Advance Auto Parts 2003 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2003 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Voluntary prepayments of borrowings under the senior

credit facility and voluntary reductions of the unutilized por-

tion of the revolving credit facility are permitted in whole or

in part, at the Company’s option, in minimum principal

amounts specified in the senior credit facility, without pre-

mium or penalty, subject to reimbursement of the lenders’

redeployment costs in the case of a prepayment of adjusted

LIBOR borrowings other than on the last day of the relevant

interest period. Voluntary prepayments of the term facilities

will (1) generally be allocated among the facilities on a pro

rata basis (based on the then outstanding principal amount

of the loans under each term facility) and (2) within each

such term facility, be applied to the installments under the

amortization schedule within the following 12 months

under such term facility until eliminated. All remaining

amounts of prepayments will be applied pro rata to the

remaining amortization payments under such term facility.

The senior credit facility is guaranteed by the Stores and

by each of its existing domestic subsidiaries and will be

guaranteed by all future domestic subsidiaries. The senior

credit facility is secured by a first priority lien on sub-

stantially all, subject to certain exceptions, of the stores’

properties and assets and the properties and assets of its

existing domestic subsidiaries (including Discount and

its subsidiaries) and will be secured by the properties

and assets of its future domestic subsidiaries. The senior

credit facility contains covenants restricting the ability of

the Company and its subsidiaries to, among other things,

(1) declare dividends or redeem or repurchase capital stock,

(2) prepay, redeem or purchase debt, (3) incur liens or

engage in sale-leaseback transactions, (4) make loans and

investments, (5) incur additional debt (including hedging

arrangements), (6) engage in certain mergers, acquisitions

and asset sales, (7) engage in transactions with affiliates,

(8) change the nature of the Company’s business and the

business conducted by its subsidiaries and (9) change the

holding company status of Advance. The Company is

required to comply with financial covenants with respect to

a maximum leverage ratio, a minimum interest coverage

ratio, a minimum current assets to funded senior debt ratio,

a maximum senior leverage ratio and maximum limits on

capital expenditures.

As of January 3, 2004, the Company was in compliance

with the covenants of the senior credit facility. Substantially

all of the net assets of the Company’s subsidiaries are

restricted at January 3, 2004.

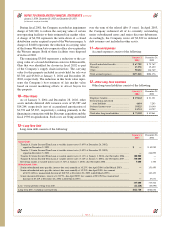

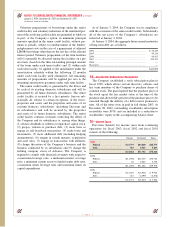

At January 3, 2004, the aggregate future annual maturities

of long-term debt are as follows:

2004 .......................................................................................... $ 22,220

2005 .......................................................................................... 49,210

2006 .......................................................................................... 48,413

2007 .......................................................................................... 325,157

2008 .......................................................................................... —

Thereafter.................................................................................. —

$445,000

14—Stockholder Subscription Receivables

The Company established a stock subscription plan in

fiscal 1998, which allows certain directors, officers and

key team members of the Company to purchase shares of

common stock. The plan required that the purchase price of

the stock equal the fair market value at the time of the

purchase and allowed fifty percent of the purchase price to be

executed through the delivery of a full recourse promissory

note. All of the notes were in paid in full during 2003. At

December 28, 2002, outstanding stockholder subscription

receivables were $976, and are included as a reduction to

stockholders’ equity in the accompanying balance sheet.

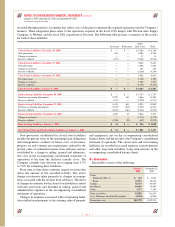

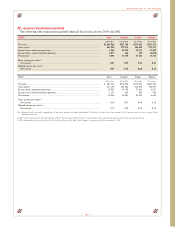

15—Income Taxes

Provision (benefit) for income taxes from continuing

operations for fiscal 2003, fiscal 2002 and fiscal 2001

consists of the following:

Current Deferred Total

2003

Federal...................................... $ 23,759 $44,820 $68,579

State.......................................... 923 8,922 9,845

$ 24,682 $53,742 $78,424

2002

Federal....................................... $(11,958) $44,740 $32,782

State........................................... 62 6,686 6,748

$(11,896) $51,426 $39,530

2001

Federal....................................... $ 12,510 $(2,948) $ 9,562

State........................................... 221 (2,499) (2,278)

$ 12,731 $(5,447) $ 7,284

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

January 3, 2004, December 28, 2002 and December 29, 2001

(in thousands, except per share data)

Page 38