AT&T Wireless 2013 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2013 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (continued)

Dollars in millions except per share amounts

60 | AT&T Inc.

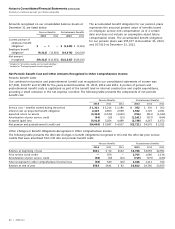

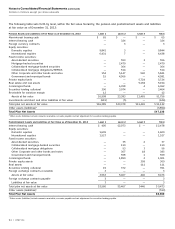

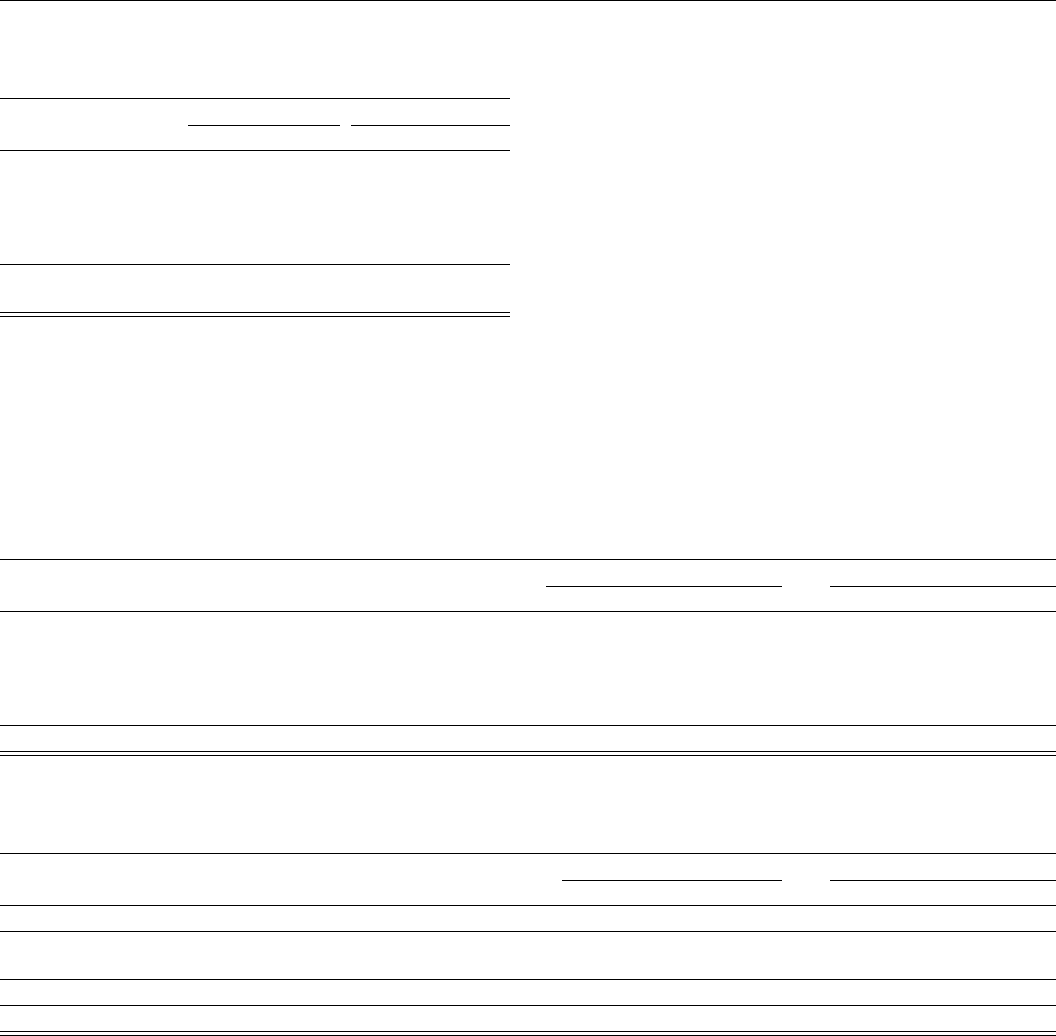

Net Periodic Benefit Cost and Other Amounts Recognized in Other Comprehensive Income

Periodic Benefit Costs

Our combined net pension and postretirement (credit) cost recognized in our consolidated statements of income was

$(7,390), $10,257 and $7,288 for the years ended December 31, 2013, 2012 and 2011. A portion of pension and

postretirement benefit costs is capitalized as part of the benefit load on internal construction and capital expenditures,

providing a small reduction in the net expense recorded. The following table presents the components of net periodic

benefit cost.

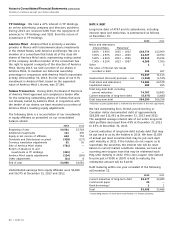

Pension Benefits Postretirement Benefits

2013 2012 2011 2013 2012 2011

Service cost – benefits earned during the period $ 1,321 $ 1,216 $ 1,186 $ 352 $ 336 $ 362

Interest cost on projected benefit obligation 2,429 2,800 2,958 1,532 1,725 2,051

Expected return on assets (3,312) (3,520) (3,690) (706) (811) (1,040)

Amortization of prior service credit (94) (15) (15) (1,161) (927) (694)

Actuarial (gain) loss (5,013) 5,206 4,498 (2,738) 4,247 1,672

Net pension and postretirement (credit) cost $(4,669) $ 5,687 $ 4,937 $(2,721) $4,570 $ 2,351

Other Changes in Benefit Obligations Recognized in Other Comprehensive Income

The following table presents the after-tax changes in benefit obligations recognized in OCI and the after-tax prior service

credits that were amortized from OCI into net periodic benefit costs:

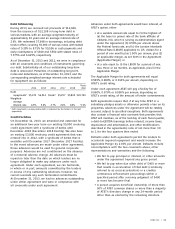

Pension Benefits Postretirement Benefits

2013 2012 2011 2013 2012 2011

Balance at beginning of year $641 $ 92 $102 $4,766 $3,655 $2,951

Prior service (cost) credit — 559 — 2,765 1,686 1,134

Amortization of prior service credit (58) (10) (10) (719) (575) (430)

Total recognized in other comprehensive (income) loss (58) 549 (10) 2,046 1,111 704

Balance at end of year $583 $641 $ 92 $6,812 $4,766 $3,655

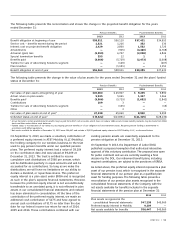

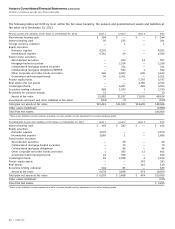

The accumulated benefit obligation for our pension plans

represents the actuarial present value of benefits based

on employee service and compensation as of a certain

date and does not include an assumption about future

compensation levels. The accumulated benefit obligation

for our pension plans was $55,077 at December 31, 2013,

and $57,010 at December 31, 2012.

Amounts recognized on our consolidated balance sheets at

December 31 are listed below:

Pension Benefits Postretirement Benefits

2013 2012 2013 2012

Current portion of

employee benefit

obligation1 $ — $ — $ (1,949) $ (2,116)

Employee benefit

obligation2 (9,322) (13,851) (19,376) (26,020)

Net amount

recognized $(9,322) $(13,851) $(21,325) $(28,136)

1 Included in “Accounts payable and accrued liabilities.”

2 Included in “Postemployment benefit obligation.”