AT&T Wireless 2013 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2013 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T Inc. | 47

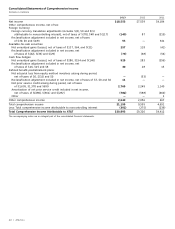

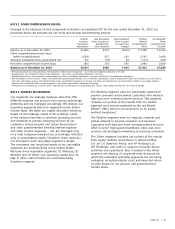

NOTE 3. OTHER COMPREHENSIVE INCOME

Changes in the balances of each component included in accumulated OCI for the year ended December 31, 2013, are

presented below. All amounts are net of tax and exclude noncontrolling interest.

Foreign Net Unrealized Net Unrealized Defined Accumulated

Currency Gains (Losses) on Gains (Losses) Benefit Other

Translation Available-for- on Cash Flow Postretirement Comprehensive

Adjustment5 Sale Securities5 Hedges5 Plans5 Income5

Balance as of December 31, 2012 $ (284) $ 272 $(110) $ 5,358 $ 5,236

Other comprehensive income (loss)

before reclassifications (138) 257 525 2,765 3,409

Amounts reclassified from accumulated OCI 551 (79)2 303 (771)4 (765)

Net other comprehensive income (loss) (83) 178 555 1,994 2,644

Balance as of December 31, 2013 $(367) $450 $ 445 $7,352 $7,880

1 Pre-tax translation loss reclassifications are included in Other income (expense) – net in the consolidated statements of income.

2 Realized gains are included in Other income (expense) – net in the consolidated statements of income.

3 Realized (gains) losses are included in interest expense in the consolidated statements of income. See Note 10 for additional information.

4 The amortization of prior service credits associated with postretirement benefits, net of amounts capitalized as part of construction labor, are included in Cost of services

and sales and Selling, general and administrative in the consolidated statements of income (see Note 12). Actuarial loss reclassifications related to our equity method

investees are included in Other income (expense) – net in the consolidated statements of income.

5 The balance at December 31, 2011 for each component of accumulated OCI, respectively, was $(371), $222, $(421), and $3,750, for a total of $3,180.

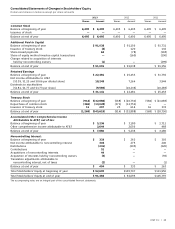

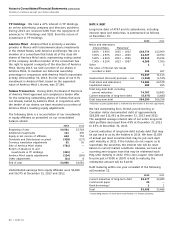

The Wireless segment uses our nationwide network to

provide consumer and business customers with wireless

data and voice communications services. This segment

includes our portion of the results from our mobile

payment joint venture marketed as the Isis Mobile

WalletTM (ISIS), which is accounted for as an equity

method investment.

The Wireline segment uses our regional, national and

global network to provide consumer and business

customers with data and voice communications services,

AT&T U-verse® high-speed broadband, video and voice

services and managed networking to business customers.

The Other segment includes our portion of the results

from equity method investments in América Móvil,

S.A. de C.V. (América Móvil), and YP Holdings LLC

(YP Holdings), and costs to support corporate-driven

activities and operations. Also included in the Other

segment are impacts of corporate-wide decisions for

which the individual operating segments are not being

evaluated, including interest costs and expected return

on plan assets for our pension and postretirement

benefit plans.

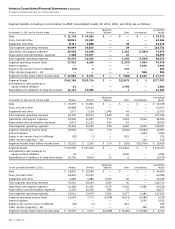

NOTE 4. SEGMENT INFORMATION

Our segments are strategic business units that offer

different products and services over various technology

platforms and are managed accordingly. We analyze our

operating segments based on segment income before

income taxes. We make our capital allocation decisions

based on the strategic needs of the business, needs

of the network (wireless or wireline) providing services

and demands to provide emerging services to our

customers. Actuarial gains and losses from pension

and other postretirement benefits, interest expense

and other income (expense) – net, are managed only

on a total company basis and are, accordingly, reflected

only in consolidated results. Therefore, these items are

not included in each reportable segment’s results.

The customers and long-lived assets of our reportable

segments are predominantly in the United States.

We have three reportable segments: (1) Wireless, (2)

Wireline and (3) Other. Our operating results prior to

May 9, 2012, also included our sold Advertising

Solutions segment.