AT&T Wireless 2013 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2013 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (continued)

Dollars in millions except per share amounts

50 | AT&T Inc.

agreement, we paid a breakup fee of $3,000, entered into a

broadband roaming agreement and transferred certain wireless

spectrum with a book value of $962. These agreement

termination charges were included in “Selling, general and

administrative” expenses in our Other segment.

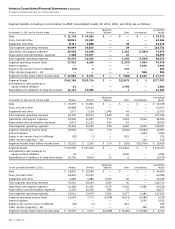

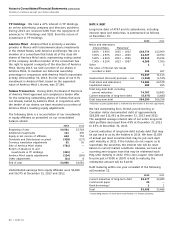

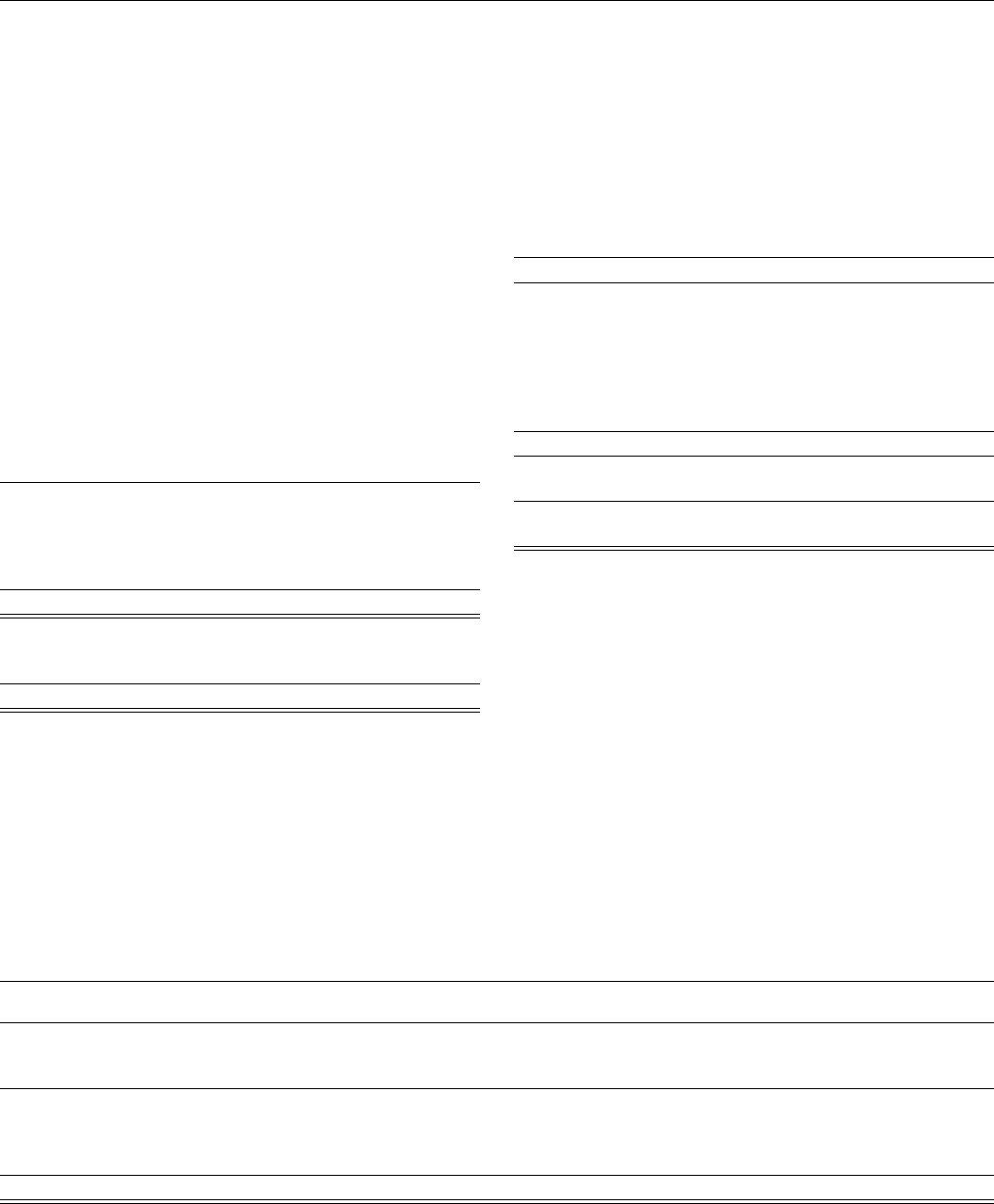

NOTE 6. PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment is summarized as follows at

December 31:

Lives (years) 2013 2012

Land — $ 1,523 $ 1,689

Buildings and improvements 10-44 31,485 28,939

Central office equipment1 3-10 86,370 86,185

Cable, wiring and conduit 15-50 76,107 80,338

Other equipment 3-15 67,887 61,387

Software 3 8,150 7,957

Under construction — 3,276 4,412

274,798 270,907

Accumulated depreciation

and amortization 163,830 161,140

Property, plant and

equipment – net $110,968 $109,767

1 Includes certain network software.

Our depreciation expense was $17,722 in 2013, $16,933 in

2012 and $16,368 in 2011. Depreciation expense included

amortization of software totaling $2,142 in 2013, $2,130 in

2012 and $2,243 in 2011.

Certain facilities and equipment used in operations are leased

under operating or capital leases. Rental expenses under

operating leases were $3,683 for 2013, $3,507 for 2012, and

$3,414 for 2011. At December 31, 2013, the future minimum

rental payments under noncancelable operating leases for

the years 2014 through 2018 were $3,003, $2,857, $2,694,

$2,458, and $2,233, with $11,707 due thereafter. Certain real

estate operating leases contain renewal options that may be

exercised. Capital leases are not significant.

Pending Disposition

Connecticut Wireline In December 2013, we entered

into an agreement to sell our incumbent local exchange

operations in Connecticut for $2,000 in cash. The transaction

is subject to review by the DOJ, the FCC and the Connecticut

Public Utilities Regulatory Authority and other state

regulatory authorities. We expect the deal to close in the

second half of 2014, subject to customary closing conditions.

These Connecticut operations represent approximately

$1,200 in annual revenues as of 2013. We applied held-for-

sale treatment to the assets and liabilities of the

Connecticut operations, and, accordingly, included the assets

in “Other current assets,” and the related liabilities in

“Accounts payable and accrued liabilities,” on our

consolidated balance sheets. However, the business will not

qualify as discontinued operations as we expect significant

continuing direct cash flows related to the disposed

operations. Assets and liabilities of the Connecticut

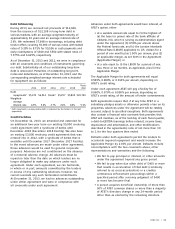

operations included the following as of December 31, 2013:

Assets held for sale:

Current assets $ 155

Property, plant and equipment – net 1,289

Goodwill 799

Other assets 17

Total assets $2,260

Liabilities related to assets held for sale:

Current liabilities $ 128

Noncurrent liabilities 480

Total liabilities $ 608

Other

T-Mobile In March 2011, we agreed to acquire from Deutsche

Telekom AG (Deutsche Telekom) all shares of T-Mobile USA, Inc.

(T-Mobile) for approximately $39,000, subject to certain

adjustments. In December 2011, in light of opposition to the

merger from the DOJ and FCC, we and Deutsche Telekom

agreed to terminate the transaction. Pursuant to the purchase

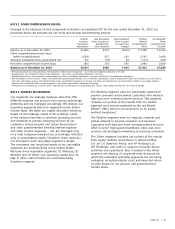

NOTE 7. GOODWILL AND OTHER INTANGIBLE ASSETS

Changes in the carrying amounts of goodwill, by segment (which is the same as the reporting unit for Wireless, Wireline and

Advertising Solutions), for the years ended December 31, 2013 and 2012, were as follows:

Advertising

Wireless Wireline Solutions Other Total

Balance as of January 1, 2012 $ 35,755 $ 33,638 $ 1,059 $ 390 $ 70,842

Goodwill acquired 13 5 — — 18

Other 35 327 (1,059) (390) (1,087)

Balance as of December 31, 2012 35,803 33,970 — — 69,773

Goodwill acquired 305 — — — 305

Held for sale — (799) — — (799)

Other (2) (4) — — (6)

Balance as of December 31, 2013 $36,106 $33,167 $ — $ — $69,273