Advance Auto Parts 2003 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2003 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

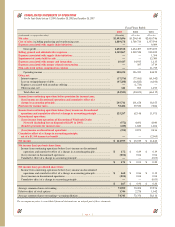

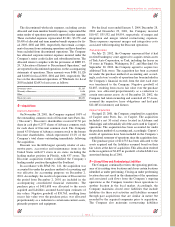

recorded through purchase accounting that reflect costs of the plan to integrate the acquired operations into the Company’s

business. These integration plans relate to the operations acquired in the fiscal 1998 merger with Western Auto Supply

Company, or Western, and the fiscal 2001 acquisition of Discount. The following table presents a summary of the activity

for both of these liabilities:

Other

Severance Relocation Exit Costs Total

Closed Store Liabilities, December 30, 2000 ................................................................................ $ — $ — $ 6,788 $ 6,788

New provisions................................................................................................................................. 475 — 8,285 8,760

Change in estimates.......................................................................................................................... — — 11 11

Reserves utilized............................................................................................................................... (475) — (5,441) (5,916)

Closed Store Liabilities, December 29, 2001 ................................................................................ — — 9,643 9,643

New provisions................................................................................................................................. — — 3,808 3,808

Change in estimates.......................................................................................................................... — — 725 725

Reserves utilized............................................................................................................................... — — (5,284) (5,284)

Closed Store Liabilities, December 28, 2002 ................................................................................ — — 8,892 8,892

New provisions................................................................................................................................. — — 1,190 1,190

Change in estimates.......................................................................................................................... — — 1,522 1,522

Reserves utilized............................................................................................................................... — — (5,197) (5,197)

Closed Store Liabilities, January 3, 2004..................................................................................... $ — $ — $ 6,407 $ 6,407

Restructuring Liabilities, December 30, 2000 .............................................................................. $ — $ — $ 3,797 $ 3,797

Purchase accounting adjustments..................................................................................................... 9,292 611 3,606 13,509

Reserves utilized............................................................................................................................... (837) — (2,500) (3,337)

Restructuring Liabilities, December 29, 2001 .............................................................................. 8,455 611 4,903 13,969

Purchase accounting adjustments..................................................................................................... (3,129) (219) (1,039) (4,387)

Reserves utilized............................................................................................................................... (3,674) (367) (1,238) (5,279)

Restructuring Liabilities, December 28, 2002 .............................................................................. 1,652 25 2,626 4,303

Change in estimates.......................................................................................................................... — — (1,178) (1,178)

Reserves utilized............................................................................................................................... (1,598) (25) (452) (2,075)

Restructuring Liabilities, January 3, 2004 .................................................................................. $ 54 $ — $ 996 $ 1,050

Total Closed Store and Restructuring Liabilities at January 3, 2004....................................... $ 54 $ — $ 7,403 $ 7,457

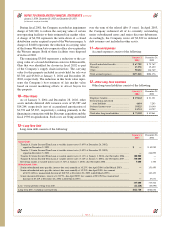

New provisions established for closed store liabilities

include the present value of the remaining lease obligations

and management’s estimate of future costs of insurance,

property tax and common area maintenance reduced by the

present value of estimated revenues from subleases and are

established by a charge to selling, general and administra-

tive costs in the accompanying consolidated statements of

operations at the time the facilities actually close. The

Company currently uses discount rates ranging from 4.5%

to 7.8% for estimating these liabilities.

From time to time these estimates require revisions that

affect the amount of the recorded liability. The above

change in estimates relate primarily to changes in assump-

tions associated with the revenue from subleases. The effect

of changes in estimates for the closed store liabilities is netted

with new provisions and included in selling, general and

administrative expenses in the accompanying consolidated

statements of operations.

Changes in estimates associated with restructuring liabil-

ities resulted in adjustments to the carrying value of property

and equipment, net on the accompanying consolidated

balance sheets and did not affect the Company’s consolidated

statement of operations. The closed store and restructuring

liabilities are recorded in accrued expenses (current portion)

and other long-term liabilities (long-term portion) in the

accompanying consolidated balance sheets.

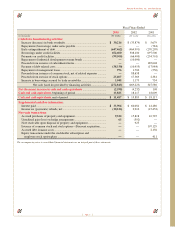

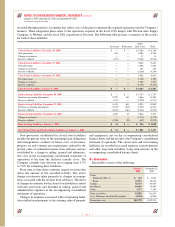

6—Receivables

Receivables consist of the following:

January 3, December 28,

2004 2002

Trade:

Wholesale (Note 3)................................. $ 435 $ 7,042

Retail....................................................... 24,594 18,836

Vendor......................................................... 56,727 67,057

Installment.................................................. 10,418 15,409

Other........................................................... 1,755 3,195

Total receivables......................................... 93,929 111,539

Less: Allowance for doubtful accounts...... (9,130) (8,965)

Receivables, net.......................................... $84,799 $102,574

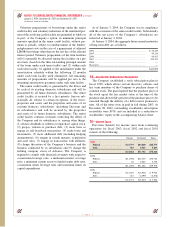

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

January 3, 2004, December 28, 2002 and December 29, 2001

(in thousands, except per share data)

Page 34