Discount. These adjustments were the result of obtaining addi-

tional information related to the estimated costs of outstanding warranties and have

been allocated proportionately to our non-current assets, primarily property and

equipment. These adjustments had no direct impact on the statement of operations, but

reduced the depreciable base of the associated non-current assets.

Revenue Recognition and Trade Receivables

The Company recognizes merchandise revenue at the

point of sale to customers in the retail segment and point of

shipment to a wholesale segment customer. Service revenue

is recognized upon performance of the service. The major-

ity of sales are made for cash; however, the Company

extends credit to certain commercial customers through a

third-party provider of private label credit cards. The

Company establishes reserves for returns and allowances at

the time of sale based on current sales levels and historical

return rates. Receivables under the private label credit card

program are transferred to the third-party provider on a lim-

ited recourse basis. The Company provides an allowance for

doubtful accounts on receivables sold with recourse based

upon factors related to credit risk of specific customers,

historical trends and other information. This arrangement is

accounted for as a secured borrowing. Receivables and the

related secured borrowings under the private label credit

card were $20,623 and $17,575 at January 3, 2004 and

December 28, 2002, respectively, and are included in

accounts receivable and other current liabilities, respec-

tively, in the accompanying consolidated balance sheets.

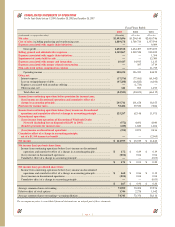

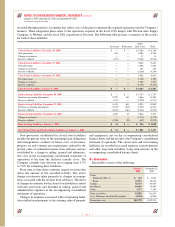

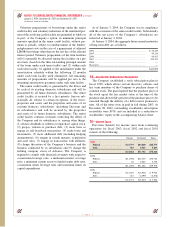

Earnings Per Share of Common Stock

Basic earnings per share of common stock has been

computed based on the weighted-average number of com-

mon shares outstanding during the period. Diluted earnings

per share of common stock reflects the increase in the

weighted-average number of common shares outstanding

assuming the exercise of outstanding stock options, calculated

on the treasury stock method. There were 59, 116 and 509

antidilutive options for the fiscal years ended January 3, 2004,

December 28, 2002 and December 29, 2001, respectively.

Stock Split

On October 29, 2003, the Company’s Board of Directors

declared a two-for-one stock split of the Company’s com-

mon stock, effected as a 100% stock dividend. The dividend

was distributed on January 2, 2004 to holders of record as

of December 11, 2003 and began trading on a post-split

basis on January 5, 2004. All share and per share amounts

in the accompanying consolidated financial statements have

been restated to reflect the effects of the stock split.

Employee Stock Options

As permitted under Statement of Financial Accounting

Standard, or SFAS, No. 123, “Accounting for Stock-Based

Compensation,” the Company accounts for its stock options

using the intrinsic value method prescribed in Accounting

Principles Board, or APB, Opinion No. 25, “Accounting for

Stock Issued to Employees,” or APB No. 25. Under APB

No. 25, compensation cost for stock options is measured as

the excess, if any, of the market price of the Company’s

common stock at the measurement date over the exercise

Page 29

Advance Auto Parts, Inc. and Subsidiaries