Advance Auto Parts 2003 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2003 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

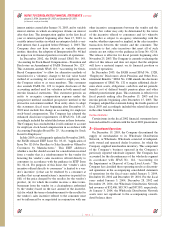

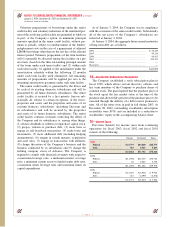

The provision (benefit) for income taxes from continuing

operations differed from the amount computed by applying

the federal statutory income tax rate due to:

2003 2002 2001

Income from continuing operations

before cumulative effect of a

change in accounting principle

at statutory U.S. federal income

tax rate............................................ $71,298 $35,587 $ 6,424

State income taxes, net of federal

income tax benefit.......................... 6,399 4,386 (1,481)

Non-deductible interest and

other expenses................................ 1,263 914 1,067

Valuation allowance ........................... (1,002) 241 44

Other, net............................................ 466 (1,598) 1,230

$78,424 $39,530 $ 7,284

During the years ended January 3, 2004, December 28,

2002, and December 29, 2001, the Company had a (loss)

income from operations of the discontinued Wholesale

Dealer Network of $(572), $4,691, and $4,040, respectively.

The Company recorded an income tax (benefit) expense of

$(220), $1,820 and $1,604 related to these discontinued oper-

ations for the years ended January 3, 2004, December 28,

2002, and December 29, 2001, respectively. During the year

ended December 29, 2001, the Company recorded the

cumulative effect of a change in accounting principle of

$3,425. The Company recorded an income tax benefit of

$1,360 related to this cumulative effect for the year ended

December 29, 2001.

Deferred income taxes are recognized for the tax conse-

quences in future years of differences between the tax bases

of assets and liabilities and their financial reporting

amounts at each period-end, based on enacted tax laws and

statutory income tax rates applicable to the periods in which

the differences are expected to affect taxable income.

Deferred income taxes reflect the net income tax effect

of temporary differences between the bases of assets and

liabilities for financial reporting purposes and for income

tax reporting purposes. Net deferred income tax balances

are comprised of the following:

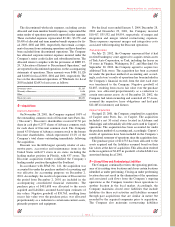

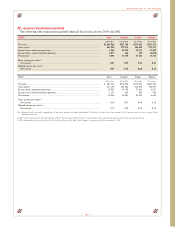

January 3, December 28,

2004 2002

Deferred income tax assets........................ $ 38,441 $ 82,555

Valuation allowance................................... (793) (1,795)

Deferred income tax liabilities .................. (100,989) (90,363)

Net deferred income tax (liabilities).......... $ (63,341) $ (9,603)

The Company incurred financial reporting and tax losses

in 1999 primarily due to integration and interest costs

incurred as a result of the fiscal 1998 Western merger and the

1998 recapitalization. At January 3, 2004 and December 28,

2002, the Company has cumulative net deferred income tax

liabilities of $63,341 and $9,603, respectively. The gross

deferred income tax assets also include state net operating

loss carryforwards, or NOLs, and state tax credit carryfor-

wards of approximately $6,695 and $594, respectively.

These NOLs and state tax credit carryforwards may be used

to reduce future taxable income and expire periodically

through fiscal year 2022. The Company believes it will

realize these tax benefits through a combination of the

reversal of temporary differences, projected future taxable

income during the NOL carryforward periods and available

tax planning strategies. Due to uncertainties related to the

realization of certain deferred tax assets for NOLs in various

jurisdictions, the Company recorded a valuation allowance

of $793 as of January 3, 2004 and $1,795 as of December 28,

2002. The amount of deferred income tax assets realizable,

however, could change in the near future if estimates of

future taxable income are changed.

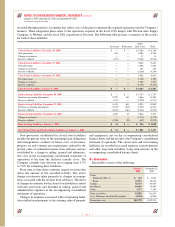

Temporary differences which give rise to significant

deferred income tax assets (liabilities) are as follows:

January 3, December 28,

2004 2002

Current deferred income tax assets

(liabilities):

Inventory differences.......................... $(51,604) $(53,372)

Accrued medical and workers’

compensation.................................. 6,755 8,355

Accrued expenses not currently

deductible for tax............................ 17,466 21,490

Net operating loss carryforwards ....... 3,567 16,426

Minimum tax credit carryforward

(no expiration)................................ —7,611

Total current deferred income tax

assets (liabilities)............................ $(23,816) $ 510

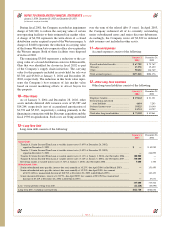

Long-term deferred income tax

assets (liabilities):

Property and equipment ..................... $(47,318) $(36,991)

Postretirement benefit obligation ....... 6,931 7,393

Unamortized bond discount ............... —12,980

Net operating loss carryforwards ....... 3,128 7,312

Tax credit carryforwards .................... 594 594

Valuation allowance ........................... (793) (1,795)

Other, net............................................ (2,067) 394

Total long-term deferred income

tax assets (liabilities)...................... $(39,525) $(10,113)

Page 39

Advance Auto Parts, Inc. and Subsidiaries