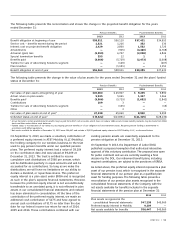

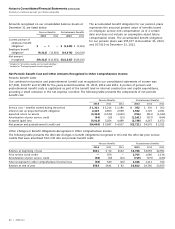

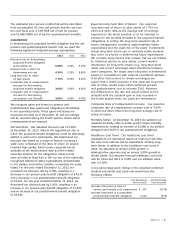

AT&T Wireless 2013 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2013 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T Inc. | 51

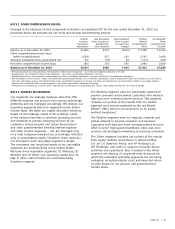

also included a reclassification of goodwill due to segment

reclassification to better align goodwill with operations.

In 2011, we recorded a $2,745 goodwill impairment in the

Advertising Solutions segment, triggered by declining

revenues in our directory business and the directory industry

as a whole, and we also recorded a $165 impairment for a

trade name.

The held for sale adjustment to goodwill in 2013 was

the result of a goodwill allocation in conjunction with our

pending sale of our Connecticut operations. Our goodwill

acquired during 2013 primarily related to our acquisition

of ATNI (see Note 5). Changes to goodwill during 2012

primarily resulted from the sale of the Advertising Solutions

segment (see Note 5). Changes in goodwill during 2012

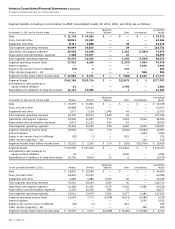

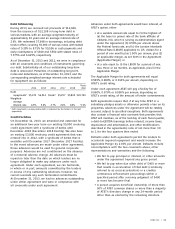

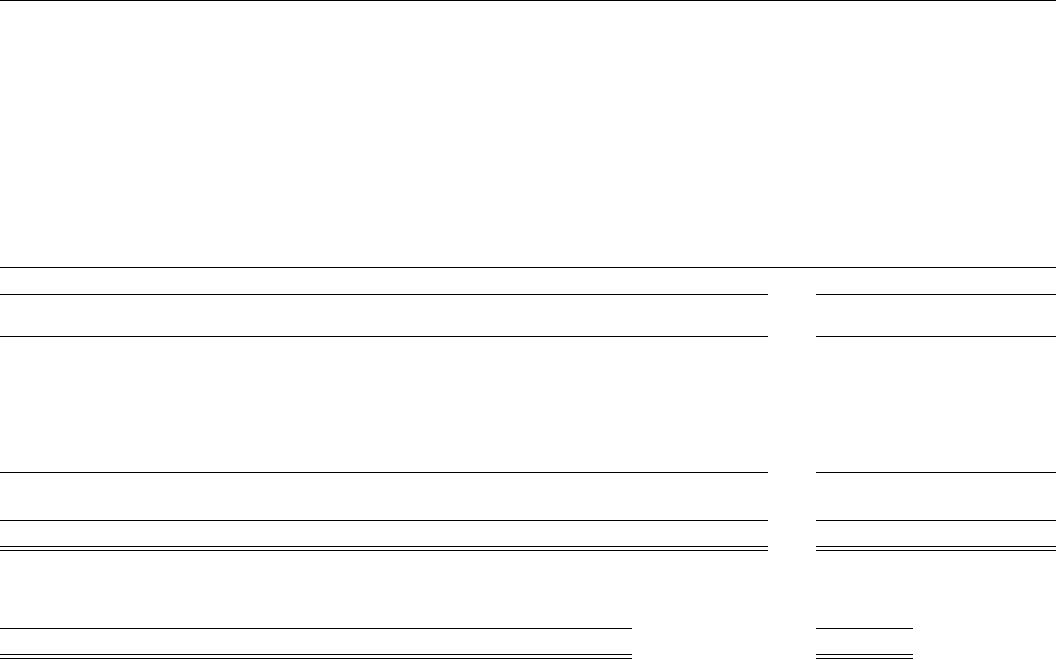

Our other intangible assets are summarized as follows:

December 31, 2013 December 31, 2012

Gross Carrying Accumulated Gross Carrying Accumulated

Other Intangible Assets Amount Amortization Amount Amortization

Amortized intangible assets:

Customer lists and relationships:

AT&T Mobility LLC $ 982 $ 771 $ 6,760 $ 6,335

BellSouth Corporation 5,825 5,317 5,825 4,994

AT&T Corp. 2,482 2,438 2,490 2,356

Other — — 351 350

Subtotal 9,289 8,526 15,426 14,035

Other 284 169 304 174

Total $ 9,573 $8,695 $15,730 $14,209

Indefinite-lived intangible assets not subject to amortization:

Licenses $56,433 $52,352

Trade names 4,901 4,902

Total $61,334 $57,254

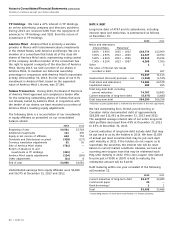

We review indefinite-lived intangible assets for impairment

annually (see Note 1). Licenses include wireless FCC

licenses of $56,399 at December 31, 2013 and $52,318

at December 31, 2012, that provide us with the exclusive

right to utilize certain radio frequency spectrum to provide

wireless communications services.

NOTE 8. EQUITY METHOD INVESTMENTS

Investments in partnerships, joint ventures and less than

majority-owned subsidiaries in which we have significant

influence are accounted for under the equity method.

Our investments in equity affiliates primarily include our

international equity investment, América Móvil, and our

interest in YP Holdings. Investments in equity affiliates

also include our investment in our mobile payment joint

venture, marketed as ISIS.

As discussed in Note 5, most of our license additions in

2013 were related to a spectrum swap and various business

acquisitions, with the remainder originating from various

spectrum license purchases.

Amortized intangible assets are definite-life assets, and as

such, we record amortization expense based on a method

that most appropriately reflects our expected cash flows

from these assets, over a weighted-average of 9.8 years

(9.7 years for customer lists and relationships and 12.2 years

for other). Amortization expense for definite-life intangible

assets was $672 for the year ended December 31, 2013,

$1,210 for the year ended December 31, 2012, and $2,009

for the year ended December 31, 2011. Amortization

expense is estimated to be $364 in 2014, $224 in 2015,

$127 in 2016, $60 in 2017, and $34 in 2018. In 2013, we

wrote off approximately $6,217 of fully amortized intangible

assets (primarily customer lists). In 2012, we wrote off

approximately $191 in fully amortized intangible assets

(primarily patents) and $3,187 of customer lists due to the

sale of our Advertising Solutions segment (see Note 5).

We review other amortizing intangible assets for impairment

whenever events or circumstances indicate that the carrying

amount may not be recoverable over the remaining life of

the asset or asset group.