Abercrombie & Fitch 2013 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2013 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65

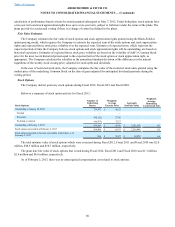

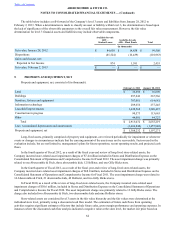

historical experience was used to determine the fair value by asset type. Included in property and equipment, net, are store-

related assets previously impaired and measured at a fair value of $10.2 million and $13.1 million, net of accumulated

depreciation, as of February 2, 2013 and January 28, 2012, respectively.

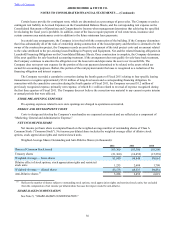

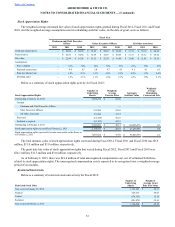

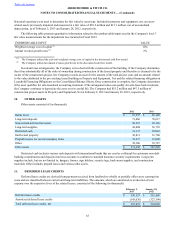

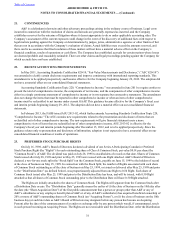

The following table presents quantitative information related to the unobservable inputs used in the Company's level 3

fair value measurements for the impairment loss incurred in Fiscal 2012.

UNOBSERVABLE INPUT VALUE

Weighted average cost of capital (1) 12%

Annual revenue growth rates (2) 2%

(1) The Company utilized the year-end weighted average cost of capital in the discounted cash flow model.

(2) The Company utilized an annual revenue growth rate in the discounted cash flow model.

In certain lease arrangements, the Company is involved with the construction of the building. If the Company determines

that it has substantially all of the risks of ownership during construction of the leased property and therefore is deemed to be the

owner of the construction project, the Company records an asset for the amount of the total project costs and an amount related

to the value attributed to the pre-existing leased building in Property and Equipment, Net and the related financing obligation in

Leasehold Financing Obligations on the Consolidated Balance Sheets. Once construction is complete, the Company determines

if the asset qualifies for sale-leaseback accounting treatment. If the arrangement does not qualify for sale-lease back treatment,

the Company continues to depreciate the asset over its useful life. The Company had $55.2 million and $47.5 million of

construction project assets in Property and Equipment, Net at February 2, 2013 and January 28, 2012, respectively.

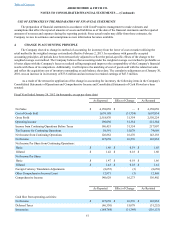

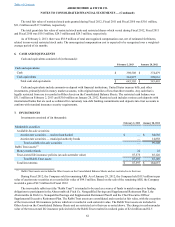

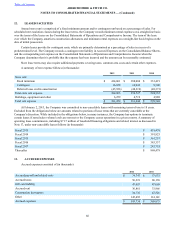

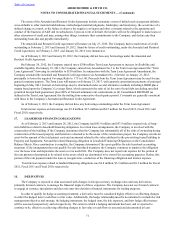

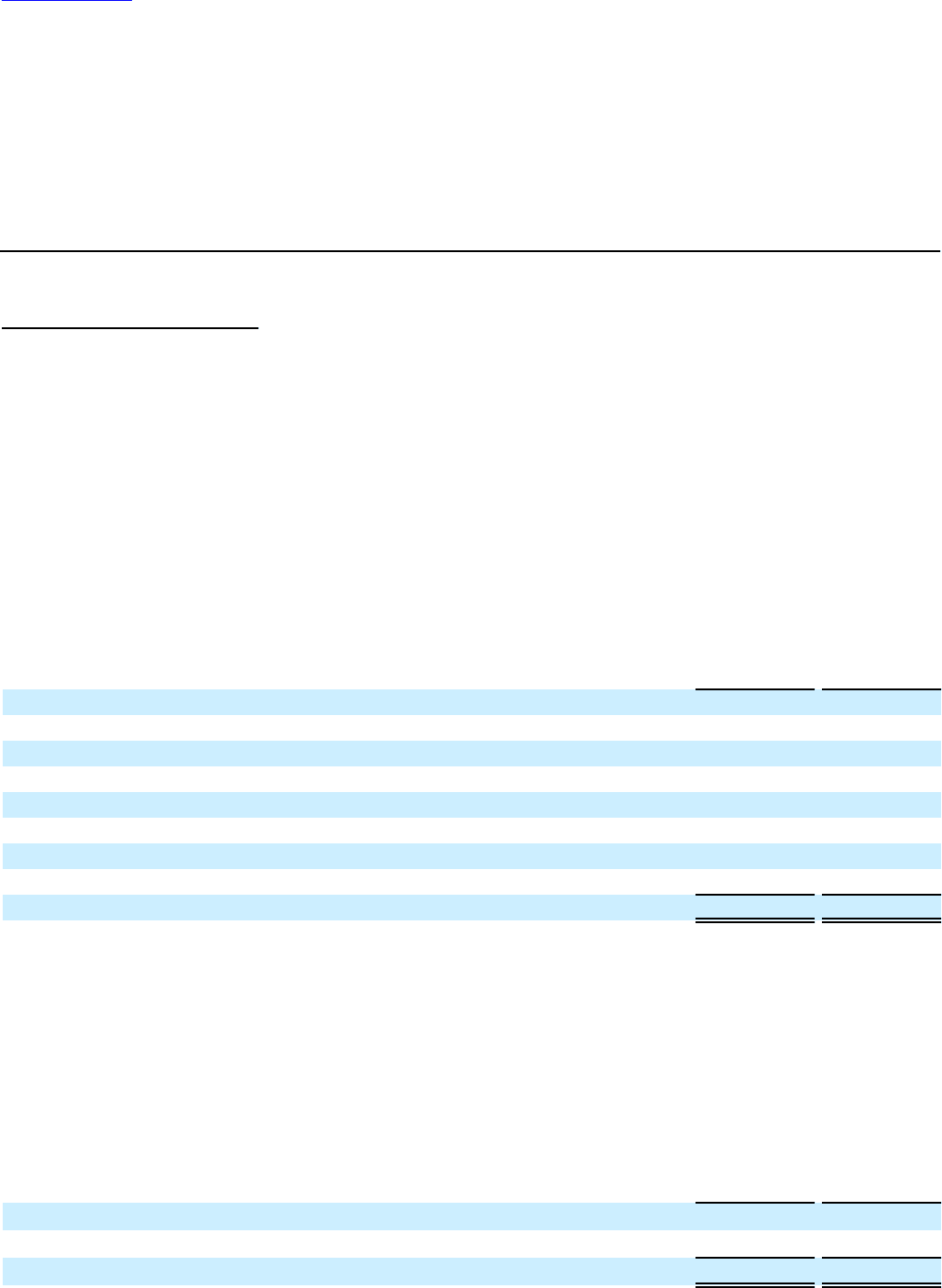

10. OTHER ASSETS

Other assets consisted of (in thousands):

2012 2011

Rabbi Trust $ 87,597 $ 85,149

Long-term deposits 71,486 78,617

Non-current deferred tax assets 50,387 29,165

Long-term supplies 42,404 36,739

Restricted cash 31,137 30,043

Intellectual property 30,811 31,760

Prepaid income tax on intercompany items 19,217 16,049

Other 38,306 39,727

Other assets $ 371,345 $ 347,249

Restricted cash includes various cash deposits with international banks that are used as collateral for customary non-debt

banking commitments and deposits into trust accounts to conform to standard insurance security requirements. Long-term

supplies include, but are not limited to, hangers, frames, sign holders, security tags, back-room supplies, and construction

materials. Other includes prepaid leases and various other assets.

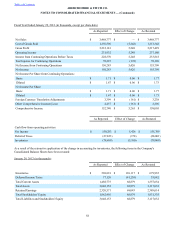

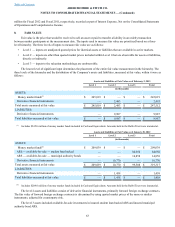

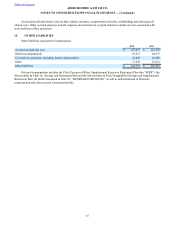

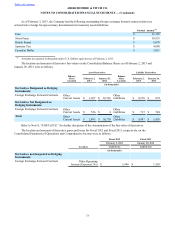

11. DEFERRED LEASE CREDITS

Deferred lease credits are derived from payments received from landlords to wholly or partially offset store construction

costs and are classified between current and long-term liabilities. The amounts, which are amortized as a reduction of rent

expense over the respective lives of the related leases, consisted of the following (in thousands):

February 2,

2013 January 28,

2012

Deferred lease credits $ 550,527 $ 551,468

Amortized deferred lease credits (343,076)(327,399)

Total deferred lease credits, net $ 207,451 $ 224,069

Table of Contents ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)