Abercrombie & Fitch 2013 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2013 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

71

The terms of the Amended and Restated Credit Agreement include customary events of default such as payment defaults,

cross-defaults to other material indebtedness, undischarged material judgments, bankruptcy and insolvency, the occurrence of a

defined change in control, or the failure to observe the negative covenants and other covenants related to the operation and

conduct of the business of A&F and its subsidiaries. Upon an event of default, the lenders will not be obligated to make loans or

other extensions of credit and may, among other things, terminate their commitments to the Company, and declare any then

outstanding loans due and payable immediately.

The Amended and Restated Credit Agreement will mature on July 27, 2016. The Company had no trade letters of credit

outstanding at February 2, 2013 and January 28, 2012. Stand-by letters of credit outstanding, under the Amended and Restated

Credit Agreement, on February 2, 2013 and January 28, 2012 were immaterial.

As of February 2, 2013 and January 28, 2012, the Company did not have any borrowings under the Amended and

Restated Credit Agreement.

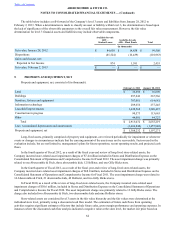

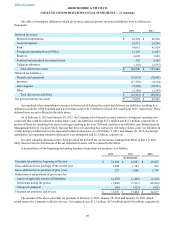

On February 24, 2012, the Company entered into a $300 million Term Loan Agreement to increase its flexibility and

available liquidity. On January 23, 2013, the Company entered into Amendment No.1 to the Term Loan Agreement (the "Term

Loan Agreement") lowering its availability to $150 million. In conjunction with the Term Loan Agreement Amendment, the

Company amended the Amended and Restated Credit Agreement (via Amendment No. 2 thereto) on January 23, 2013,

principally to lower the required Coverage Ratio to 1.75 to 1.00. Proceeds from the Term Loan Agreement may be used for any

general corporate purpose. The Term Loan will mature on February 23, 2017, with quarterly amortization payments of principal

beginning in May 2013. Interest on borrowings may be determined under several alternative methods including LIBOR plus a

margin based upon the Company’s Leverage Ratio, which represents the ratio of (a) the sum of total debt (excluding specified

permitted foreign bank guarantees) plus 600% of forward minimum rent commitments to (b) Consolidated EBITDAR (as

defined in the Term Loan Agreement) for the trailing four-consecutive-fiscal-quarter period. Covenants are generally consistent

with those in the Company’s Amended and Restated Credit Agreement.

As of February 2, 2013, the Company did not have any borrowings outstanding under the Term Loan Agreement.

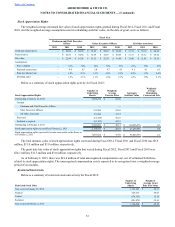

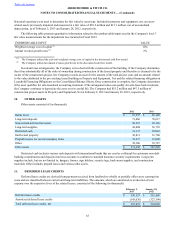

Total interest expense on borrowings was $3.8 million, $2.5 million and $4.5 million for Fiscal 2012, Fiscal 2011 and

Fiscal 2010, respectively.

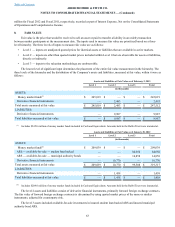

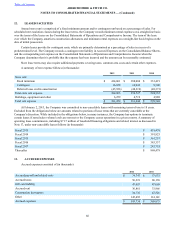

17. LEASEHOLD FINANCING OBLIGATIONS

As of February 2, 2013 and January 28, 2012, the Company had $63.9 million and $57.9 million, respectively, of long-

term liabilities related to leasehold financing obligations. In certain lease arrangements, the Company is involved with the

construction of the building. If the Company determines that the Company has substantially all of the risks of ownership during

construction of the leased property and therefore is deemed to be the owner of the construction project, the Company records an

asset for the amount of the total project costs and an amount related to the value attributed to the pre-existing leased building in

Property and Equipment, Net and the related financing obligation in Leasehold Financing Obligations on the Consolidated

Balance Sheets. Once construction is complete, the Company determines if the asset qualifies for sale-leaseback accounting

treatment. If the arrangement does not qualify for sale-leaseback treatment, the Company continues to amortize the obligation

over the lease term and depreciates the asset over its useful life. The Company does not report rent expense for the portion of

the rent payment determined to be related to the assets which are determined to be owned for accounting purposes. Rather, this

portion of the rent payment under the lease is recognized as a reduction of the financing obligation and interest expense.

Total interest expense related to landlord financing obligations was $6.8 million, $5.3 million and $3.3 million for Fiscal

2012, Fiscal 2011 and Fiscal 2010, respectively.

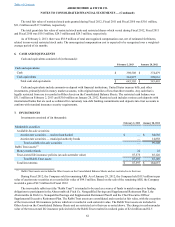

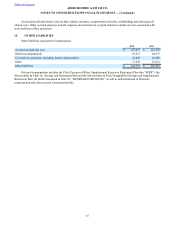

18. DERIVATIVES

The Company is exposed to risks associated with changes in foreign currency exchange rates and uses derivatives,

primarily forward contracts, to manage the financial impacts of these exposures. The Company does not use forward contracts

to engage in currency speculation and does not enter into derivative financial instruments for trading purposes.

In order to qualify for hedge accounting treatment, a derivative must be considered highly effective at offsetting changes

in either the hedged item’s cash flows or fair value. Additionally, the hedge relationship must be documented to include the risk

management objective and strategy, the hedging instrument, the hedged item, the risk exposure, and how hedge effectiveness

will be assessed prospectively and retrospectively. The extent to which a hedging instrument has been, and is expected to

continue to be, effective at achieving offsetting changes in fair value or cash flows is assessed and documented at least

Table of Contents ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)