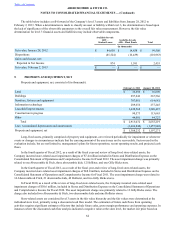

Abercrombie & Fitch 2013 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2013 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62

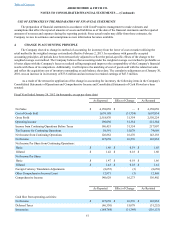

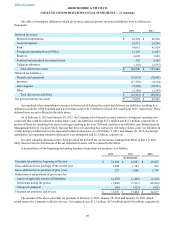

The total fair value of restricted stock units granted during Fiscal 2012, Fiscal 2011 and Fiscal 2010 was $30.1 million,

$31.2 million and $17.9 million, respectively.

The total grant date fair value of restricted stock units and restricted shares which vested during Fiscal 2012, Fiscal 2011

and Fiscal 2010 was $19.5 million, $24.3 million and $24.3 million, respectively.

As of February 2, 2013, there was $38.9 million of total unrecognized compensation cost, net of estimated forfeitures,

related to non-vested restricted stock units. The unrecognized compensation cost is expected to be recognized over a weighted-

average period of six months.

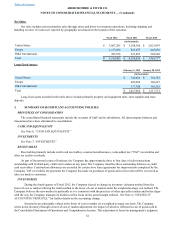

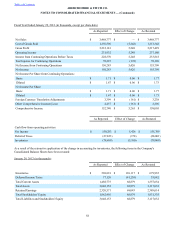

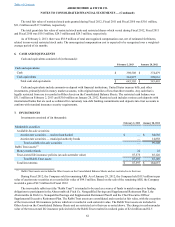

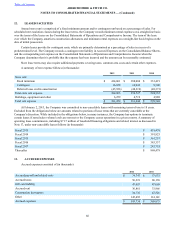

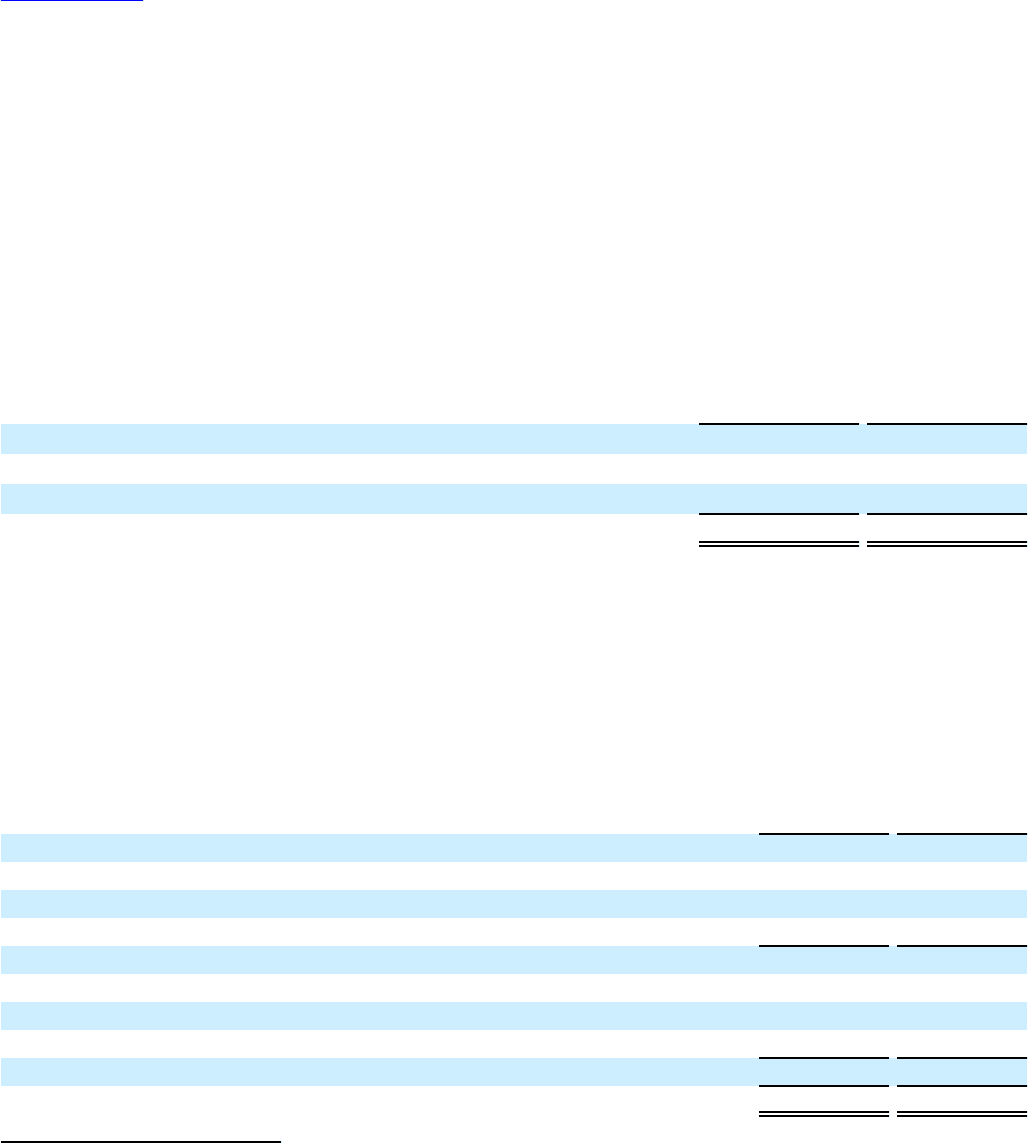

6. CASH AND EQUIVALENTS

Cash and equivalents consisted of (in thousands):

February 2, 2013 January 28, 2012

Cash and equivalents:

Cash $ 398,508 $ 374,479

Cash equivalents 244,997 209,016

Total cash and equivalents $ 643,505 $ 583,495

Cash and equivalents include amounts on deposit with financial institutions, United States treasury bills, and other

investments, primarily held in money market accounts, with original maturities of less than three months. Any cash that is

legally restricted from use is recorded in Other Assets on the Consolidated Balance Sheets. The restricted cash balance was

$31.1 million on February 2, 2013 and $30.0 million on January 28, 2012. Restricted cash includes various cash deposits with

international banks that are used as collateral for customary non-debt banking commitments and deposits into trust accounts to

conform with standard insurance security requirements.

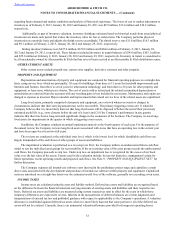

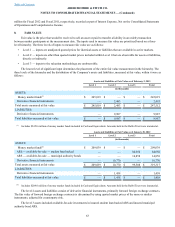

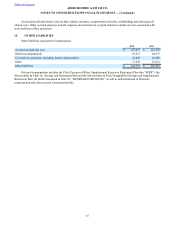

7. INVESTMENTS

Investments consisted of (in thousands):

February 2, 2013 January 28, 2012

Marketable securities:

Available-for-sale securities:

Auction rate securities — student loan backed $ — $ 84,650

Auction rate securities — municipal authority bonds — 14,858

Total available-for-sale securities — 99,508

Rabbi Trust assets:(1)

Money market funds 22 23

Trust-owned life insurance policies (at cash surrender value) 87,575 85,126

Total Rabbi Trust assets 87,597 85,149

Total Investments $ 87,597 $ 184,657

(1) Rabbi Trust assets are included in Other Assets on the Consolidated Balance Sheets and are restricted as to their use.

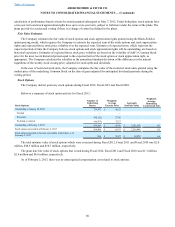

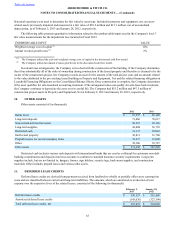

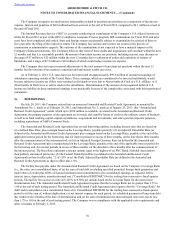

During Fiscal 2012, the Company sold its remaining ARS. As of January 28, 2012, the Company held $113 million in par

value of auction rate securities at a recorded fair value of $99.5 million. Based on the sale of the remaining ARS, the Company

recorded a gain of $2.5 million for Fiscal 2012.

The irrevocable rabbi trust (the “Rabbi Trust”) is intended to be used as a source of funds to match respective funding

obligations to participants in the Abercrombie & Fitch Co. Nonqualified Savings and Supplemental Retirement Plan I, the

Abercrombie & Fitch Co. Nonqualified Savings and Supplemental Retirement Plan II and the Chief Executive Officer

Supplemental Executive Retirement Plan. The Rabbi Trust assets are consolidated and recorded at fair value, with the exception

of the trust-owned life insurance policies which are recorded at cash surrender value. The Rabbi Trust assets are included in

Other Assets on the Consolidated Balance Sheets and are restricted as to their use as noted above. The change in cash surrender

value of the trust-owned life insurance policies held in the Rabbi Trust resulted in realized gains of $2.4 million and $2.5

Table of Contents ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)