Abercrombie & Fitch 2013 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2013 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

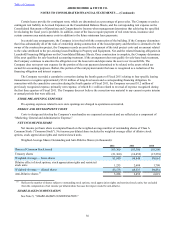

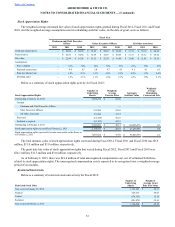

regarding future demand and market conditions and analysis of historical experience. The lower of cost or market adjustment to

inventory as of February 2, 2013, January 28, 2012 and January 29, 2011 was $9.9 million, $13.0 million and $10.2 million,

respectively.

Additionally, as part of inventory valuation, inventory shrinkage estimates based on historical trends from actual physical

inventories are made each period that reduce the inventory value for lost or stolen items. The Company performs physical

inventories on a periodic basis and adjusts the shrink reserve accordingly. The shrink reserve was $11.8 million, $10.3 million

and $9.1 million at February 2, 2013, January 28, 2012 and January 29, 2011, respectively.

Ending inventory balances were $427.0 million, $679.9 million and $464.6 million at February 2, 2013, January 28,

2012 and January 29, 2011, respectively. These balances included inventory in transit balances of $34.8 million, $103.1 million

and $55.0 million at February 2, 2013, January 28, 2012 and January 29, 2011, respectively. Inventory in transit is considered to

be all merchandise owned by Abercrombie & Fitch that has not yet been received at an Abercrombie & Fitch distribution center.

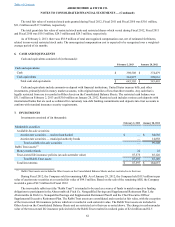

OTHER CURRENT ASSETS

Other current assets include prepaid rent, current store supplies, derivative contracts and other prepaids.

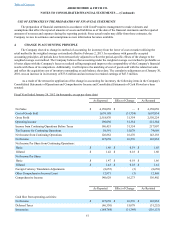

PROPERTY AND EQUIPMENT

Depreciation and amortization of property and equipment are computed for financial reporting purposes on a straight-line

basis, using service lives which are principally: 30 years for buildings; from three to 15 years for leasehold improvements and

furniture and fixtures; from three to seven years for information technology; and from three to 20 years for other property and

equipment; or lease term, whichever is shorter. The cost of assets sold or retired and the related accumulated depreciation or

amortization are removed from the accounts with any resulting gain or loss included in net income. Maintenance and repairs are

charged to expense as incurred. Major remodels and improvements that extend service lives of the related assets are capitalized.

Long-lived assets, primarily comprised of property and equipment, are reviewed whenever events or changes in

circumstances indicate that their carrying amount may not be recoverable. The primary triggering events are (1) when the

Company believes that it is more likely than not that long-lived assets will be disposed of before the end of their previously

estimated useful life (e.g., store closures before the end of a lease) and (2) if the Company’s performance in any quarter

indicates that there has been a long-term and significant change in the economics of the business. The Company reviews long-

lived assets for impairments in the quarter in which a triggering event occurs.

In addition, the Company conducts an annual impairment analysis in the fourth quarter of each year. For the purposes of

the annual review, the Company reviews long-lived assets associated with stores that have an operating loss in the current year

and have been open for at least two full years.

The reviews are conducted at the individual store level, which is the lowest level for which identifiable cash flows are

largely independent of the cash flows of other groups of assets and liabilities.

The impairment evaluation is performed as a two-step test. First, the Company utilizes an undiscounted future cash flow

model to test the individual asset groups for recoverability. If the net carrying value of the asset group exceeds the undiscounted

cash flows, the Company proceeds to step two. Under step two, an impairment loss is recognized for the excess of net book

value over the fair value of the assets. Factors used in the evaluation include, but are not limited to, management’s plans for

future operations, recent operating results and projected cash flows. See Note 9, “PROPERTY AND EQUIPMENT, NET,” for

further discussion.

The Company expenses all internal-use software costs incurred in the preliminary project stage and capitalizes certain

direct costs associated with the development and purchase of internal-use software within property and equipment. Capitalized

costs are amortized on a straight-line basis over the estimated useful lives of the software, generally not exceeding seven years.

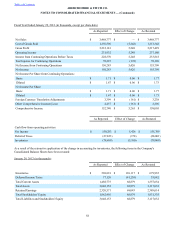

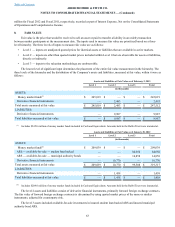

INCOME TAXES

Income taxes are calculated using the asset and liability method. Deferred tax assets and liabilities are recognized based

on the difference between the financial statement carrying amounts of existing assets and liabilities and their respective tax

bases. Deferred tax assets and liabilities are measured using current enacted tax rates in effect for the years in which those

temporary differences are expected to reverse. Inherent in the measurement of deferred balances are certain judgments and

interpretations of enacted tax law and published guidance with respect to applicability to the Company’s operations. A valuation

allowance is established against deferred tax assets when it is more likely than not that some portion or all of the deferred tax

assets will not be realized. Currently, there is an immaterial valuation allowance provided for foreign net operating losses.

Table of Contents ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)