Abercrombie & Fitch 2013 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2013 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

77

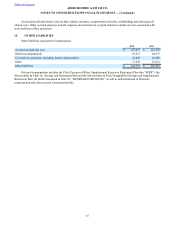

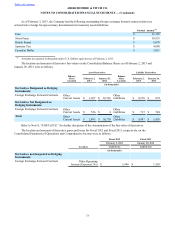

(1) Results reported above have been restated to reflect the change in method of accounting for inventory effective in the fourth quarter of

Fiscal 2012. Refer to Note 4, “CHANGE IN ACCOUNTING PRINCIPLE,” for further discussion.

(2) For the first quarter of Fiscal 2012, the change in accounting principle decreased gross profit by $35.3 million, decreased net income

by $24.3 million and decreased net income per diluted share by $0.28.

(3) For the second quarter of Fiscal 2012, the change in accounting principle decreased gross profit by $2.0 million, increased net income

by $1.5 million and increased net income per diluted share by $0.01.

(4) For the third quarter of Fiscal 2012, the change in accounting principle increased gross profit by $20.9 million, increased net income

by $12.5 million and increased net income per diluted share by $0.15.

(5) The fourth quarter of Fiscal 2012 includes impairment charges of $0.06 per diluted share.

(6) For the first quarter of Fiscal 2011, the change in accounting principle decreased gross profit by $18.1 million, decreased net income

by $12.1 million and decreased net income per diluted share by $0.14.

(7) For the second quarter of Fiscal 2011, the change in accounting principle decreased gross profit by $4.6 million, decreased net income

by $3.9 million and decreased net income per diluted share by $0.04.

(8) For the third quarter of Fiscal 2011, the change in accounting principle increased gross profit by $9.7 million, increased net income by

$6.1 million and increased net income per diluted share by $0.07.

(9) For the fourth quarter of Fiscal 2011, the change in accounting principle increased gross profit by $44.3 million, increased net income

by $26.2 million and increased net income per diluted share by $0.30. Additionally, the fourth quarter of Fiscal 2011 includes

impairment charges of $0.50 per diluted share, asset write down charges of $0.10 per diluted share, store closure and lease exit charges

of $0.13 per diluted share, legal charges of $0.07 per diluted share, and charges related to a change in intent with regarding the

Company’s ARS portfolio of $0.10 per diluted share.

(10) Tax expense for the fourteen weeks ended February 2, 2013 included $1.1 million to correct for understated tax expense relating to the

fourth quarter of 2011. Additionally, the fourth quarter included certain other corrections related to the first three quarters of 2012 that

have an immaterial effect on the fourth quarter. The Company does not believe these corrections were material to any current or prior

interim or annual periods that were affected.

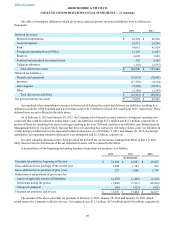

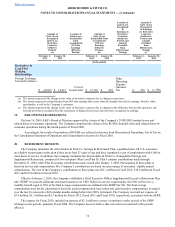

25. SUBSEQUENT EVENT

On February 21, 2013, the Company drew down the full $150 million available under the Term Loan Agreement at an

effective interest rate of 1.96%.

Table of Contents ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)