Abercrombie & Fitch 2013 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2013 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64

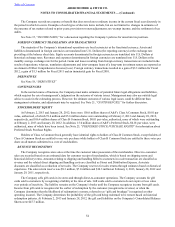

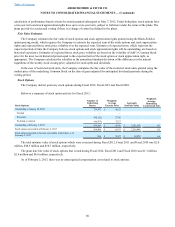

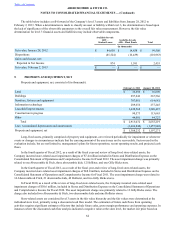

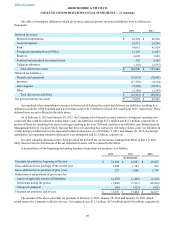

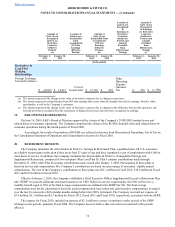

The table below includes a roll-forward of the Company’s level 3 assets and liabilities from January 28, 2012 to

February 2, 2013. When a determination is made to classify an asset or liability within level 3, the determination is based upon

the lack of significance of the observable parameters to the overall fair value measurement. However, the fair value

determination for level 3 financial assets and liabilities may include observable components.

Available-for-sale

ARS -

Student Loans Available-for-sale

ARS - Muni Bonds Total

(in thousands)

Fair value, January 28, 2012 $ 84,650 $ 14,858 $ 99,508

Dispositions (85,524)(16,439)(101,963)

Gains and (losses), net:

Reported in Net Income 874 1,581 2,455

Fair value, February 2, 2013 $ — $ — $ —

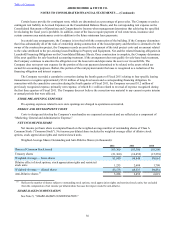

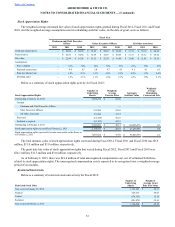

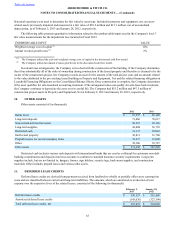

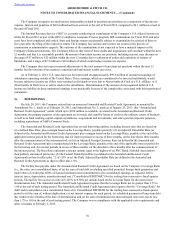

9. PROPERTY AND EQUIPMENT, NET

Property and equipment, net, consisted of (in thousands):

February 2, 2013 January 28, 2012

Land $ 36,890 $ 36,890

Buildings 297,243 267,566

Furniture, fixtures and equipment 707,061 614,641

Information technology 289,656 237,245

Leasehold improvements 1,449,568 1,340,487

Construction in progress 90,573 113,663

Other 44,081 44,727

Total $ 2,915,072 $ 2,655,219

Less: Accumulated depreciation and amortization (1,606,840)(1,457,948)

Property and equipment, net $ 1,308,232 $ 1,197,271

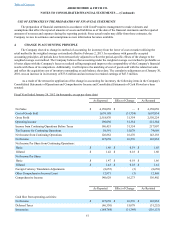

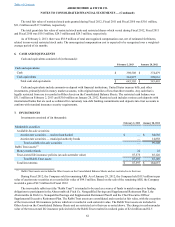

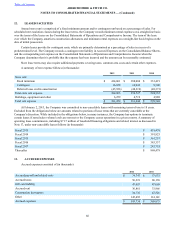

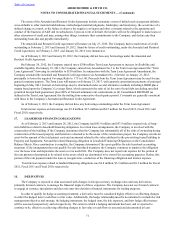

Long-lived assets, primarily comprised of property and equipment, are reviewed periodically for impairment or whenever

events or changes in circumstances indicate that the carrying amount of the assets may not be recoverable. Factors used in the

evaluation include, but are not limited to, management’s plans for future operations, recent operating results, and projected cash

flows.

In the fourth quarter of Fiscal 2012, as a result of the fiscal year-end review of long-lived store-related assets, the

Company incurred store-related asset impairment charges of $7.4 million included in Stores and Distribution Expense on the

Consolidated Statement of Operations and Comprehensive Income for Fiscal 2012. The asset impairment charge was primarily

related to one Abercrombie & Fitch, three abercrombie kids, 12 Hollister, and one Gilly Hicks store.

In the fourth quarter of Fiscal 2011, as a result of the fiscal year-end review of long-lived store-related assets, the

Company incurred store-related asset impairment charges of $68.0 million, included in Stores and Distribution Expense on the

Consolidated Statement of Operations and Comprehensive Income for Fiscal 2011. The asset impairment charge was related to

14 Abercrombie & Fitch, 21 abercrombie kids, 42 Hollister, and two Gilly Hicks stores.

In Fiscal 2010, as a result of the review of long-lived store-related assets, the Company incurred store-related asset

impairment charges of $50.6 million, included in Stores and Distribution Expense on the Consolidated Statement of Operations

and Comprehensive Income for Fiscal 2010. The asset impairment charge was primarily related to 13 Gilly Hicks stores. The

charge also included two Abercrombie & Fitch, two abercrombie kids and nine Hollister stores.

Store-related assets are considered level 3 assets in the fair value hierarchy and the fair values were determined at the

individual store level, primarily using a discounted cash flow model. The estimation of future cash flows from operating

activities requires significant estimates of factors that include future sales, gross margin performance and operating expenses. In

instances where the discounted cash flow analysis indicated a negative value at the store level, the market exit price based on

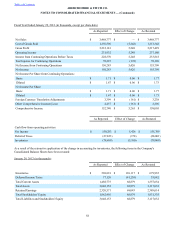

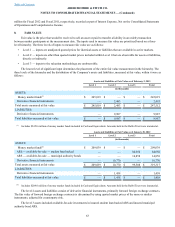

Table of Contents ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)