AT&T Wireless 2013 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2013 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)

Dollars in millions except per share amounts

20 | AT&T Inc.

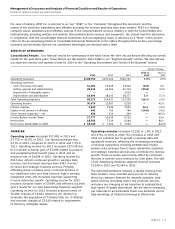

OPERATING ENVIRONMENT AND TRENDS OF THE BUSINESS

2014 Revenue Trends We expect our operating

environment in 2014 to remain challenging as current

uncertain economic conditions continue and competition

continues to increase, especially in the wireless area.

Despite these challenges, we expect our consolidated

operating revenues in 2014 to grow, driven by continuing

growth in our wireless data and IP-related wireline data

services, including U-verse. We expect our primary driver

of growth to be wireless data services from smartphones,

tablets and other services (such as wireless home services

and mobile navigation, including car-based services).

While price changes may impact revenue and service

ARPU, we expect to increase equipment sales under our

AT&T Next installment program. We expect that all our

major customer categories will continue to increase their

use of Internet-based broadband/data services. We expect

continuing declines in traditional access lines and in

traditional telephone service revenues. Where available,

our U-verse services have proved effective in stemming

access line losses, and we expect to continue to expand

our U-verse service offerings in 2014.

2014 Expense Trends We expect a stable consolidated

operating income margin in 2014 with expanding wireless

margins being offset by wireline margin pressure as a

result of our IP broadband and video expansion and other

initiatives to enhance business offerings, including cloud

services. Expenses related to growth areas of our business,

including wireless data, U-verse and strategic business

services, will apply some pressure to our operating

income margin.

Market Conditions During 2013, ongoing slow recovery

in the general economy has continued to negatively affect

our customers. Our business and residential customers have

continued to purchase lower levels of traditional wireline

services and we expect those trends to continue. These

negative trends were partially offset by continued growth

in our wireless data and IP-related services. We expect

further pressure on pricing and margins as we compete

for both wireline and wireless customers who have less

discretionary income. We also may experience difficulty

purchasing equipment in a timely manner or maintaining

and replacing equipment under warranty from our suppliers.

Other

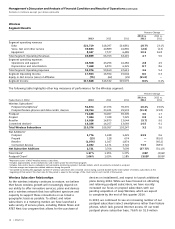

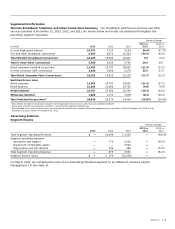

Segment Results

Percent Change

2013 vs. 2012 vs.

2013 2012 2011 2012 2011

Total Segment Operating Revenues $ 39 $ 49 $ 66 (20.4)% (25.8)%

Total Segment Operating Expenses 1,336 1,065 5,077 25.4 (79.0)

Segment Operating Loss (1,297) (1,016) (5,011) (27.7) 79.7

Equity in Net Income of Affiliates 715 815 815 (12.3) —

Segment Income (Loss) $ (582) $ (201) $(4,196) — 95.2%

The Other segment includes our ownership percentage

of the results from América Móvil and YP Holdings, and

costs to support corporate-driven activities and operations.

Also included in the Other segment are impacts of

corporate-wide decisions for which the individual operating

segments are not being evaluated, including interest costs

and expected return on plan assets for our pension and

postretirement benefit plans.

Segment operating revenues decreased $10, or 20.4%,

in 2013 and $17, or 25.8%, in 2012. The decrease was

primarily due to reduced revenues from leased equipment

programs.

Segment operating expenses increased $271,

or 25.4%, in 2013 and decreased $4,012, or 79.0%,

in 2012. The increase in 2013 was primarily related

to higher charges for employee separations, increased

new product development expenses and higher corporate

support and capital leasing operations costs, partially offset

by gains of $293 associated with the transfers of Advanced

Wireless Service (AWS) licenses as part of our 700 MHz

spectrum acquisitions and decreased Pension/OPEB

financing costs and other employee-related charges.

The decrease in 2012 was due to charges incurred in

2011 related to the termination of the T-Mobile acquisition.

Equity in net income of affiliates decreased $100,

or 12.3%, in 2013 and remained flat for 2012. Decreased

equity in net income of affiliates in 2013 was due to

reduced earnings and foreign exchange impacts from

América Móvil. In 2012 increased equity income of

affiliates from YP Holdings earnings were offset by

lower results at América Móvil.

Our equity in net income of affiliates by major investment is

listed below:

2013 2012 2011

América Móvil $532 $686 $720

YP Holdings 182 130 —

Telmex1 — — 95

Other 1 (1) —

Other Segment Equity in

Net Income of Affiliates $715 $815 $815

1 Acquired by América Móvil in 2011.