Advance Auto Parts 2003 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2003 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

advertising and promotional payments, a share in the

manufacturers’ profits, and excessive payments for services

purportedly performed for the manufacturers in violation of

the Robinson-Patman Act. In January 2003, a trial was held

and the jury found that the Company did not violate the

Robinson-Patman Act. The plaintiffs subsequently appealed

this decision, however, in November 2003 the Court of

Appeals upheld the verdict.

The Company’s Western Auto subsidiary, together with

other defendants including automobile manufacturers, auto-

motive parts manufacturers and other retailers, has been

named as a defendant in lawsuits alleging injury as a result

of exposure to asbestos-containing products. The Company,

Discount and Parts America, acquired as part of the Western

Auto Supply Company acquisition in 1998, also have been

named as defendants in many of these lawsuits. The plain-

tiffs have alleged that these products were manufactured,

distributed and/or sold by the various defendants. To date,

these products have included brake and clutch parts and

roofing materials. The number of cases in which the

Company or one of its subsidiaries has been named as a

defendant has increased in the past year. Many of the cases

pending against the Company or its subsidiaries are in the

early stages of litigation. The damages claimed against the

defendants in some of these proceedings are substantial.

Additionally, some of the automotive parts manufacturers

named as defendants in these lawsuits have declared bank-

ruptcy, which will limit plaintiffs’ ability to recover mone-

tary damages from those defendants. The Company believes

that it has valid defenses against these claims. The

Company also believes that most of these claims are at least

partially covered by insurance. Based on discovery to date,

the Company does not believe the cases currently pending

will have a material adverse effect on it. However, if the

Company was to incur an adverse verdict in one or more of

these claims and were ordered to pay damages that were not

covered by insurance, these claims could have a material

adverse affect on its operating results, financial position and

liquidity. If the number of claims filed against the Company

or any of its subsidiaries alleging injury as a result of expo-

sure to asbestos-containing products increases substantially,

the costs associated with concluding these claims, including

damages resulting from any adverse verdicts, could have a

material adverse effect on its operating results, financial

position and liquidity in future periods.

In October 2000, a vendor repudiated a long-term pur-

chase agreement entered into with the Company in January

2000. The Company filed suit against the vendor in

November of fiscal 2000 to recover monetary damages.

Based on consultation with the Company’s legal counsel,

management believed the purchase agreement was entered

into in good faith and it was highly probable that the

Company would prevail in its suit. Therefore, the Company

recorded a gain of $3,300, which represented actual dam-

ages incurred through December 30, 2000, as a reduction of

cost of sales in the accompanying consolidated statement of

operations for the year ended December 30, 2000. Related

income taxes and legal fees of $1,300 were also recorded in

the accompanying consolidated statement of operations for

the year ended December 30, 2000. During the first quarter

of fiscal 2001, the Company reached a settlement with this

vendor and recorded a net gain of $8,300 as a reduction to

cost of sales in the accompanying consolidated statement of

operations for the year ended December 29, 2001.

The Company is also involved in various other claims

and lawsuits arising in the normal course of business. The

damages claimed against the Company in some of these

proceedings are substantial. Although the final outcome of

these legal matters cannot be determined, based on the facts

presently known, it is management’s opinion that the final

outcome of such claims and lawsuits will not have a mate-

rial adverse effect on the Company’s financial position or

results of operations.

The Company is self-insured with respect to workers’

compensation and health care claims for eligible active team

members. In addition, the Company is self-insured for general

and automobile liability claims. The Company maintains

certain levels of stop-loss insurance coverage for these claims

through an independent insurance provider. The cost of self-

insurance claims is accrued based on actual claims reported

plus an estimate for claims incurred but not reported. These

estimates are based on historical information along with

certain assumptions about future events, and are subject to

change as additional information becomes available.

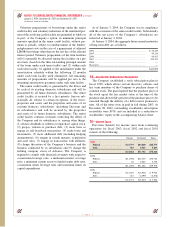

The Company has entered into employment agreements

with certain team members that provide severance pay ben-

efits under certain circumstances after a change in control

of the Company or upon termination of the team member

by the Company. The maximum contingent liability under

these employment agreements is approximately $2,408 and

$7,309 at January 3, 2004 and December 28, 2002 of which

nothing has been accrued, respectively.

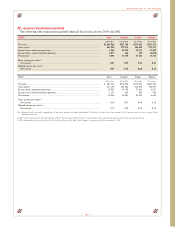

19—Benefit Plans

401(k) Plan

The Company maintains a defined contribution team

member benefit plan, which covers substantially all team

members after one year of service. The plan allows for

team member salary deferrals, which are matched at the

Company’s discretion. Company contributions were $6,398,

$6,930 and $5,238 in fiscal 2003, fiscal 2002, and fiscal 2001.

All team members covered under the Discount plan were

included in the Company’s plan effective May 31, 2002.

Page 41

Advance Auto Parts, Inc. and Subsidiaries