Abercrombie & Fitch 2013 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2013 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69

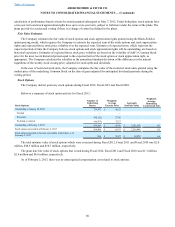

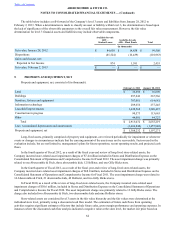

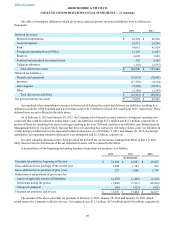

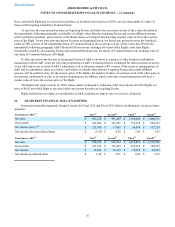

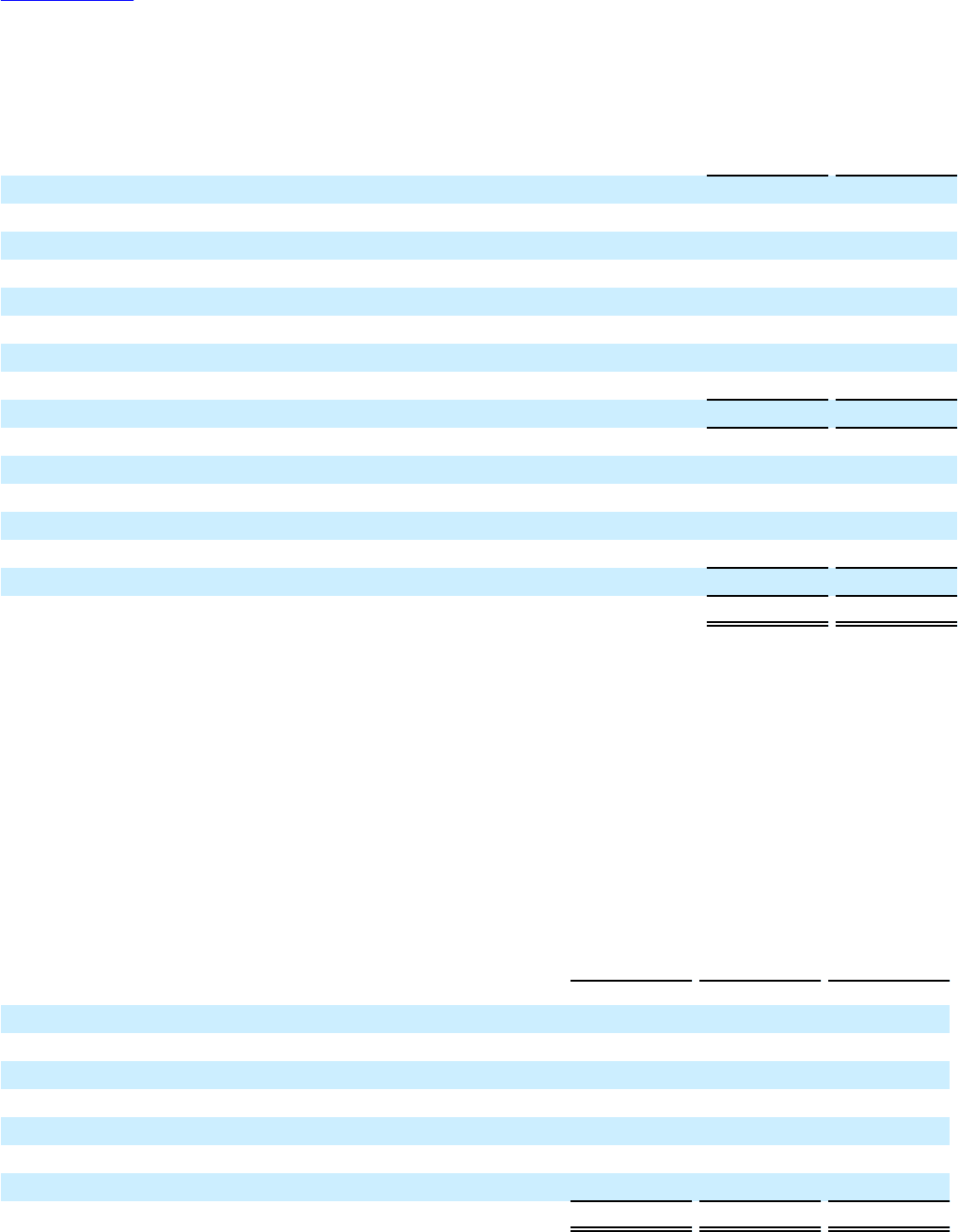

The effect of temporary differences which gives rise to deferred income tax assets (liabilities) were as follows (in

thousands):

2012 2011

Deferred tax assets:

Deferred compensation $ 83,529 $ 69,296

Accrued expenses 18,971 20,356

Rent 39,061 41,424

Foreign net operating losses (NOLs) 12,107 11,687

Reserves 6,698 7,669

Realized and unrealized investment losses 592 5,565

Valuation allowance (158)(2,531)

Total deferred tax assets $ 160,800 $ 153,466

Deferred tax liabilities:

Property and equipment (57,875)(70,961)

Inventory (13,156)(8,164)

Store supplies (9,990)(10,591)

Other (2,140)(1,245)

Total deferred tax liabilities $(83,161) $ (90,961)

Net deferred income tax assets $ 77,639 $ 62,505

Accumulated other comprehensive income is shown net of deferred tax assets and deferred tax liabilities, resulting in a

deferred tax liability of $0.8 million and a deferred tax asset of $1.6 million for Fiscal 2012 and Fiscal 2011, respectively. These

deferred taxes are not reflected in the table above.

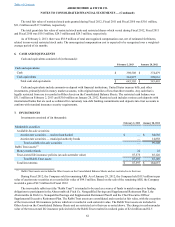

As of February 2, 2013 and January 28, 2012, the Company had deferred tax assets related to foreign net operating loss

carryovers that could be utilized to reduce future years’ tax liabilities, totaling $12.1 million and $11.7 million, respectively. A

portion of these net operating loss carryovers begin expiring in the year 2016 and some have an indefinite carryforward period.

Management believes it is more likely than not that these net operating loss carryovers will reduce future years’ tax liabilities in

certain foreign jurisdictions less the associated valuation allowance. As of February 2, 2013 and January 28, 2012, the foreign

subsidiaries’ net operating valuation allowances were immaterial and $2.5 million, respectively.

No other valuation allowances have been provided for deferred tax assets because management believes that it is more

likely than not that the full amount of the net deferred tax assets will be realized in the future.

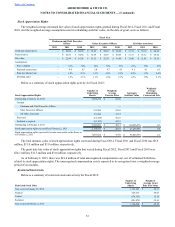

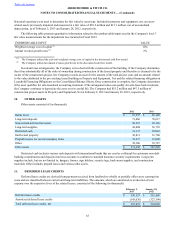

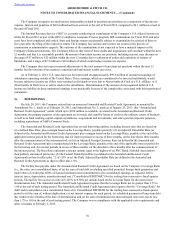

A reconciliation of the beginning and ending amounts of uncertain tax positions is as follows:

2012 2011 2010

(in thousands)

Uncertain tax positions, beginning of the year $ 13,404 $ 14,827 $ 29,437

Gross addition for tax positions of the current year 1,084 1,183 562

Gross addition for tax positions of prior years 227 1,602 1,734

Reductions of tax positions of prior years for:

Lapses of applicable statutes of limitations (2,053)(2,448)(2,328)

Settlements during the period (1,480)(1,631)(14,166)

Changes in judgment (66)(129)(412)

Uncertain tax positions, end of year $ 11,116 $ 13,404 $ 14,827

The amount of the above uncertain tax positions at February 2, 2013, January 28, 2012 and January 29, 2011 which

would impact the Company’s effective tax rate, if recognized, was $11.1 million, $13.4 million and $14.8 million, respectively.

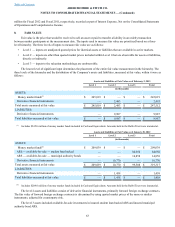

Table of Contents ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)