Abercrombie & Fitch 2013 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2013 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

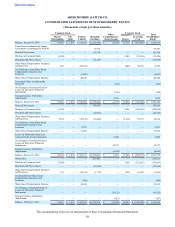

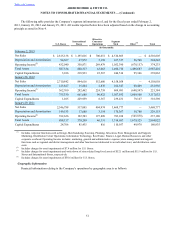

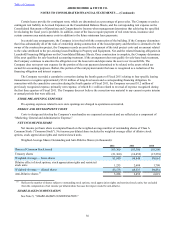

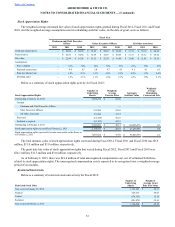

Net Sales:

Net sales includes net merchandise sales through stores and direct-to-consumer operations, including shipping and

handling revenue. Net sales are reported by geographic area based on the location of the customer.

Fiscal 2012 Fiscal 2011 Fiscal 2010

(in thousands):

United States $ 3,087,205 $ 3,108,380 $ 2,821,993

Europe 1,137,664 822,473 443,836

Other International 285,936 227,205 202,948

Total $ 4,510,805 $ 4,158,058 $ 3,468,777

Long-Lived Assets:

February 2, 2013 January 28, 2012

(in thousands):

United States $ 742,926 $ 794,723

Europe 496,960 366,647

Other International 177,780 156,361

Total $ 1,417,666 $ 1,317,731

Long-lived assets included in the table above include primarily property and equipment (net), store supplies and lease

deposits.

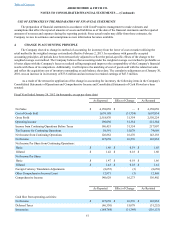

3. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

PRINCIPLES OF CONSOLIDATION

The consolidated financial statements include the accounts of A&F and its subsidiaries. All intercompany balances and

transactions have been eliminated in consolidation.

CASH AND EQUIVALENTS

See Note 6, “CASH AND EQUIVALENTS.”

INVESTMENTS

See Note 7, “INVESTMENTS.”

RECEIVABLES

Receivables primarily include credit card receivables, construction allowances, value added tax (“VAT”) receivables and

other tax credits or refunds.

As part of the normal course of business, the Company has approximately three to four days of sales transactions

outstanding with its third-party credit card vendors at any point. The Company classifies these outstanding balances as credit

card receivables. Construction allowances are recorded for certain store lease agreements for improvements completed by the

Company. VAT receivables are payments the Company has made on purchases of goods and services that will be recovered as

sales are made to customers.

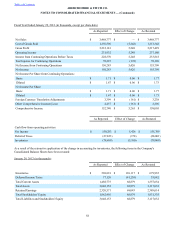

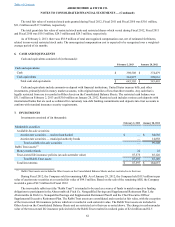

INVENTORIES

During the fourth quarter of Fiscal 2012, the Company elected to change its inventory valuation method from the

lower of cost or market utilizing the retail method to the lower of cost or market under the weighted average cost method. The

Company believes the new method is preferable as it is consistent with the practices of other specialty retailers and better aligns

with the way the Company manages its business with a focus on the actual margin realized. See Note 4, “CHANGE IN

ACCOUNTING PRINCIPLE,” for further details on the accounting change.

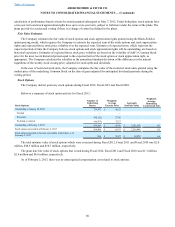

Inventories are principally valued at the lower of cost or market on a weighted-average cost basis. The Company

writes down inventory through a lower of cost or market adjustment, the impact of which is reflected in cost of goods sold in

the Consolidated Statements of Operations and Comprehensive Income. This adjustment is based on management's judgment

Table of Contents ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)