Advance Auto Parts 2003 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2003 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

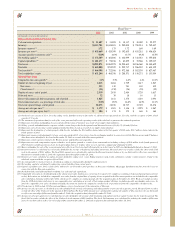

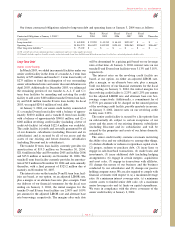

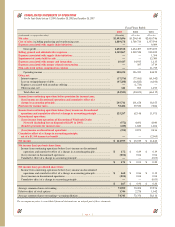

Quarterly Financial Results (unaudited) (in thousands, except per share data)

16-Weeks 12-Weeks 12-Weeks 13-Weeks 16-Weeks 12-Weeks 12-Weeks 12-Weeks

Ended Ended Ended Ended Ended Ended Ended Ended

4/19/03 7/12/03 10/4/03 1/3/04 4/20/02 7/13/02 10/5/02 12/28/02

Net sales ............................................... $1,005,968 $827,348 $839,101 $821,279 $967,316 $774,906 $772,723 $689,195

Gross profit........................................... 463,989 379,474 386,928 374,127 431,198 345,802 346,840 310,567

Net income ........................................... $ 5,041 $ 43,458 $ 45,164 $ 31,272 $ 12,096 $ 15,941 $ 28,363 $ 8,619

Net income per share:

Basic................................................. $ 0.07 $ 0.59 $ 0.61 $ 0.42 $ 0.18 $ 0.23 $ 0.40 $ 0.12

Diluted.............................................. $ 0.07 $ 0.58 $ 0.60 $ 0.41 $ 0.17 $ 0.22 $ 0.39 $ 0.12

rates during 2002 as compared to 2001. This increase in

borrowings is a result of the additional debt incurred in

conjunction with the Discount acquisition.

Income tax expense for 2002 was $39.5 million, as

compared to $7.3 million for 2001. Our effective income

tax rate decreased to 38.8% for 2002, as compared to

39.7%, for 2001. The decrease was primarily due to

increases in pre-tax income, which reduced the impact of

certain permanent differences on the effective rate.

During 2002, we recorded $16.8 million in a loss on

extinguishment of debt. This loss reflects the write-off of

the ratable portion of the deferred loan costs associated with

our partial repayment of our tranche A and tranche B term

loans and expenses associated with the refinancing of the

remaining portion of our tranche B term loans. Additionally,

this loss includes the write-off of the ratable portion of

deferred loan costs and premiums paid associated with the

partial repurchase and retirement of our outstanding senior

subordinated notes and senior discount debentures.

We recorded net income of $65.0 million, $0.90 per

diluted share for 2002, as compared to $11.4 million, or

$0.20 per diluted share for 2001. As a percentage of sales, net

income for 2002 was 2.0%, as compared to 0.5% for 2001.

The effect of the above merger and integration items and loss

on extinguishment of debt on net income is $32.0 million,

or $0.44 per diluted share for 2002. The effect of the 2001

merger and integration expenses, loss on extinguishment of

debt, cumulative effect of a change in accounting policy

and other charges as detailed above were $29.5 million, or

$0.51 per diluted share for 2001. As previously mentioned

these per share amounts reflect the two-for-one stock split

declared in 2003.

Page 17

Advance Auto Parts, Inc. and Subsidiaries

Liquidity and Capital Resources

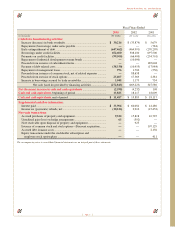

At January 3, 2004, we had outstanding indebtedness

consisting of borrowings of $440.0 million under our senior

credit facility. Additionally, we had outstanding borrowings

of $5.0 million under our revolving credit facility and

had $32.6 million in letters of credit outstanding, which

reduced our availability under the revolving credit facility

to $122.4 million.

Our primary capital requirements have been the funding of

our continued store expansion program, including new store

openings and store acquisitions, store relocations and remod-

els, inventory requirements, the construction and upgrading of

distribution centers, the development and implementation of

proprietary information systems and our strategic acquisitions.

We have financed our growth through a combination of cash

generated from operations, borrowings under the credit facil-

ity and issuances of equity.

Our new stores, if leased, require capital expenditures of

approximately $150,000 per store and an inventory invest-

ment of approximately $150,000 per store, net of vendor

payables. A portion of the inventory investment is held at

a distribution facility. Pre-opening expenses, consisting

primarily of store set-up costs and training of new store

team members, average approximately $25,000 per store

and are expensed when incurred.

Our future capital requirements will depend on the

number of new stores we open or acquire and the timing of

those openings or acquisitions within a given year. We

opened 125 and 110 new stores during 2003 and 2002,

respectively, (including stores acquired in the Trak and

Carport acquisitions, but excluding stores acquired in the

Discount acquisition). In addition, we anticipate adding

approximately 125 to 135 new stores during 2004 primarily

through new store openings.

Historically, we have negotiated extended payment terms

from suppliers that help finance inventory growth, and we

believe that we will be able to continue financing much of

our inventory growth through such extended payment

terms. We anticipate that inventory levels will continue to

increase but at a rate lower than anticipated sales growth. As

recently announced, we have launched a vendor factoring

program in 2004 that will allow us to extend the terms on a

portion of our accounts payable with our suppliers, therefore,

positively impacting cash flow.

Our capital expenditures were $101.2 million in 2003.

These amounts related to the new store openings, the

upgrade of our information systems, remodels and reloca-

tions of existing stores, including our physical conversion

of Discount stores, and capitalizable store improvements.

In 2004, we anticipate that our capital expenditures will