AT&T Wireless 2013 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2013 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T Inc. | 49

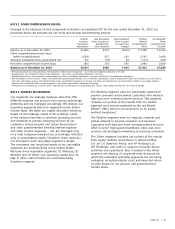

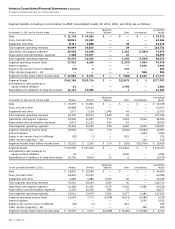

NOTE 5. ACQUISITIONS, DISPOSITIONS AND OTHER ADJUSTMENTS

Acquisitions

Spectrum Acquisitions During 2013, we acquired $895 of

wireless spectrum and operations from various companies,

not including the 700 MHz, Atlantic Tele-Network Inc. (ATNI),

and NextWave purchases discussed below. During 2012, we

acquired $855 of wireless spectrum from various companies.

During 2011, we acquired $33 of wireless spectrum from

various companies, not including the Qualcomm spectrum

purchase discussed below.

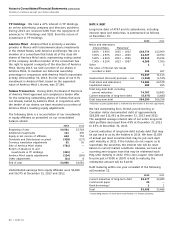

700 MHz Spectrum In September 2013, we acquired

spectrum in the 700 MHz B band from Verizon Wireless

for $1,900 in cash and an assignment of Advanced

Wireless Service (AWS) spectrum licenses in five markets.

The 700 MHz licenses acquired by AT&T cover 42 million

people in 18 states. We recognized a gain of approximately

$293 on this and other spectrum transactions.

Atlantic Tele-Network In September 2013, we acquired

ATNI’s U.S. retail wireless operations, operated under the

Alltel brand, for $806 in cash, which included closing

adjustments. Under the terms of the agreement, we

acquired wireless properties, with a value of $322 in

licenses and $296 of goodwill.

NextWave In January 2013, we completed the acquisition

of NextWave Wireless Inc. (NextWave), which held wireless

licenses in the Wireless Communication Services and AWS

bands. We acquired all the equity and purchased a portion

of the debt of NextWave for $605. The transaction was

accounted for as an asset acquisition of spectrum.

Qualcomm Spectrum Purchase In December 2011,

we completed our purchase of spectrum licenses in

the Lower 700 MHz frequency band from Qualcomm

Incorporated for approximately $1,925 in cash. The

spectrum covers more than 300 million people total

nationwide, including 12 MHz of Lower 700 MHz D and E

block spectrum covering more than 70 million people in

five of the top 15 metropolitan areas and 6 MHz of Lower

700 MHz D block spectrum covering more than 230

million people across the rest of the United States.

Purchase of Wireless Partnership Minority Interest In

July 2011, we completed the acquisition of Convergys

Corporation’s minority interest in the Cincinnati SMSA

Limited Partnership and an associated cell tower holding

company for approximately $320 in cash.

Pending Acquisitions

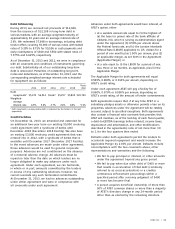

Leap In July 2013, we announced an agreement to

acquire Leap Wireless International, Inc. (Leap), a

provider of prepaid wireless service, for fifteen dollars

per outstanding share of Leap’s common stock, or

approximately $1,260, plus one nontransferable

contingent value right (CVR) per share. The CVR will

entitle each Leap stockholder to a pro rata share of

the net proceeds of the future sale of the Chicago

700 MHz A-band FCC license held by Leap. As of

September 30, 2013, Leap had approximately $3,100

of debt, net of cash. Under the terms of the agreement,

we will acquire all of Leap’s stock and, thereby, acquire

all of its wireless properties, including spectrum licenses,

network assets, retail stores and subscribers.

The agreement was approved by Leap’s stockholders on

October 30, 2013. The transaction is subject to review

by the FCC and Department of Justice (DOJ). The review

process is underway at both agencies. The transaction

is expected to close in the first quarter of 2014. The

agreement provides both parties with certain termination

rights if the transaction does not close by July 11, 2014,

which can be extended until January 11, 2015, if certain

conditions have not been met by that date. Under certain

circumstances, Leap may be required to pay a termination

fee or AT&T may be required to provide Leap with a

three-year roaming agreement for LTE data coverage

in certain Leap markets lacking LTE coverage, if the

transaction does not close. If Leap enters into the roaming

agreement, AT&T will then have the option within 30 days

after entry into the roaming agreement to purchase certain

specified Leap spectrum assets. If AT&T does not exercise

its right to purchase all of the specified Leap spectrum

assets, Leap can then within 60 days after expiration of

AT&T’s option require AT&T to purchase all of the specified

spectrum assets.

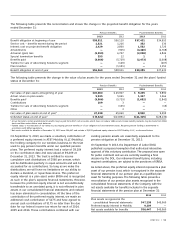

Dispositions

América Móvil In 2013, we sold a portion of our shares

in América Móvil for approximately $1,179. We sold the

shares to maintain our historical ownership percentage

in conjunction with América Móvil’s repurchase activity.

(See Note 8)

Advertising Solutions On May 8, 2012, we completed

the sale of our Advertising Solutions segment to an affiliate

of Cerberus Capital Management, L.P. for approximately

$740 in cash after closing adjustments, a $200 advance,

which was repaid in 2013, and a 47 percent equity interest

in the new entity, YP Holdings. Our operating results include

the results of the Advertising Solutions segment through

May 8, 2012.

Tender of Telmex Shares In August 2011, the Board of

Directors of América Móvil approved a tender offer for the

remaining outstanding shares of Télefonos de México, S.A.

de C.V. (Telmex) that were not already owned by América

Móvil. We tendered all of our shares of Telmex for $1,197

of cash. Telmex was accounted for as an equity method

investment (see Note 8).