Abercrombie & Fitch 2013 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2013 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

USE OF ESTIMATES IN THE PREPARATION OF FINANCIAL STATEMENTS

The preparation of financial statements in accordance with GAAP requires management to make estimates and

assumptions that affect the reported amounts of assets and liabilities as of the date of the financial statements and the reported

amounts of revenues and expenses during the reporting periods. Since actual results may differ from those estimates, the

Company revises its estimates and assumptions as new information becomes available.

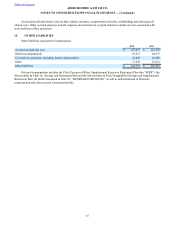

4. CHANGE IN ACCOUNTING PRINCIPLE

The Company elected to change its method of accounting for inventory from the lower of cost or market utilizing the

retail method to the weighted average cost method effective February 2, 2013. In accordance with generally accepted

accounting principles, all periods have been retroactively adjusted to reflect the period-specific effects of the change to the

weighted average cost method. The Company believes that accounting under the weighted average cost method is preferable as

it better aligns with the Company's focus on realized selling margin and improves the comparability of the Company's financial

results with those of its competitors. Additionally, it will improve the matching of cost of goods sold with the related net sales

and reflect the acquisition cost of inventory outstanding at each balance sheet date. The cumulative adjustment as of January 30,

2010, was an increase in its inventory of $73.6 million and an increase in retained earnings of $47.3 million.

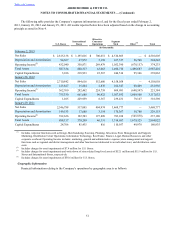

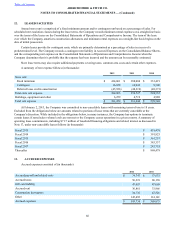

As a result of the retroactive application of the change in accounting for inventory, the following items in the Company's

Consolidated Statements of Operations and Comprehensive Income and Consolidated Statements of Cash Flows have been

restated:

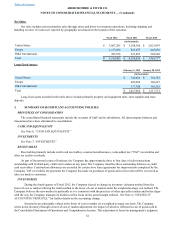

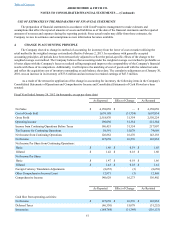

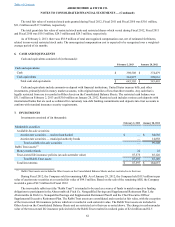

Fiscal Year Ended January 28, 2012 (in thousands, except per share data)

As Reported Effect of Change As Restated

Net Sales $ 4,158,058 $ — $ 4,158,058

Cost of Goods Sold 1,639,188 (31,354) 1,607,834

Gross Profit 2,518,870 31,354 2,550,224

Operating Income 190,030 31,354 221,384

Income from Continuing Operations Before Taxes 186,453 31,354 217,807

Tax Expense for Continuing Operations 59,591 15,078 74,669

Net Income from Continuing Operations 126,862 16,276 143,138

Net Income 127,658 16,276 143,934

Net Income Per Share from Continuing Operations:

Basic $ 1.46 $ 0.19 $ 1.65

Diluted $ 1.42 $ 0.18 $ 1.60

Net Income Per Share:

Basic $ 1.47 $ 0.19 $ 1.66

Diluted $ 1.43 $ 0.18 $ 1.61

Foreign Currency Translation Adjustments (8,655)(3)(8,658)

Other Comprehensive Income (Loss) 12,971 (3) 12,968

Comprehensive Income 140,629 16,273 156,902

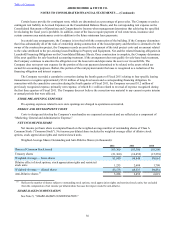

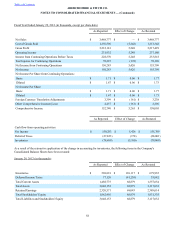

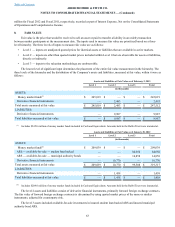

As Reported Effect of Change As Restated

Cash flow from operating activities:

Net Income $ 127,658 $ 16,276 $ 143,934

Deferred Taxes (46,330) 15,078 (31,252)

Inventories (184,784)(31,349)(216,133)

Table of Contents ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)