Abercrombie & Fitch 2013 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2013 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

Future Cash Requirements and Sources of Cash

Over the next twelve months, the Company’s primary cash requirements will be to fund operating activities, including the

acquisition of inventory, and obligations related to compensation, rent, taxes and other operating activities, as well as capital

expenditures and paying of quarterly dividend payments to stockholders subject to the A&F Board of Directors’ approval. The

Company also has availability under the Amended and Restated Credit Agreement as a source of additional funding. In

addition, on February 21, 2013, the Company drew down the full $150 million available under the Term Loan Agreement to

take advantage of the current lending market and to increase its flexibility and liquidity. The Company expects to generate

positive free cash flow defined as operating cash flow less capital expenditures for Fiscal 2013.

Subject to suitable market conditions, A&F expects to continue to repurchase shares of its Common Stock. The Company

anticipates funding these cash requirements with available cash from operations and as deemed appropriate, the Amended and

Restated Credit Agreement and the Term Loan Agreement proceeds.

The Company is not dependent on dividends from its foreign subsidiaries to fund its U.S. operations or make

distributions to A&F's shareholders. Unremitted earnings from foreign subsidiaries, which are considered to be invested

indefinitely, would become subject to income tax if they were remitted as dividends or were lent to A&F or a U.S. affiliate.

Off-Balance Sheet Arrangements

As of February 2, 2013, the Company did not have any off-balance sheet arrangements.

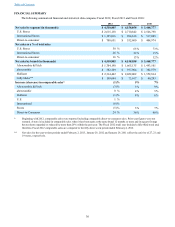

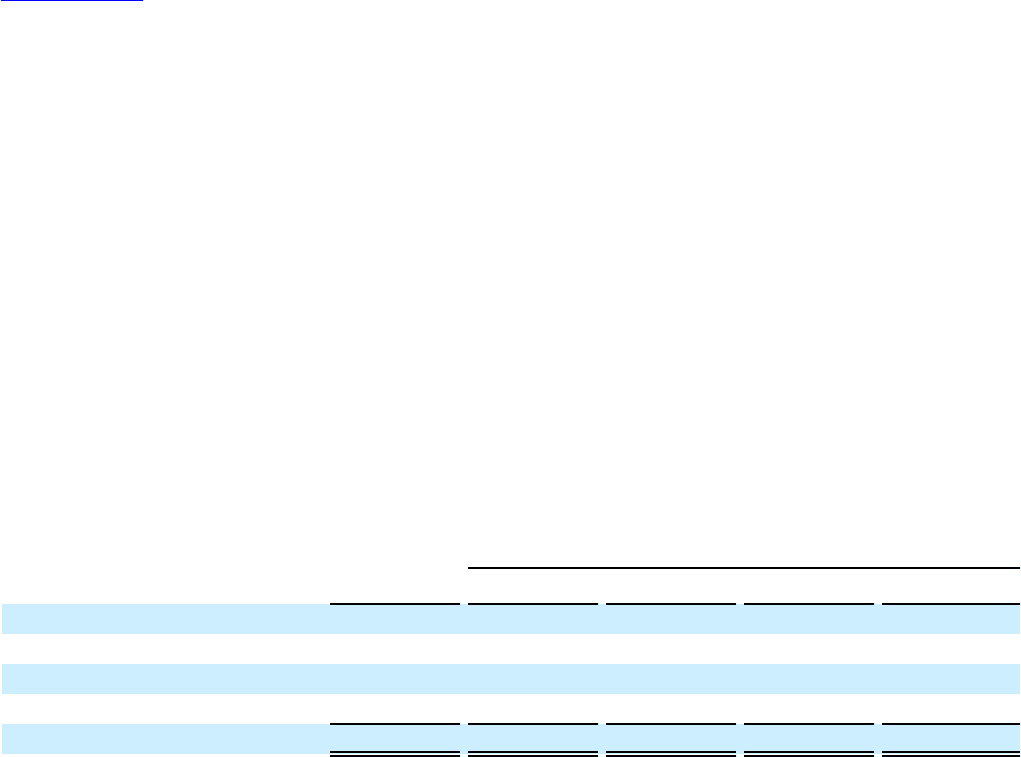

Contractual Obligations

Payments due by period (thousands)

Total Less than 1 year 1-3 years 3-5 years More than 5 years

Operating Lease Obligations (1) $ 2,635,519 $ 421,577 $ 758,711 $ 586,752 $ 868,479

Purchase Obligations 161,615 161,615 — — —

Other Obligations 41,584 18,634 9,493 1,110 12,347

Dividends ———— —

Totals $ 2,838,718 $ 601,826 $ 768,204 $ 587,862 $ 880,826

(1) Includes leasehold financing obligations of $71.7 million and related interest. Refer to Note 17, "LEASEHOLD FINANCING

OBLIGATIONS," of the Notes to Consolidated Financial Statements for additional reference.

Operating lease obligations consist primarily of non-cancelable future minimum lease commitments related to store

operating leases. See Note 12, “LEASED FACILITIES,” of the Notes to Consolidated Financial Statements included in “ITEM

8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA” of this Annual Report on Form 10-K, for further

discussion. Excluded from the obligations above are amounts related to portions of lease terms that are currently cancelable at

the Company's discretion. While included in the obligations above, in many instances, the Company has options to terminate

certain leases if stated sales volume levels are not met or the Company ceases operations in a given country. Operating lease

obligations do not include common area maintenance (“CAM”), insurance, marketing or tax payments for which the Company

is also obligated. Total expense related to CAM, insurance, marketing and taxes was $168.6 million in Fiscal 2012.

The purchase obligations category represents purchase orders for merchandise to be delivered during Fiscal 2013 and

commitments for fabric expected to be used during upcoming seasons.

Other obligations consist primarily of asset retirement obligations and information technology contracts.

Due to uncertainty as to the amounts and timing of future payments, the contractual obligations table above does not

include tax (including accrued interest and penalties) of $16.0 million related to uncertain tax positions at February 2, 2013.

Deferred taxes are also not included in the preceding table. For further discussion, see Note 15, “INCOME TAXES,” of the

Notes to Consolidated Financial Statements included in “ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY

DATA” of this Annual Report on Form 10-K.

The table above does not include estimated future retirement payments under the Chief Executive Officer Supplemental

Executive Retirement Plan (the “SERP”) for the Company’s Chairman and Chief Executive Officer with a present value of

$18.5 million at February 2, 2013. See Note 20, “RETIREMENT BENEFITS,” of the Notes to Consolidated Financial

Statements included in “ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA” of this Annual Report on

Form 10-K and the description of the SERP to be included in the text under the caption “EXECUTIVE OFFICER

COMPENSATION” in A&F’s definitive Proxy Statement for the Annual Meeting of Stockholders to be held on June 20, 2013,

incorporated by reference in “ITEM 11. EXECUTIVE COMPENSATION” of this Annual Report on Form 10-K.

Table of Contents