Abercrombie & Fitch 2013 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2013 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

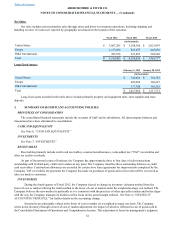

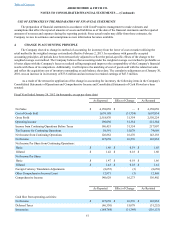

1. BASIS OF PRESENTATION

Abercrombie & Fitch Co. (“A&F”), through its wholly-owned subsidiaries (collectively, A&F and its wholly-owned

subsidiaries are referred to as “Abercrombie & Fitch” or the “Company”), is a specialty retailer of high-quality, casual apparel

for men, women and kids with an active, youthful lifestyle.

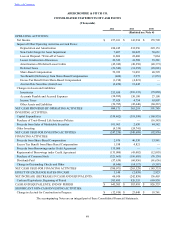

The accompanying consolidated financial statements include the historical financial statements of, and transactions

applicable to, the Company and reflect its assets, liabilities, results of operations and cash flows.

FISCAL YEAR

The Company’s fiscal year ends on the Saturday closest to January 31, typically resulting in a fifty-two week year, but

occasionally giving rise to an additional week, resulting in a fifty-three week year as was the case for Fiscal 2012. Fiscal years

are designated in the consolidated financial statements and notes by the calendar year in which the fiscal year commences. All

references herein to “Fiscal 2012” represent the 53-week fiscal year ended February 2, 2013; to “Fiscal 2011” represent the 52-

week fiscal year ended January 28, 2012; and to “Fiscal 2010” represent the 52-week fiscal year ended January 29, 2011. In

addition, all references herein to “Fiscal 2013” represent the 52-week fiscal year that will end on February 1, 2014.

RECLASSIFICATIONS

Certain prior period amounts have been reclassified or adjusted to conform to the current year presentation.

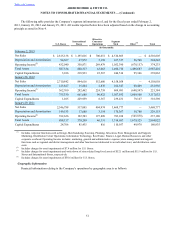

2. SEGMENT REPORTING

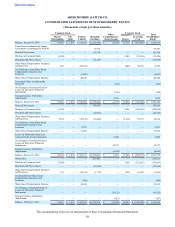

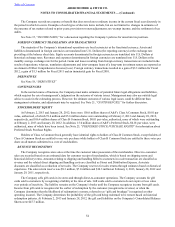

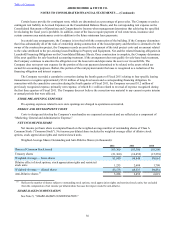

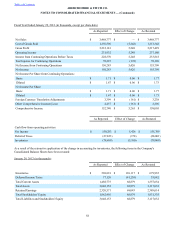

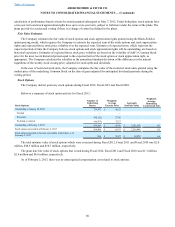

The Company determines its segments on the same basis that it uses to allocate resources and assess performance. All of

the Company’s segments sell a similar group of products—casual sportswear apparel, personal care products and accessories

for men, women and kids and bras, underwear and sleepwear for girls. The Company has three reportable segments: U.S.

Stores, International Stores, and Direct-to-Consumer. Corporate functions, interest income and expense, and other income and

expense are evaluated on a consolidated basis and are not allocated to the Company’s segments, and therefore are included in

Other.

The U.S. Stores reportable segment includes the results of store operations in the United States and Puerto Rico,

including outlet stores. The International Stores reportable segment includes the results of store operations in Canada, Europe

and Asia and sell-off of merchandise to authorized third-party resellers. The Direct-to-Consumer reportable segment includes

the results of operations directly associated with on-line operations, both domestic and international.

Operating income is the primary measure of profit the Company uses to make decisions regarding the allocation of

resources to its operating segments. For the U.S. Stores and International Stores reportable segments, operating income is

defined as aggregate income directly attributable to individual stores on a four-wall basis. Four-wall expense includes all

expenses contained “within the four walls of the stores.” The four-wall expense includes: cost of merchandise, selling payroll

and related costs, rent, utilities, depreciation, repairs and maintenance, supplies and packaging and other store sales-related

expenses including credit card and bank fees and taxes. Operating income also reflects pre-opening charges related to stores not

yet in operation. For the Direct-to-Consumer reportable segment, operating income is defined as aggregate income attributable

to the direct-to-consumer business, less call center, fulfillment and shipping expense, charge card fees and direct-to-consumer

operations management and support expenses. The U.S. Stores, International Stores and Direct-to-Consumer segments exclude

marketing, general and administrative expense; store management and support functions such as regional and district

management and other functions not dedicated to an individual store; and distribution center costs. All costs excluded from the

three reportable segments are included in Other.

Reportable segment assets include those used directly in or resulting from the operations of each reportable segment.

Total assets for the U.S. Stores and International Stores reportable segments primarily consist of store cash, credit card

receivables, prepaid rent, store packaging and supplies, lease deposits, merchandise inventory, leasehold acquisition costs,

restricted cash and the net book value of store long-lived assets. Total assets for International Stores also include VAT

receivables. Total assets for the Direct-to-Consumer reportable segment primarily consist of credit card receivables,

merchandise inventory, and the net book value of long-lived assets. Total assets for Other include cash, investments,

distribution center inventory, the net book value of home office and distribution center long-lived assets, foreign currency hedge

assets and tax-related assets. Reportable segment capital expenditures are direct purchases of property and equipment for that

segment.

Table of Contents