AT&T Wireless 2013 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2013 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)

Dollars in millions except per share amounts

28 | AT&T Inc.

exclusive rights to lease and operate 9,048 and purchase

627 of our wireless towers for $4,827 in cash. Under the

terms of the leases, Crown Castle will have exclusive rights

to lease and operate the towers over various terms with

an average length of approximately 28 years. As the leases

expire, Crown Castle will have fixed price purchase options

for these towers totaling approximately $4,200, based on

their estimated fair market values at the end of the lease

terms. We will sublease space on the towers from Crown

Castle for a minimum of 10 years at current market rates,

with options to renew. We accounted for the proceeds

as a financing obligation.

Connecticut Wireline Disposition In December 2013,

we agreed to sell our incumbent local exchange operations

in Connecticut to Frontier Communications Corporation for

$2,000 in cash. These Connecticut operations represent

approximately $1,200 in annual revenues as of 2013.

The transaction is subject to review by the U.S. Department

of Justice, the FCC and the Connecticut Public Utilities

Regulatory Authority and other state regulatory authorities.

We expect the transaction to close in the second half of

2014, subject to customary closing conditions.

Environmental We are subject from time to time to

judicial and administrative proceedings brought by various

governmental authorities under federal, state or local

environmental laws. We reference in our Forms 10-Q and

10-K certain environmental proceedings that could result

in monetary sanctions (exclusive of interest and costs) of

one hundred thousand dollars or more. However, we do

not believe that any of those currently pending will have

a material adverse effect on our results of operations.

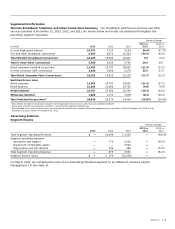

LIQUIDITY AND CAPITAL RESOURCES

We had $3,339 in cash and cash equivalents available at

December 31, 2013. Cash and cash equivalents included

cash of $697 and money market funds and other cash

equivalents of $2,642. Cash and cash equivalents decreased

$1,529 since December 31, 2012. During 2013, cash inflows

were primarily provided by cash receipts from operations,

a net increase in our debt and cash received from our

tower leasing arrangement with Crown Castle and other

asset sales. These inflows were largely offset by cash

used to meet the needs of the business, including but not

limited to, payment of operating expenses, funding capital

expenditures, dividends to stockholders, stock repurchases

and the acquisition of wireless spectrum and operations.

We discuss many of these factors in detail below.

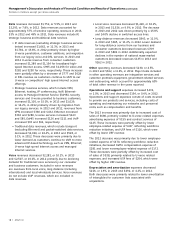

Cash Provided by or Used in Operating Activities

During 2013, cash provided by operating activities was

$34,796, compared to $39,176 in 2012. Lower operating

cash flows in 2013 were due to higher cash tax payments

and the timing of working capital payments and wireless

device financing related to our AT&T Next program.

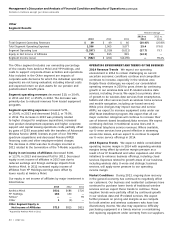

Leap Acquisition In July 2013, we announced an

agreement to acquire Leap Wireless International, Inc.

(Leap), a provider of prepaid wireless service under the

Cricket brand name, for fifteen dollars per outstanding

share of Leap’s common stock, or approximately $1,260,

plus one nontransferable contingent value right (CVR)

per share. The CVR will entitle each Leap stockholder

to a pro rata share of the net proceeds of the future sale

of the Chicago 700 MHz A-band FCC license held by Leap.

As of September 30, 2013, Leap had approximately $3,100

of debt, net of cash. Under the terms of the agreement,

we will acquire all of Leap’s stock and, thereby, acquire

all of its wireless properties, including spectrum licenses,

network assets, retail stores and approximately 4.6 million

subscribers. Leap’s spectrum licenses include Personal

Communications Services (PCS) and AWS bands and are

largely complementary to our licenses. Leap’s network

covers approximately 96 million people in 35 states and

consists of a 3G CDMA network and an LTE network

covering approximately 21 million people.

The agreement was approved by more than 99 percent

of votes cast by Leap’s stockholders on October 30, 2013.

The transaction is subject to review by the FCC and

Department of Justice (DOJ). The review process is

underway at both agencies. The transaction is expected

to close in the first quarter of 2014. The agreement

provides both parties with certain termination rights if the

transaction does not close by July 11, 2014, which can be

extended until January 11, 2015 if certain conditions have

not been met by that date. Under certain circumstances,

Leap may be required to pay a termination fee or AT&T

may be required to provide Leap with a three-year roaming

agreement for LTE data coverage in certain Leap markets

lacking LTE coverage, if the transaction does not close.

If Leap enters into the roaming agreement, AT&T will then

have the option within 30 days after entry into the roaming

agreement to purchase certain specified Leap spectrum

assets. If AT&T does not exercise its right to purchase all

of the specified Leap spectrum assets, Leap can then within

60 days after expiration of AT&T’s option require AT&T to

purchase all of the specified spectrum assets.

Spectrum Acquisitions In September 2013, we acquired

spectrum in the 700 MHz B band from Verizon Wireless

for $1,900 in cash and an assignment of AWS spectrum

licenses in five markets. The 700 MHz licenses acquired by

AT&T cover 42 million people in 18 states. In January 2014,

we announced an agreement to purchase 49 AWS spectrum

licenses, covering nearly 50 million people in 14 states,

from Aloha Partners II, L.P. The transaction is subject to

regulatory approval and we expect to close the transaction

in the second half of 2014.

Tower Transaction On December 16, 2013, we closed

our transaction with Crown Castle International Corp.

(Crown Castle) in which Crown Castle will have the