Abercrombie & Fitch 2013 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2013 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66

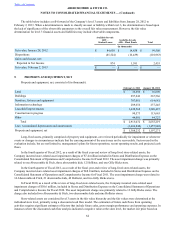

12. LEASED FACILITIES

Annual store rent is comprised of a fixed minimum amount and/or contingent rent based on a percentage of sales. For

scheduled rent escalation clauses during the lease terms, the Company records minimum rental expenses on a straight-line basis

over the terms of the leases on the Consolidated Statements of Operations and Comprehensive Income. The term of the lease

over which the Company amortizes construction allowances and minimum rental expenses on a straight-line basis begins on the

date of initial possession.

Certain leases provide for contingent rents, which are primarily determined as a percentage of sales in excess of a

predetermined level. The Company records a contingent rent liability in Accrued Expenses on the Consolidated Balance Sheets,

and the corresponding rent expense on the Consolidated Statements of Operations and Comprehensive Income when the

Company determines that it is probable that the expense has been incurred and the amount can be reasonably estimated.

Store lease terms may also require additional payments covering taxes, common area costs and certain other expenses.

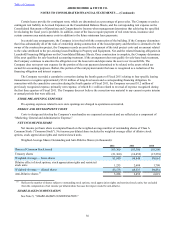

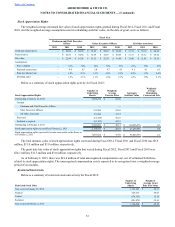

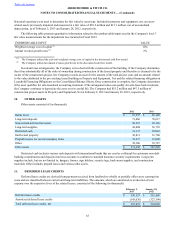

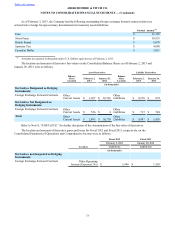

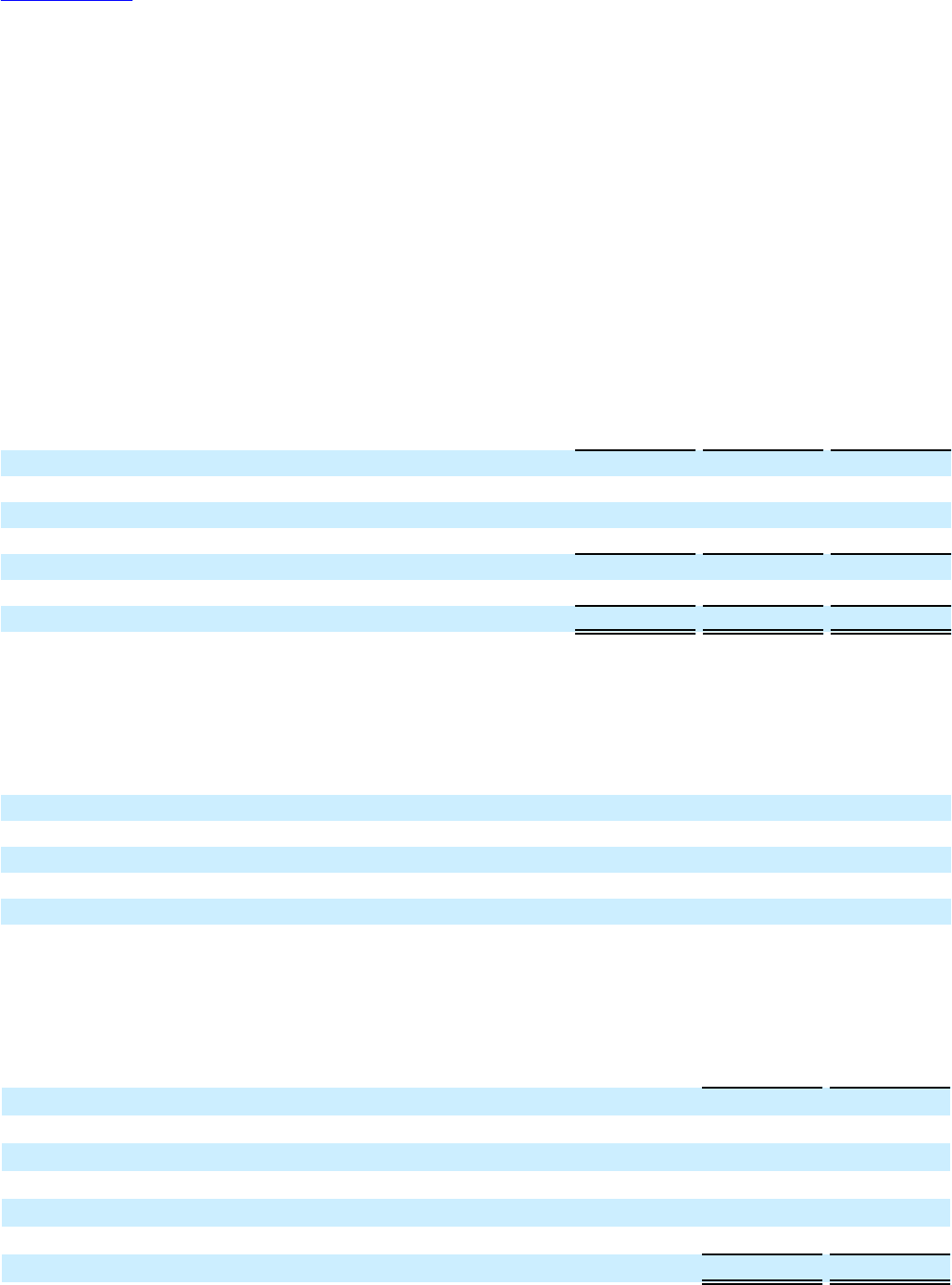

A summary of rent expense follows (in thousands):

2012 2011 2010

Store rent:

Fixed minimum $ 414,061 $ 388,004 $ 333,419

Contingent 16,828 16,942 9,306

Deferred lease credits amortization (45,926)(48,219)(48,373)

Total store rent expense 384,963 356,727 294,352

Buildings, equipment and other 6,259 4,719 4,988

Total rent expense $ 391,222 $ 361,446 $ 299,340

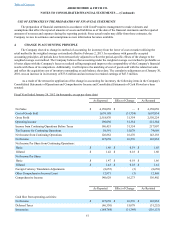

At February 2, 2013, the Company was committed to non-cancelable leases with remaining terms of one to 18 years.

Excluded from the obligations below are amounts related to portions of lease terms that are currently cancelable at the

Company's discretion. While included in the obligations below, in many instances, the Company has options to terminate

certain leases if stated sales volume levels are not met or the Company ceases operations in a given country. A summary of

operating lease commitments, including $71.7 million of leasehold financing obligations and related interest as discussed in

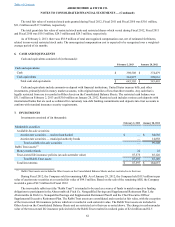

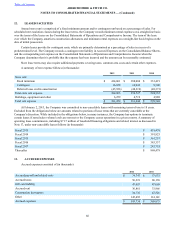

Note 17, under non-cancelable leases follows (in thousands):

Fiscal 2013 $ 418,478

Fiscal 2014 $ 391,925

Fiscal 2015 $ 361,257

Fiscal 2016 $ 343,337

Fiscal 2017 $ 242,735

Thereafter $ 868,479

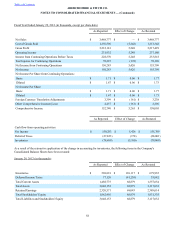

13. ACCRUED EXPENSES

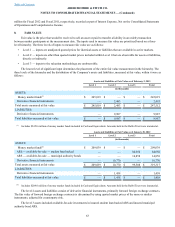

Accrued expenses consisted of (in thousands):

2012 2011

Accrued payroll and related costs $ 74,747 $ 57,633

Accrued taxes 56,219 68,138

Gift card liability 47,683 47,669

Accrued rent 36,861 33,966

Construction in progress 34,732 47,526

Other 145,492 114,141

Accrued expenses $ 395,734 $ 369,073

Table of Contents ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)