AT&T Wireless 2013 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2013 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T Inc. | 59

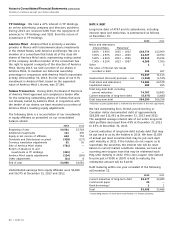

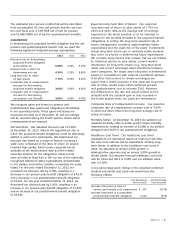

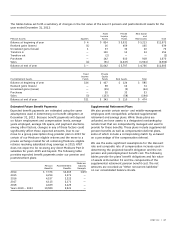

The following table presents this reconciliation and shows the change in the projected benefit obligation for the years

ended December 31:

Pension Benefits Postretirement Benefits

2013 2012 2013 2012

Benefit obligation at beginning of year $58,911 $56,110 $37,431 $34,953

Service cost – benefits earned during the period 1,321 1,216 352 336

Interest cost on projected benefit obligation 2,429 2,800 1,532 1,725

Amendments — (905) (4,460) (2,768)

Actuarial (gain) loss (2,390) 6,707 (2,098) 4,844

Special termination benefits 255 12 1 5

Benefits paid (3,966) (5,729) (2,473) (2,608)

Transfer for sale of Advertising Solutions segment — (149) — (207)

Plan transfers — (1,151) — 1,151

Benefit obligation at end of year $56,560 $58,911 $30,285 $37,431

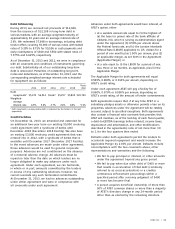

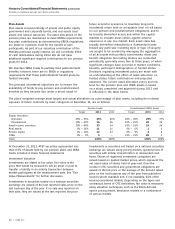

The following table presents the change in the value of plan assets for the years ended December 31 and the plans’ funded

status at December 31:

Pension Benefits Postretirement Benefits

2013 2012 2013 2012

Fair value of plan assets at beginning of year $45,060 $ 45,907 $ 9,295 $ 9,890

Actual return on plan assets 5,935 5,041 1,347 1,266

Benefits paid1 (3,966) (5,729) (1,682) (1,842)

Contributions 209 3 — —

Transfer for sale of Advertising Solutions segment — (165) — (19)

Other — 3 — —

Fair value of plan assets at end of year3 47,238 45,060 8,960 9,295

Unfunded status at end of year2 $ (9,322) $(13,851) $(21,325) $(28,136)

1 At our discretion, certain postretirement benefits may be paid from AT&T cash accounts, which does not reduce VEBA assets. Future benefit payments may be made from VEBA

trusts and thus reduce those asset balances.

2 Funded status is not indicative of our ability to pay ongoing pension benefits or of our obligation to fund retirement trusts. Required pension funding is determined in

accordance with ERISA regulations.

3 Net assets available for benefits at December 31, 2013 were $56,447 and include a $9,209 preferred equity interest in AT&T Mobility II LLC, as discussed below.

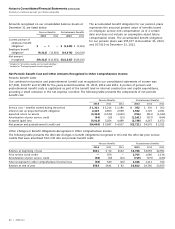

existing pension assets are essentially equivalent to the

pension obligation at December 31, 2013.

On September 9, 2013, the Department of Labor (DOL)

published a proposed exemption that authorized retroactive

approval of this voluntary contribution. The proposal was open

for public comment and we are currently awaiting a final

decision by the DOL. Our retirement benefit plans, including

required contributions, are subject to the provisions of ERISA.

As noted above, this preferred equity interest represents a plan

asset of our pension trust, which is recognized in the separate

financial statements of our pension plan as a qualified plan

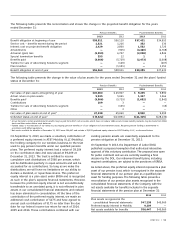

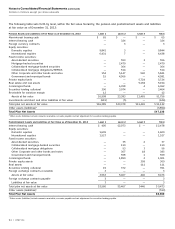

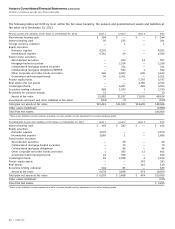

asset for funding purposes. The following table presents a

reconciliation of our pension plan assets recognized in the

consolidated financial statements of the Company with the

net assets available for benefits included in the separate

financial statements of the pension plan at December 31:

2013 2012

Plan assets recognized in the

consolidated financial statements $47,238 $45,060

Preferred equity interest in Mobility 9,209 —

Net assets available for benefits $56,447 $45,060

On September 9, 2013, we made a voluntary contribution of

a preferred equity interest in AT&T Mobility II LLC (Mobility),

the holding company for our wireless business, to the trust

used to pay pension benefits under our qualified pension

plans. The preferred equity interest had a value of $9,104

on the contribution date and was valued at $9,209 at

December 31, 2013. The trust is entitled to receive

cumulative cash distributions of $560 per annum, which

will be distributed quarterly in equal amounts and will be

accounted for as contributions. So long as we make the

distributions, we will have no limitations on our ability to

declare a dividend, or repurchase shares. This preferred

equity interest is a plan asset under ERISA and is recognized

as such in the plan’s separate financial statements. However,

because the preferred equity interest is not unconditionally

transferable to an unrelated party, it is not reflected in plan

assets in our consolidated financial statements and instead

has been eliminated in consolidation. At the time of the

contribution of the preferred equity interest, we made an

additional cash contribution of $175 and have agreed to

annual cash contributions of $175 no later than the due

date for our federal income tax return for each of 2014,

2015 and 2016. These contributions combined with our