AT&T Wireless 2013 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2013 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

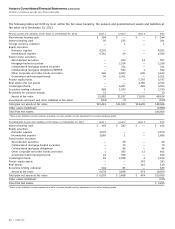

Notes to Consolidated Financial Statements (continued)

Dollars in millions except per share amounts

70 | AT&T Inc.

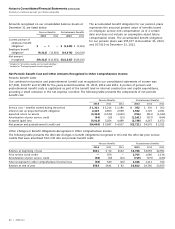

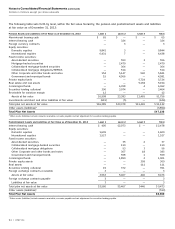

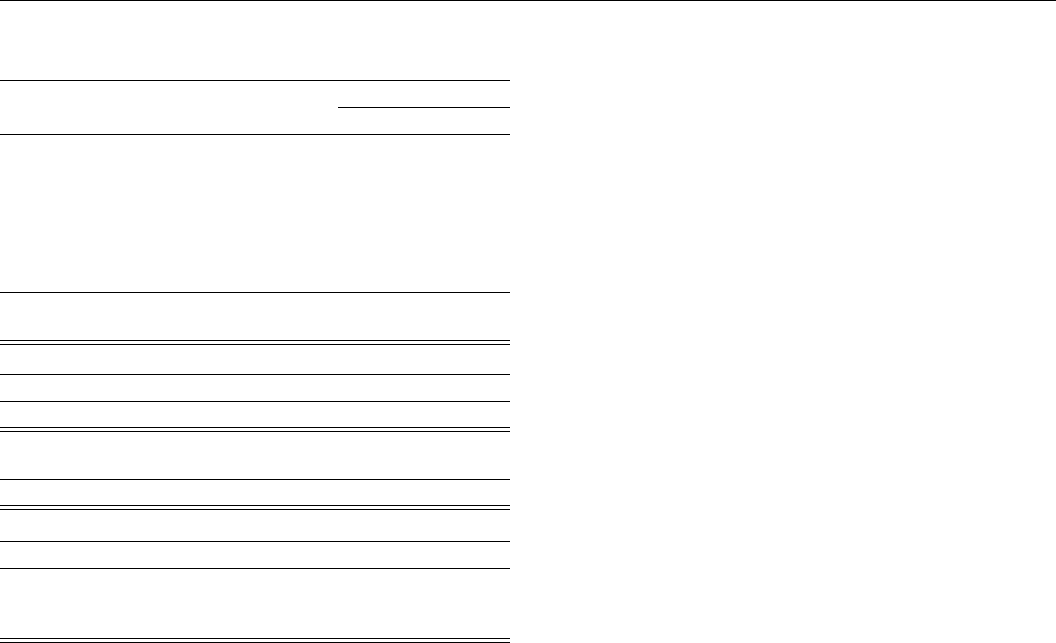

NOTE 15. ADDITIONAL FINANCIAL INFORMATION

December 31,

Consolidated Balance Sheets 2013 2012

Accounts payable and accrued liabilities:

Accounts payable $11,561 $12,076

Accrued payroll and commissions 1,985 2,332

Current portion of employee

benefit obligation 1,949 2,116

Accrued interest 1,559 1,588

Other 4,053 2,382

Total accounts payable and

accrued liabilities $21,107 $20,494

Consolidated Statements of Income 2013 2012 2011

Advertising expense $3,268 $2,910 $3,135

Interest expense incurred $4,224 $3,707 $3,697

Capitalized interest (284) (263) (162)

Total interest expense $3,940 $3,444 $3,535

Consolidated Statements of Cash Flows 2013 2012 2011

Cash paid during the year for:

Interest $4,302 $3,714 $3,691

Income taxes, net of refunds 1,985 458 32

No customer accounted for more than 10% of consolidated

revenues in 2013, 2012 or 2011.

A majority of our employees are represented by labor

unions as of year-end 2013.

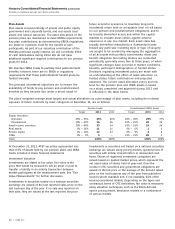

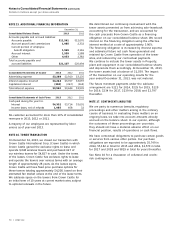

NOTE 16. TOWER TRANSACTION

On December 16, 2013, we closed our transaction with

Crown Castle International Corp. (Crown Castle) in which

Crown Castle gained the exclusive rights to lease and

operate 9,048 wireless towers and purchased 627 of

our wireless towers for $4,827 in cash. Under the terms

of the leases, Crown Castle has exclusive rights to lease

and operate the towers over various terms with an average

length of approximately 28 years. As the leases expire,

Crown Castle will have fixed price purchase options for

these towers totaling approximately $4,200, based on their

estimated fair market values at the end of the lease terms.

We sublease space on the towers from Crown Castle for

an initial term of 10 years at current market rates, subject

to optional renewals in the future.

We determined our continuing involvement with the

tower assets prevented us from achieving sale-leaseback

accounting for the transaction, and we accounted for

the cash proceeds from Crown Castle as a financing

obligation on our consolidated balance sheet. We record

interest on the financing obligation using the effective

interest method at a rate of approximately 3.90%.

The financing obligation is increased by interest expense

and estimated future net cash flows generated and

retained by Crown Castle from operation of the tower

sites, and reduced by our contractual payments.

We continue to include the tower assets in Property,

plant and equipment in our consolidated balance sheets

and depreciate them accordingly. At December 31, 2013,

the tower assets had a balance of $1,039. The impact

of the transaction on our operating results for the

year ended December 31, 2013, was not material.

The future minimum payments under the sublease

arrangement are $221 for 2014, $225 for 2015, $229

for 2016, $234 for 2017, $239 for 2018, and $2,797

thereafter.

NOTE 17. CONTINGENT LIABILITIES

We are party to numerous lawsuits, regulatory

proceedings and other matters arising in the ordinary

course of business. In evaluating these matters on an

ongoing basis, we take into account amounts already

accrued on the balance sheet. In our opinion, although

the outcomes of these proceedings are uncertain,

they should not have a material adverse effect on our

financial position, results of operations or cash flows.

We have contractual obligations to purchase certain goods

or services from various other parties. Our purchase

obligations are expected to be approximately $5,749 in

2014, $5,182 in total for 2015 and 2016, $2,570 in total

for 2017 and 2018 and $819 in total for years thereafter.

See Note 10 for a discussion of collateral and credit-

risk contingencies.