Abercrombie & Fitch 2013 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2013 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

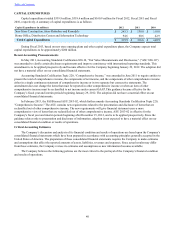

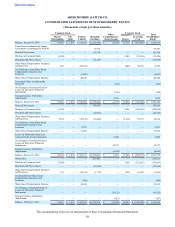

CAPITAL EXPENDITURES

Capital expenditures totaled $339.9 million, $318.6 million and $160.9 million for Fiscal 2012, Fiscal 2011 and Fiscal

2010, respectively. A summary of capital expenditures is as follows:

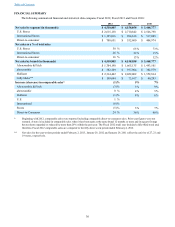

Capital Expenditures (in millions) 2012 2011 2010

New Store Construction, Store Refreshes and Remodels $ 245.3 $ 258.0 $ 118.0

Home Office, Distribution Centers and Information Technology 94.6 60.6 42.9

Total Capital Expenditures $ 339.9 $ 318.6 $ 160.9

During Fiscal 2013, based on new store opening plans and other capital expenditure plans, the Company expects total

capital expenditures to be approximately $200 million.

Recent Accounting Pronouncements

In May 2011, Accounting Standards Codification 820-10, “Fair Value Measurements and Disclosures,” (“ASC 820-10”)

was amended to clarify certain disclosure requirements and improve consistency with international reporting standards. This

amendment is to be applied prospectively and became effective for the Company beginning January 29, 2012. The adoption did

not have a material effect on our consolidated financial statements.

Accounting Standards Codification Topic 220, “Comprehensive Income,” was amended in June 2011 to require entities to

present the total of comprehensive income, the components of net income, and the components of other comprehensive income

either in a single continuous statement of comprehensive income or in two separate but consecutive statements. The

amendment does not change the items that must be reported in other comprehensive income or when an item of other

comprehensive income must be reclassified to net income under current GAAP. This guidance became effective for the

Company’s fiscal year and interim periods beginning January 29, 2012. The adoption did not have a material effect on our

consolidated financial statements.

In February 2013, the FASB issued ASU 2013-02, which further amends Accounting Standards Codification Topic 220,

"Comprehensive Income." The ASU contains new requirements related to the presentation and disclosure of items that are

reclassified out of other comprehensive income. The new requirements will give financial statement users a more

comprehensive view of items that are reclassified out of other comprehensive income. ASU 2013-02 is effective for the

Company's fiscal year and interim periods beginning after December 15, 2012, and is to be applied prospectively. Since the

guidance relates only to presentation and disclosure of information, adoption is not expected to have a material effect on our

consolidated financial condition or results of operations.

Critical Accounting Estimates

The Company’s discussion and analysis of its financial condition and results of operations are based upon the Company’s

consolidated financial statements which have been prepared in accordance with accounting principles generally accepted in the

United States of America. The preparation of these consolidated financial statements requires the Company to make estimates

and assumptions that affect the reported amounts of assets, liabilities, revenues and expenses. Since actual results may differ

from those estimates, the Company revises its estimates and assumptions as new information becomes available.

The Company believes the following policies are the most critical to the portrayal of the Company’s financial condition

and results of operations.

Table of Contents