AT&T Wireless 2013 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2013 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T Inc. | 55

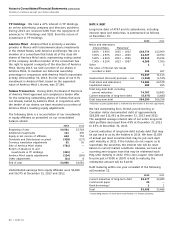

are recorded in accumulated OCI. Unrealized losses that are

considered other than temporary are recorded in “Other

income (expense) – net” with the corresponding reduction

to the carrying basis of the investment. Fixed income

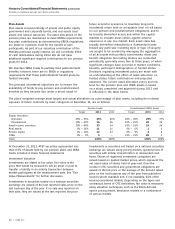

investments of $106 have maturities of less than one

year, $279 within one to three years, $109 within three

to five years, and $265 for five or more years.

Our short-term investments (including money market

securities) and customer deposits are recorded at amortized

cost, and the respective carrying amounts approximate fair

values. Our investment securities are recorded in “Other

Assets” on the consolidated balance sheets.

Investment Securities

Our investment securities include equities, fixed income

bonds and other securities. A substantial portion of the

fair values of our available-for-sale securities was estimated

based on quoted market prices. Investments in securities

not traded on a national securities exchange are valued

using pricing models, quoted prices of securities with

similar characteristics or discounted cash flows. Realized

gains and losses on securities are included in “Other

income (expense) – net” in the consolidated statements of

income using the specific identification method. Unrealized

gains and losses, net of tax, on available-for-sale securities

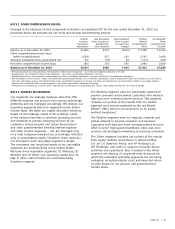

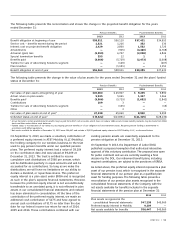

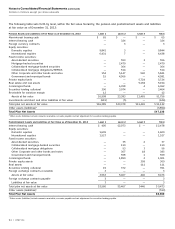

Following is the fair value leveling for available-for-sale securities and derivatives as of December 31, 2013, and

December 31, 2012:

December 31, 2013

Level 1 Level 2 Level 3 Total

Available-for-Sale Securities

Domestic equities $1,049 $ — $ — $1,049

International equities 563 — — 563

Fixed income bonds — 759 — 759

Asset Derivatives1

Interest rate swaps — 191 — 191

Cross-currency swaps — 1,951 — 1,951

Liability Derivatives1

Interest rate swaps — (7) — (7)

Cross-currency swaps — (519) — (519)

December 31, 2012

Level 1 Level 2 Level 3 Total

Available-for-Sale Securities

Domestic equities $ 873 $ — $ — $ 873

International equities 469 — — 469

Fixed income bonds — 837 — 837

Asset Derivatives1

Interest rate swaps — 287 — 287

Cross-currency swaps — 752 — 752

Foreign exchange contracts — 1 — 1

Liability Derivatives1

Cross-currency swaps — (672) — (672)

1 Derivatives designated as hedging instruments are reflected as “Other Assets,” “Other noncurrent liabilities” and, for a portion of interest rate swaps, “Other current assets”

in our consolidated balance sheets.

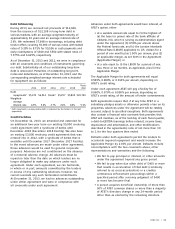

The majority of our derivatives are designated either as a

hedge of the fair value of a recognized asset or liability or

of an unrecognized firm commitment (fair value hedge), or

as a hedge of a forecasted transaction or of the variability

of cash flows to be received or paid related to a recognized

asset or liability (cash flow hedge).

Fair Value Hedging We designate our fixed-to-floating

interest rate swaps as fair value hedges. The purpose of

these swaps is to manage interest rate risk by managing

our mix of fixed-rate and floating-rate debt. These swaps

involve the receipt of fixed-rate amounts for floating

interest rate payments over the life of the swaps without

Derivative Financial Instruments

We employ derivatives to manage certain market risks,

primarily interest rate risk and foreign currency exchange

risk. This includes the use of interest rate swaps, interest

rate locks, foreign exchange forward contracts and

combined interest rate foreign exchange contracts (cross-

currency swaps). We do not use derivatives for trading

or speculative purposes. We record derivatives on our

consolidated balance sheets at fair value that is derived

from observable market data, including yield curves and

foreign exchange rates (all of our derivatives are Level 2).

Cash flows associated with derivative instruments are

presented in the same category on the consolidated

statements of cash flows as the item being hedged.