Abercrombie & Fitch 2013 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2013 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

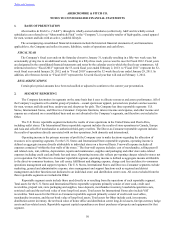

Policy Effect if Actual Results Differ from Assumptions

Revenue Recognition

The Company recognizes retail sales at the time the customer

takes possession of the merchandise. The Company reserves

for sales returns through estimates based on historical

experience and various other assumptions that management

believes to be reasonable. The value of point of sale coupons

that result in a reduction of the price paid by the customer is

recorded as a reduction of sales.

The Company sells gift cards in its stores and through direct-

to-consumer operations. The Company accounts for gift cards

sold to customers by recognizing a liability at the time of

sale. The liability remains on the Company’s books until the

earlier of redemption (recognized as revenue) or when the

Company determines the likelihood of redemption is remote,

known as breakage (recognized as other operating income),

based on historical redemption patterns.

The Company has not made any material changes in the

accounting methodology used to determine the sales return

reserve and revenue recognition for gift cards over the past

three fiscal years.

The Company does not expect material changes in the near

term to the underlying assumptions used to measure the sales

return reserve or to measure the timing and amount of future

gift card redemptions as of February 2, 2013. However,

changes in these assumptions do occur, and, should those

changes be significant, the Company may be exposed to

gains or losses that could be material.

A 10% change in the sales return reserve as of February 2,

2013 would have affected pre-tax income by an immaterial

amount for Fiscal 2012.

A 10% change in the assumption of the breakage for gift

cards as of February 2, 2013 would have affected pre-tax

income by an immaterial amount for Fiscal 2012.

Inventory Valuation

Inventories are principally valued at the lower of average cost

or market utilizing the weighted average cost method (the

"cost method").

The Company reduces the inventory valuation only when the

cost of specific inventory items on hand exceeds the amount

expected to be realized from the ultimate sale or disposal of

the goods through a lower of cost or market ("LCM") reserve.

Additionally, as part of inventory valuation, an inventory

shrink estimate is made each period that reduces the value of

inventory for lost or stolen items.

Effective February 2, 2013, the Company changed its method

of accounting for inventories from the retail method to the

cost method. This accounting change resulted in a

fundamental change in the inventory valuation reserve from a

markdown reserve under the retail method to an LCM reserve

under the cost method. The Company has not made any

material changes to the way it accounts for shrink during the

past three fiscal years.

The Company does not expect material changes in the near

term to the underlying assumptions used to determine the

shrink reserve or LCM reserve as of February 2, 2013.

However, changes in these assumptions do occur, and, should

those changes be significant, they could significantly impact

the ending inventory valuation at cost, as well as the resulting

gross margin(s).

An increase or decrease in the LCM reserve of 10% would

have affected pre-tax income by approximately $1.0 million

for Fiscal 2012.

An increase or decrease in the inventory shrink accrual of

10% would have affected pre-tax income by approximately

$1.2 million for Fiscal 2012.

Table of Contents