Abercrombie & Fitch 2013 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2013 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

CURRENT TRENDS AND OUTLOOK

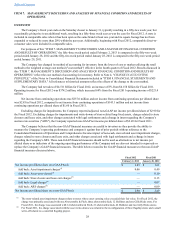

Our results for Fiscal 2012 included an 8% increase in net sales and a 78% increase in diluted earnings per share

compared to last year.

We have made progress in our operating income the past couple of years, including improvement in gross margin in

Fiscal 2012 driven by a reduction in average unit cost. However, our operating margins remain well below historical levels,

despite our highly profitable international business, which presents opportunities in two specific areas.

First, we will be revisiting our operating model and identifying processes and investments we make in our business

that may have had a return in the past but no longer do today. We have established a cross-functional team to simplify

processes, eliminate low value added components of our model, increase efficiencies and lower expenses.

Second, we will be seeking to identify ways to increase our average unit retail, particularly in the U.S. stores and U.S.

direct-to-consumer operations. Growth in our average unit retail will help our gross margins and contribute to expense

leverage.

Beyond the two initiatives above, our focus remains on key strategic initiatives with regard to merchandising, inventory

productivity, expense and average unit cost, insight and intelligence, customer engagement and targeted closure of under-

performing U.S. stores. We are confident that our focus on these initiatives, allied with our iconic brands and continued

judicious use of shareholder capital, will drive significant long-term value.

With regard to real estate plans for Fiscal 2013, we expect to open Abercrombie & Fitch flagship locations in Seoul and

Shanghai and approximately 20 international Hollister stores. The Hollister openings will include our first stores in Australia,

our first store in the Middle East in Dubai through a joint venture and entry into the Japanese market for Hollister. Additionally,

we are contemplating opening international mall-based Abercrombie & Fitch stores within the next 12 months. We expect

capital expenditures to be approximately $200 million for the year, with estimated store pre-opening costs of around $30

million.

We are confident that we are on track in regard to our long-term strategy of leveraging the international appeal of our

brands to build a highly profitable, sustainable, global business.

We continue to target annual EPS growth of approximately 15%. As in the past, our earnings are sensitive to changes in

comparable sales trends.

Our capital allocation philosophy continues to be highly disciplined in allocating capital to where it will derive the

greatest return on a risk-adjusted basis. After allocating capital to new stores and other internal projects that provide superior

returns, we continue to expect to return excess cash to shareholders.

Table of Contents