AT&T Wireless 2013 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2013 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

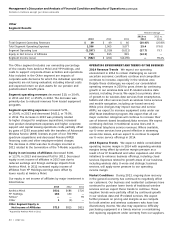

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)

Dollars in millions except per share amounts

22 | AT&T Inc.

services. We also participate in ISIS which has also begun

its national rollout of mobile payment services.

In the United States, we now cover all major metropolitan

areas and nearly 280 million people with our LTE technology.

We expect to cover approximately 300 million people

and to be essentially complete by the summer of 2014.

We also provide 4G coverage using various other

technologies (UMTS and HSPA+), and when combined with

our upgraded backhaul, we are able to enhance our network

capabilities and provide superior mobile broadband speeds

for data and video services. Our wireless network also relies

on other GSM digital transmission technologies for 3G and

2G data communications. As of December 31, 2013, we

served more than 110 million subscribers. We continue

to expand the number of locations, including airports and

cafés, where customers can access broadband Internet

connections using wireless fidelity (local radio frequency

commonly referred to as Wi-Fi) technology.

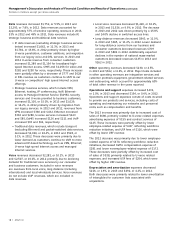

As the wireless industry continues to mature, we believe

that future wireless growth will increasingly depend on

our ability to offer innovative data services and a wireless

network that has sufficient spectrum and capacity to

support these innovations. We are facing significant

spectrum and capacity constraints on our wireless network

in certain markets. We expect such constraints to increase

and expand to additional markets in the coming years.

While we are continuing to invest significant capital in

expanding our network capacity, our capacity constraints

could affect the quality of existing voice and data services

and our ability to launch new, advanced wireless broadband

services, unless we are able to obtain more spectrum.

Any long-term spectrum solution will require that the

FCC make new or existing spectrum available to the

wireless industry to meet the expanding needs of our

subscribers. We will continue to attempt to address

spectrum and capacity constraints on a market-by-market

basis. To that end, we closed more than 60 deals to acquire

spectrum and wireless operations during 2013. Much of

the recently acquired spectrum came from an innovative

solution in which we obtained FCC approval to use Wireless

Communication Services spectrum for mobile broadband

for the first time.

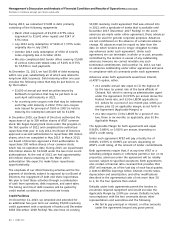

U-verse Services During 2013, we continued to expand

our offerings of U-verse high speed Internet and TV services.

As of December 31, 2013, we are marketing U-verse

services to approximately 27 million customer locations

(locations eligible to receive U-verse service). As of

December 31, 2013, we had 10.7 million total U-verse

subscribers (high-speed Internet and video), including

10.4 million Internet and 5.5 million video subscribers

(subscribers to both services are only counted once in the

total). As part of Project Velocity IP (VIP), we plan to expand

our IP-broadband service to approximately 57 million

the rules prohibited providers of fixed (but not mobile)

broadband Internet access service from unreasonably

discriminating in their transmission of lawful network traffic.

In its decision, the court found the FCC had authority

under section 706 of the Act (which directs the FCC and

state commissions to promote broadband deployment)

to adopt rules designed to preserve the open Internet,

but vacated and remanded the antidiscrimination and

no-blocking rules on the ground that they impermissibly

imposed common carrier regulation on broadband

Internet access service. The court held that, having

declared broadband Internet access services to be

information services, the FCC could not regulate them

as telecommunications services. The court did not vacate

the transparency rules.

The invalidation of the no-blocking and antidiscrimination

rules means that broadband Internet access providers have

greater flexibility in their provision of mass market services.

However, the court’s finding that section 706 provides the

FCC independent authority to adopt rules to promote

broadband deployment appears to give the FCC broad

authority to regulate the Internet and, more generally,

IP-based services, provided the FCC finds such regulation

promotes deployment of broadband infrastructure.

In addition, because section 706(a) grants authority

to both the FCC and the states to adopt rules to promote

broadband deployment, states could attempt to rely on

that provision to regulate broadband services, although

the states’ authority to do so appears to be narrower

than the FCC’s. If the FCC were to reclassify broadband

as a telecommunications service, or the FCC and/or the

states were to impose additional regulation of the Internet

or broadband services, it could have a material adverse

impact on our broadband services and operating results.

Expected Growth Areas

We expect our wireless services and wireline IP-data

products to remain the most significant growth portions

of our business and have also discussed trends affecting

the segments in which we report results for these products

(see “Wireless Segment Results” and “Wireline Segment

Results”). Over the next few years, we expect our growth

to come from IP-based data services used by our wireless

and wireline customers. Whether, or the extent to which,

growth in these areas will offset declines in other areas

of our business is not known.

Wireless We expect to deliver continued revenue

growth in the coming years. We are in a period of rapid

growth in wireless data usage and believe that there are

substantial opportunities available for next-generation

converged services that combine wireless, broadband,

voice and video. For example, we have launched our

innovative home monitoring service (Digital Life) and have

announced plans for car-related security and entertainment