AT&T Wireless 2013 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2013 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T Inc. | 29

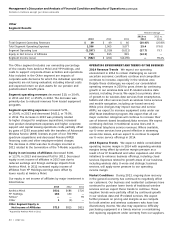

by dividend rate increases. In December 2013, our Board

of Directors approved a 2.2% increase in the quarterly

dividend from $0.45 to $0.46 per share. This follows a

2.3% dividend increase approved by our Board in

November2012. Dividends declared by our Board of

Directors totaled $1.81 per share in 2013, $1.77 per

share in 2012, and $1.73 per share in 2011. Our dividend

policy considers the expectations and requirements of

stockholders, internal requirements of AT&T and long-term

growth opportunities. It is our intent to provide the

financial flexibility to allow our Board of Directors to

consider dividend growth and to recommend an increase

in dividends to be paid in future periods. All dividends

remain subject to declaration by our Board of Directors.

In 2013, we continued to take advantage of lower market

interest rates and undertook several activities related to our

long-term debt which caused our weighted average interest

rate of our entire long-term debt portfolio to decrease from

4.9% at December 31, 2012 to 4.5% at December 31, 2013.

We had $74,484 of total notes and debentures outstanding

(see Note 9) at December 31, 2013, which included Euro,

British pound sterling or Canadian dollar denominated debt

of approximately $18,206.

During 2013, we received net proceeds of $12,040 from the

issuance of $12,108 in long-term debt in various markets,

with an average weighted maturity of approximately 10 years

and an average interest rate of 2.6%. Debt issued included:

• February 2013 issuance of $1,000 of 0.900% global

notes due 2016 and $1,250 of floating rate notes due

2016. The floating rate is based upon the three-month

London Interbank Offered Rate (LIBOR), reset quarterly,

plus 38.5 basis points.

• March 2013 issuance of $500 of 1.400% global notes

due 2017.

• March 2013 issuance of €1,250 of 2.500% global notes

due 2023 (equivalent to $1,626 when issued) and €400

of 3.550% global notes due 2032 (equivalent to $520

when issued).

• May 2013 issuance of £1,000 of 4.250% global notes

due 2043 (equivalent to $1,560 when issued).

• November 2013 issuance of €1,000 of 2.650% global

notes due 2021 (equivalent to $1,349 when issued)

and €1,000 of 3.500% global notes due 2025

(equivalent to $1,349 when issued).

• November 2013 issuance of CDN$1,000 of 3.825%

global notes due 2020 (equivalent to $954 when

issued).

• November 2013 issuance of $1,600 of 2.375% global

notes due 2018 and $400 of floating rate notes due

2018. The floating rate is based upon the three-month

LIBOR, reset quarterly, plus 91 basis points.

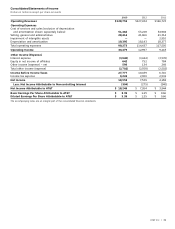

We expect lower cash from operations in 2014, in part

as the tax rules allowing companies to more rapidly deduct

the cost of equipment have ended and our AT&T Next

program continues to gain popularity with customers.

During 2012, cash provided by operating activities was

$39,176 compared to $34,743 in 2011. Our higher

operating cash flows in 2012 were due to nonrecurring

payments made in the prior year, including a $3,000 merger

breakup fee to Deutsche Telekom AG (Deutsche Telekom)

and a contribution to our pension plan of $1,000, as well

as improvements in inventory and working capital

management during 2012.

Cash Used in or Provided by Investing Activities

During 2013, cash used in investing activities consisted

primarily of:

• $20,944 in capital expenditures, excluding interest

during construction.

• $284 in interest during construction.

• $4,050 purchase of wireless spectrum licenses and

operations.

During 2013, cash provided by investing activities consisted

primarily of:

• $1,179 from the sale of a portion of our shares in

América Móvil.

• $712 from the sale of various properties.

• $200 from the repayment of advances to YP Holdings.

• $101 from the return of investment in YP Holdings.

Virtually all of our capital expenditures are spent on our

wireless and wireline networks, our U-verse services and

support systems for our communications services. Capital

expenditures, excluding interest during construction,

increased $1,479 from 2012. Our Wireless segment

represented 52% of our total spending and increased 3%

in 2013. The Wireline segment, which includes U-verse

services, represented 48% of the total capital expenditures

and increased 13% in 2013, primarily reflecting our

implementation of Project VIP.

We expect that our capital expenditures during 2014

will be in the $21,000 range. We expect 2014 to be our

peak investment year for Project VIP and anticipate our

Wireless and Wireline segments’ spend to be proportionally

consistent to the previous year. Upon our completion of

Project VIP, we expect capital investments to trend back

to historic levels. The amount of capital investment is

influenced by demand for services and products, continued

growth and regulatory considerations.

Cash Used in or Provided by Financing Activities

We paid dividends of $9,696 in 2013, $10,241 in 2012, and

$10,172 in 2011, primarily reflecting the decline in shares

outstanding due to our repurchase activity, partially offset