AT&T Wireless 2013 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2013 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44 | AT&T Inc.

Notes to Consolidated Financial Statements

Dollars in millions except per share amounts

upon either usage (e.g., minutes of traffic/bytes of data

processed), period of time (e.g., monthly service fees) or

other established fee schedules. Our service revenues

are billed either in advance, arrears or are prepaid.

We record revenue reductions for estimated future

adjustments to customer accounts, other than bad

debt expense, at the time revenue is recognized based

on historical experience. Service revenues also include

billings to our customers for various regulatory fees imposed

on us by governmental authorities. Cash incentives given

to customers are recorded as a reduction of revenue.

When required as part of providing service, revenues and

associated expenses related to nonrefundable, upfront

service activation and setup fees are deferred and

recognized over the associated service contract period

or customer life. Associated expenses are deferred only

to the extent of such deferred revenue. For contracts that

involve the bundling of services, revenue is allocated to

the services based on their relative selling price, subject to

the requirement that revenue recognized is limited to the

amounts received from the customer that are not contingent

upon the delivery of additional products or services to the

customer in the future. We record the sale of equipment

to customers as gross revenue when we are the principal

in the arrangement, when title is passed and when the

products are accepted by customers. For agreements

involving the resale of third-party services in which we

are not considered the principal in the arrangement, we

record the revenue net of the associated costs incurred.

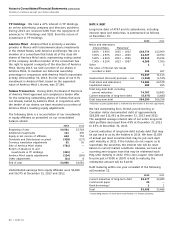

We offer to our customers the option to purchase certain

devices in installments over a period of up to 26 months,

with the right to trade in for a new device after a

specified period of time and have the remaining unpaid

balance waived for the original device. For customers

that elect these trade-in programs, we recognize revenue

for the entire amount of the customer receivable, net

of the fair value of the trade-in right guarantee and

imputed interest. As of December 31, 2013, total

equipment installment plan receivables of $863 were

recorded in “Accounts receivable” or “Other assets” on

our consolidated balance sheets.

Allowance for Doubtful Accounts We record expense

to maintain an allowance for doubtful accounts for

estimated losses that result from the failure or inability

of our customers to make required payments deemed

collectable from the customer when the service was

provided or product was delivered. When determining

the allowance, we consider the probability of

recoverability of accounts receivable based on past

experience, taking into account current collection trends

as well as general economic factors, including bankruptcy

rates. Credit risks are assessed based on historical

NOTE 1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation Throughout this document,

AT&T Inc. is referred to as “AT&T,” “we” or the “Company.”

The consolidated financial statements include the

accounts of the Company and our majority-owned

subsidiaries and affiliates. Our subsidiaries and affiliates

operate in the communications services industry both

domestically and internationally, providing wireless

communications services, traditional wireline voice

services, data/broadband and Internet services, video

services, telecommunications equipment, managed

networking and wholesale services.

All significant intercompany transactions are eliminated

in the consolidation process. Investments in partnerships

and less than majority-owned subsidiaries where we have

significant influence are accounted for under the equity

method. Earnings from certain foreign equity investments

accounted for using the equity method are included for

periods ended within up to one month of our year end

(see Note 8). We also record our proportionate share

of our equity method investees’ other comprehensive

income (OCI) items, including actuarial gains and losses

on pension and other postretirement benefit obligations.

The preparation of financial statements in conformity

with U.S. generally accepted accounting principles (GAAP)

requires management to make estimates and assumptions

that affect the amounts reported in the financial statements

and accompanying notes, including estimates of probable

losses and expenses. Actual results could differ from those

estimates. Certain amounts have been reclassified to

conform to the current period’s presentation.

Income Taxes We provide deferred income taxes for

temporary differences between the carrying amounts of

assets and liabilities for financial reporting purposes and

the computed tax basis of those assets and liabilities.

We provide valuation allowances against the deferred tax

assets for which the realization is uncertain. We review

these items regularly in light of changes in federal and

state tax laws and changes in our business.

We report revenues from transactions between us and

our customers net of taxes imposed by government

authorities in our consolidated statements of income.

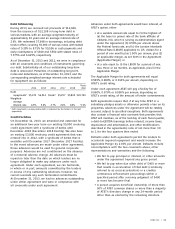

Cash and Cash Equivalents Cash and cash equivalents

include all highly liquid investments with original

maturities of three months or less. The carrying amounts

approximate fair value. At December 31, 2013, we held

$697 in cash and $2,642 in money market funds and

other cash equivalents.

Revenue Recognition Revenues derived from wireless,

local telephone, long distance, data and video services

are recognized when services are provided. This is based