Abercrombie & Fitch 2013 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2013 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68

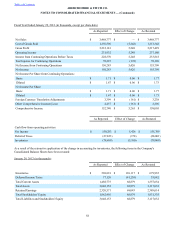

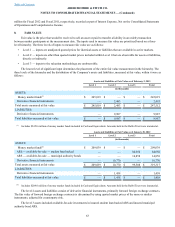

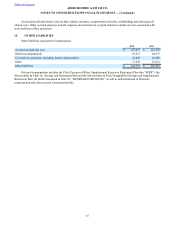

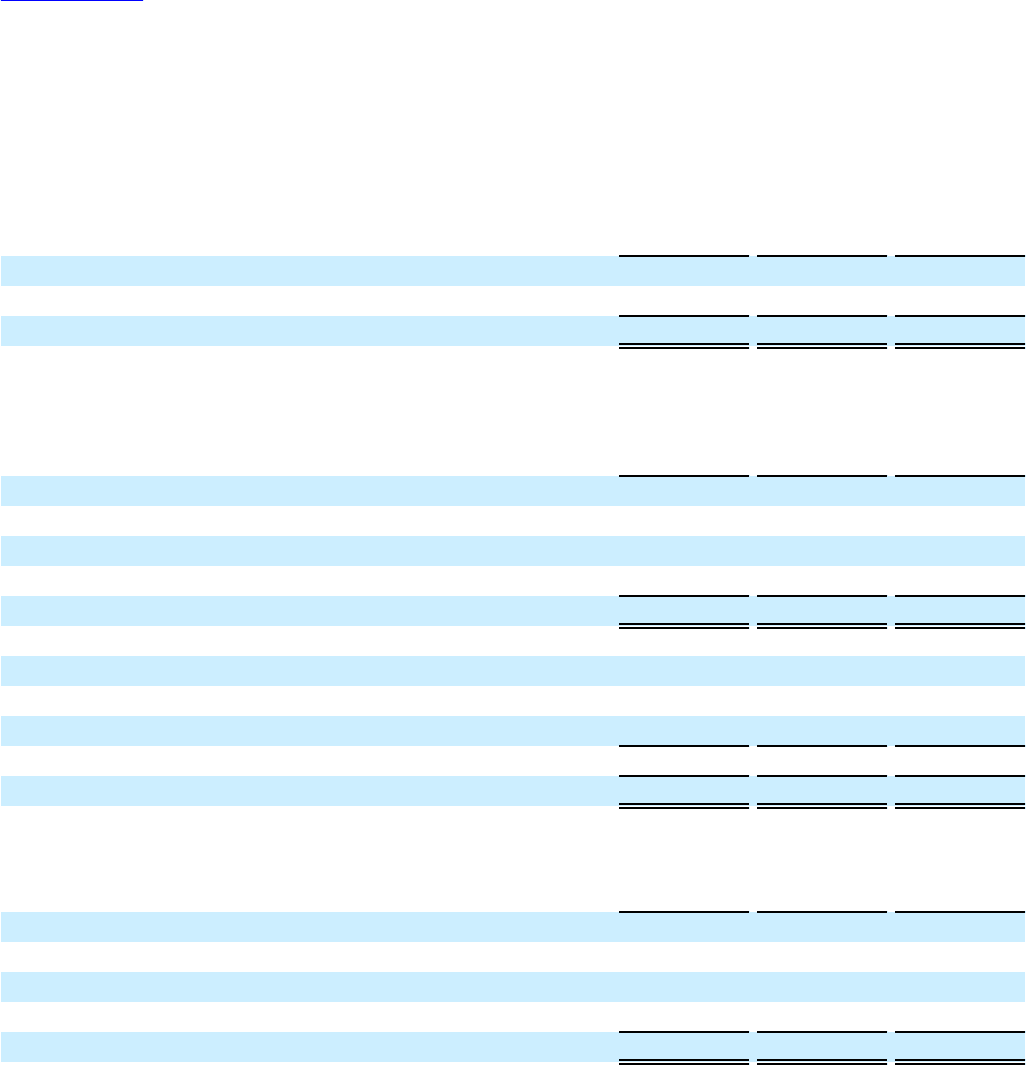

15. INCOME TAXES

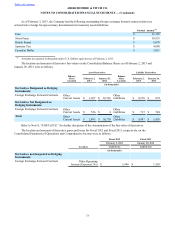

Income from continuing operations before taxes was comprised of (in thousands) (amounts restated due to change in

accounting principle referenced in Note 4):

2012 2011 2010

Domestic $ 302,589 $ 192,312 $ 188,444

Foreign 64,356 25,495 45,374

Total $ 366,945 $ 217,807 $ 233,818

Domestic income from continuing operations above includes intercompany charges to foreign affiliates for management

fees, cost-sharing, royalties, including those related to international direct-to-consumer operations, and interest. The provision

for tax expense from continuing operations consisted of (in thousands):

2012 2011 2010

Current:

Federal $ 111,761 $ 100,495 $ 94,922

State 15,323 11,085 16,126

Foreign 17,984 13,262 11,395

$ 145,068 $ 124,842 $ 122,443

Deferred:

Federal $(10,456) $ (32,776) $ (33,441)

State 458 (8,662)(7,299)

Foreign (5,136)(8,735)(3,594)

$(15,134) $ (50,173) $ (44,334)

Total provision $ 129,934 $ 74,669 $ 78,109

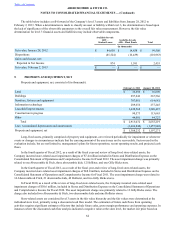

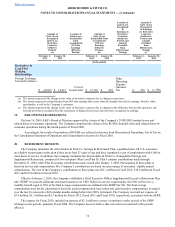

Reconciliation between the statutory federal income tax rate and the effective tax rate for continuing operations is as

follows:

2012 2011 2010

Federal income tax rate 35.0% 35.0% 35.0%

State income tax, net of federal income tax effect 2.7 3.9 2.5

Tax effect of foreign earnings (1.8)(3.0)(3.7)

Other items, net (0.5)(1.6)(0.4)

Total 35.4% 34.3% 33.4%

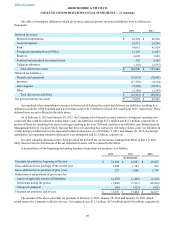

Amounts paid directly to taxing authorities were $122.7 million, $118.2 million, and $85.1 million in Fiscal 2012, Fiscal

2011, and Fiscal 2010, respectively.

Table of Contents ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)