Abercrombie & Fitch 2013 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2013 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26

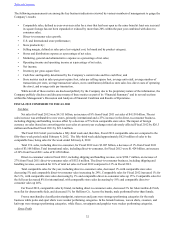

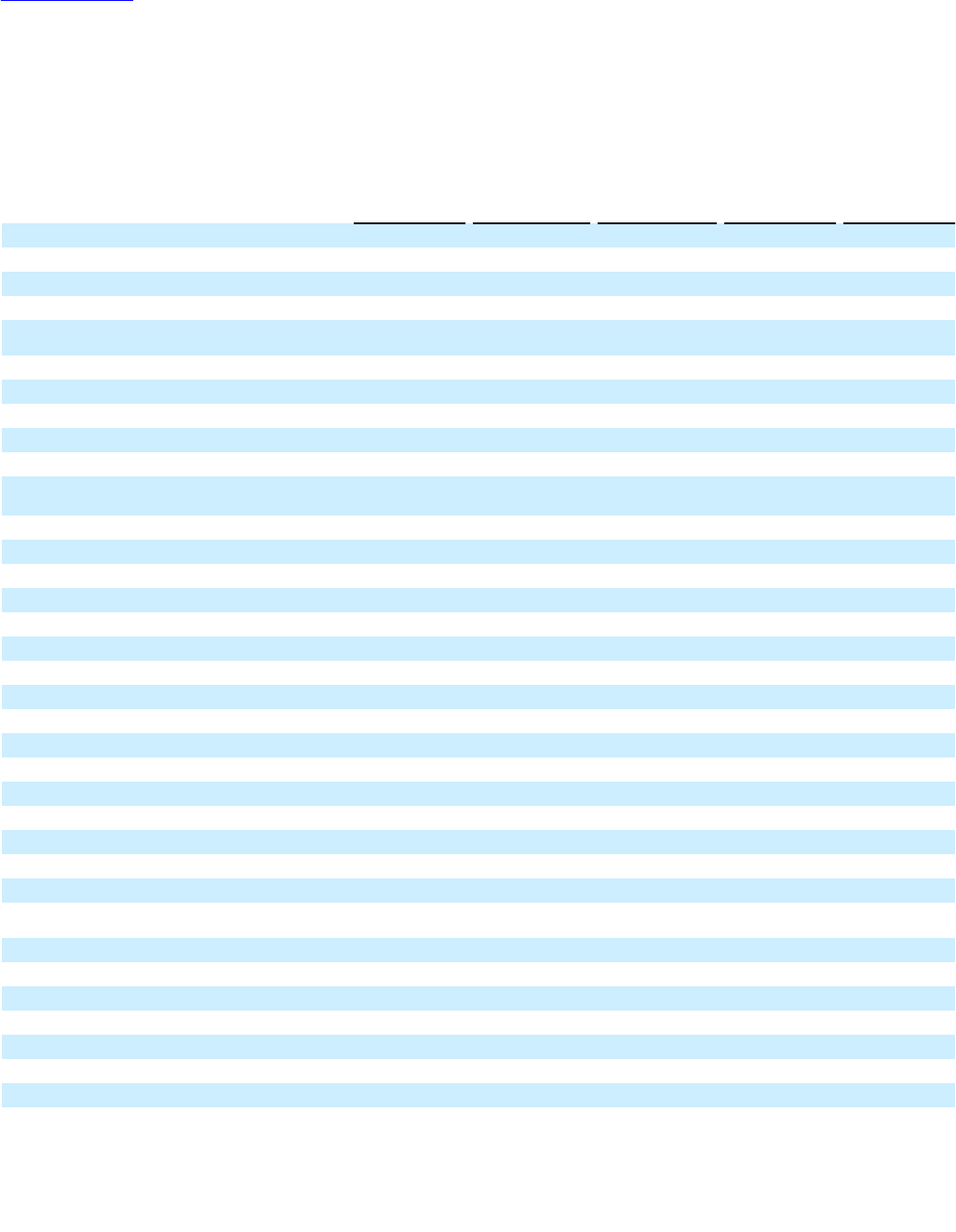

ITEM 6. SELECTED FINANCIAL DATA.

ABERCROMBIE & FITCH CO.

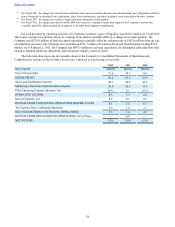

FINANCIAL SUMMARY

(Thousands, except per share and per square foot amounts, ratios and store and associate data)

(Information below excludes amounts related to discontinued operations, except where otherwise noted)

2012 (1) Restated 2011 (2) Restated 2010 (2) 2009 2008

Net Sales $ 4,510,805 $ 4,158,058 $ 3,468,777 $ 2,928,626 $ 3,484,058

Gross Profit $ 2,816,709 $ 2,550,224 $ 2,217,429 $ 1,883,598 $ 2,331,095

Operating Income $ 374,233 $ 221,384 $ 237,180 $ 117,912 $ 498,262

Net Income from Continuing Operations $ 237,011 $ 143,138 $ 155,709 $ 78,953 $ 308,169

Income (Loss) from Discontinued Operations, Net of

Tax(3) —$ 796 $ — $ (78,699) $ (35,914)

Net Income(3) $ 237,011 $ 143,934 $ 155,709 $ 254 $ 272,255

Dividends Declared Per Share $ 0.70 $ 0.70 $ 0.70 $ 0.70 $ 0.70

Net Income Per Share from Continuing Operations

Basic $ 2.89 $ 1.65 $ 1.77 $ 0.90 $ 3.55

Diluted $ 2.85 $ 1.60 $ 1.73 $ 0.89 $ 3.45

Net Income (Loss) Per Share from Discontinued

Operations(3)

Basic $ — $ 0.01 $ — $ (0.90) $ (0.41)

Diluted $ — $ 0.01 $ — $ (0.89) $ (0.40)

Net Income Per Share(3)

Basic $ 2.89 $ 1.66 $ 1.77 $ 0.00 $ 3.14

Diluted $ 2.85 $ 1.61 $ 1.73 $ 0.00 $ 3.05

Basic Weighted-Average Shares Outstanding 81,940 86,848 88,061 87,874 86,816

Diluted Weighted-Average Shares Outstanding 83,175 89,537 89,851 88,609 89,291

Other Financial Information

Total Assets (including discontinued operations) $ 2,987,401 $ 3,117,032 $ 2,994,022 $ 2,821,866 $ 2,848,181

Working Capital(4) $ 617,023 $ 858,248 $ 927,024 $ 776,311 $ 622,213

Current Ratio(5) 1.89 2.23 2.68 2.73 2.38

Net Cash Provided by Operating Activities(3) $ 684,171 $ 365,219 $ 391,789 $ 395,487 $ 491,031

Capital Expenditures $ 339,862 $ 318,598 $ 160,935 $ 175,472 $ 367,602

Free Cash Flow(6) $ 344,309 $ 46,621 $ 230,854 $ 220,015 $ 123,429

Borrowings — — $ 43,805 $ 50,927 $ 100,000

Leasehold Financing Obligations $ 63,942 $ 57,851 $ 24,761 $ 20,286 $ 5,881

Stockholders’ Equity (including discontinued

operations) $ 1,818,268 $ 1,931,335 $ 1,943,391 $ 1,827,917 $ 1,845,578

Return on Average Stockholders’ Equity(7) 13 % 7% 8% 0 % 16 %

Comparable Sales(8) (1)% 5% 7% (23)% (13)%

Net Store Sales Per Average Gross Square Foot $ 485 $ 463 $ 390 $ 339 $ 432

Stores at End of Year and Average Associates

Total Number of Stores Open 1,051 1,045 1,069 1,096 1,097

Gross Square Feet 7,958 7,778 7,756 7,848 7,760

Average Number of Associates(9) 95,800 91,000 83,000 83,000 96,200

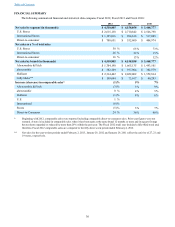

(1) Fiscal 2012 was a fifty-three week year.

(2) Reported results for Fiscal 2011 and Fiscal 2010 have been restated to reflect the change in method of accounting for inventory

effective in the fourth quarter of Fiscal 2012. Refer to Note 4, “CHANGE IN ACCOUNTING PRINCIPLE,” of the Notes to

Consolidated Financial Statements included in “ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA” of this

Annual Report on Form 10-K for further discussion. Reported results for periods prior to Fiscal 2010 have not been restated to reflect

the change in accounting principle as the information is not available.

(3) Includes results of operations from RUEHL branded stores and related direct-to-consumer operations. Results from discontinued

operations were immaterial in Fiscal 2010.

(4) Working Capital is computed by subtracting current liabilities (including discontinued operations) from current assets (including

discontinued operations).

Table of Contents