Abercrombie & Fitch 2013 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2013 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

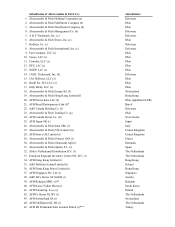

92

*10.35

Stock Appreciation Right Agreement [Retention Grant Tranche 1], made to be effective as of December 19, 2008, by

and between A&F and Michael S. Jeffries entered into to evidence first tranche of Retention Grant covering

1,600,000 stock appreciation rights granted under the Abercrombie & Fitch Co. 2007 Long-Term Incentive Plan

(now known as the Amended and Restated Abercrombie & Fitch Co. 2007 Long-Term Incentive Plan) as

contemplated by the Employment Agreement, entered into as of December 19, 2008, by and between A&F and

Michael S. Jeffries, incorporated herein by reference to Exhibit 10.3 to A&F’s Current Report on Form 8-K dated

and filed February 17, 2009 (File No. 001-12107).

*10.36

Stock Appreciation Right Agreement [Retention Grant Tranche 2] by and between A&F and Michael S. Jeffries

entered into effective as of March 2, 2009 to evidence second tranche of Retention Grant covering 1,200,000 stock

appreciation rights granted under the Abercrombie & Fitch Co. 2007 Long-Term Incentive Plan (now known as the

Amended and Restated Abercrombie & Fitch Co. 2007 Long-Term Incentive Plan) as contemplated by the

Employment Agreement, entered into as of December 19, 2008, by and between A&F and Michael S. Jeffries,

incorporated herein by reference to Exhibit 10.4 to A&F’s Current Report on Form 8-K dated and filed February 17,

2009 (File No. 001-12107).

*10.37

Stock Appreciation Right Agreement [Retention Grant Tranche 3] by and between A&F and Michael S. Jeffries

entered into effective as of September 1, 2009 to evidence third tranche of Retention Grant covering 1,200,000 stock

appreciation rights granted under the Abercrombie & Fitch Co. 2007 Long-Term Incentive Plan (now known as the

Amended and Restated Abercrombie & Fitch Co. 2007 Long-Term Incentive Plan) as contemplated by the

Employment Agreement, entered into as of December 19, 2008, by and between A&F and Michael S. Jeffries,

incorporated herein by reference to Exhibit 10.5 to A&F’s Current Report on Form 8-K dated and filed February 17,

2009 (File No. 001-12107).

*10.38

Form of Stock Appreciation Right Agreement to be used to evidence the grant of stock appreciation rights to

associates (employees) of Abercrombie & Fitch Co. and its subsidiaries under the Abercrombie & Fitch Co. 2005

Long-Term Incentive Plan after February 12, 2009, incorporated herein by reference to Exhibit 10.6 to A&F’s

Current Report on Form 8-K dated and filed February 17, 2009 (File No. 001-12107).

*10.39

Abercrombie & Fitch Co. Directors’ Deferred Compensation Plan (Plan II) — as authorized by the Board of

Directors of A&F on December 17, 2007, to become one of two plans following the division of the Abercrombie &

Fitch Co. Directors’ Deferred Compensation Plan (as amended and restated May 22, 2003) into two separate plans

effective January 1, 2005 and to be named Abercrombie & Fitch Co. Directors’ Deferred Compensation Plan (Plan

II) [terms to govern “amounts deferred” (within the meaning of Section 409A of the Internal Revenue Code of 1986,

as amended) in taxable years beginning on or after January 1, 2005 and any earnings thereon], incorporated herein

by reference to Exhibit 10.50 to A&F’s Annual Report on Form 10-K for the fiscal year ended January 31, 2009

(File No. 001-12107).

12.1 Computation of Leverage Ratio and Coverage Ratio for the fiscal year ended February 2, 2013.

14.1

Abercrombie & Fitch Code of Business Conduct and Ethics, as amended by the Board of Directors of A&F on

August 21, 2007, incorporated herein by reference to Exhibit 14 to A&F’s Current Report on Form 8-K dated and

filed August 27, 2007 (File No. 001-12107).

18.1 Letter of Change in Accounting Principle

21.1 List of Subsidiaries of the Registrant

23.1 Consent of Independent Registered Public Accounting Firm — PricewaterhouseCoopers LLP

24.1 Powers of Attorney

31.1

Certifications by Principal Executive Officer pursuant to Rule 13a-14(a) or 15d-14(a) under the Securities Exchange

Act of 1934, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

31.2

Certifications by Principal Financial Officer pursuant to Rule 13a-14(a) or 15d-14(a) under the Securities Exchange

Act of 1934, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

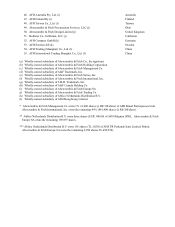

32.1

Certifications by Principal Executive Officer and Principal Financial Officer pursuant to 18 U.S.C. Section 1350, as

adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002**

101

The following materials from Abercrombie & Fitch Co.’s Annual Report on Form 10-K for the fiscal year ended

February 2, 2013, formatted in XBRL (eXtensible Business Reporting Language): (i) Consolidated Statements of

Operations and Comprehensive Income for the fiscal years ended February 2, 2013, January 28, 2012 and January

29, 2011; (ii) Consolidated Balance Sheets at February 2, 2013 and January 28, 2012; (iii) Consolidated Statements

of Stockholders’ Equity for the fiscal years ended February 2, 2013, January 28, 2012 and January 29, 2011;

(iv) Consolidated Statements of Cash Flows for the fiscal years ended February 2, 2013, January 28, 2012 and

January 29, 2011; and (v) Notes to Consolidated Financial Statements***

* Management contract or compensatory plan or arrangement required to be filed as an exhibit to this Annual Report on Form 10-K

pursuant to Item 15(a)(3) of this Annual Report on Form 10-K.

** These certifications are furnished.

*** Electronically submitted herewith

Table of Contents